Image courtesy of Fuzzy Gerdes.

Real estate agents and brokers surveyed by Inman News say their colleagues often engage in practices that most agree are unacceptable, such as relisting a property to generate fresh interest or reset days on market.

But the survey also found that real estate professionals are divided on the acceptability of much of what goes on "behind the curtain" — such as agents "double ending" a transaction and representing both the buyer and seller.

The online survey of agents and brokers — "Real Estate: Behind the Curtain" — asked real estate professionals about not only the frequency of more than three dozen customs and practices, but whether they thought such behavior was acceptable

or not.

More than 500 respondents rated the acceptability of those practices, while 367 reported on the frequency of those practices in their markets, based on their own experiences.

Some of the practices that agents and brokers found most troublesome — like sharing the seller’s minimum price with a buyer’s agent — seem to be infrequent or rare.

Many brokers and agents were indifferent about some practices that appear to be fairly common, such as pricing properties at less than their market value in order to generate interest.

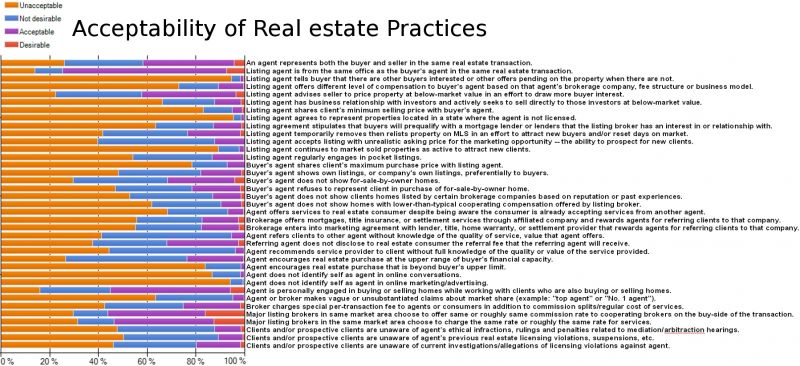

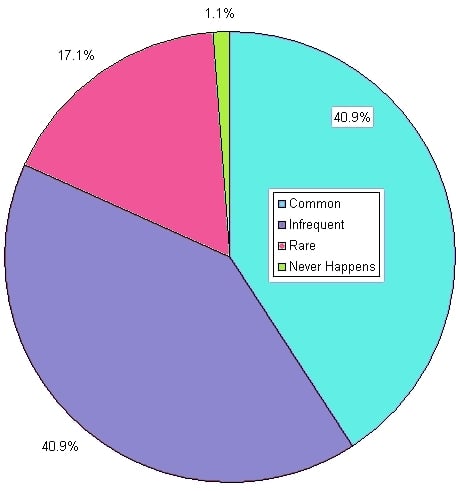

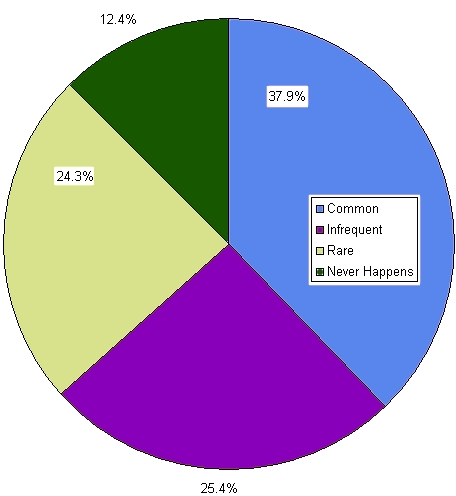

One telling statistic: Nearly 58 percent of those surveyed (see Chart 1) said it was common for major listing brokers in their market to charge the same rate or roughly the same rate for services — a sign that consumers have little power to negotiate

commissions, and that there’s a lack of competition based on cost.

CHART 1. FREQUENCY: Major listing brokers in the same market area choose to charge the same rate or roughly the same rate for services.

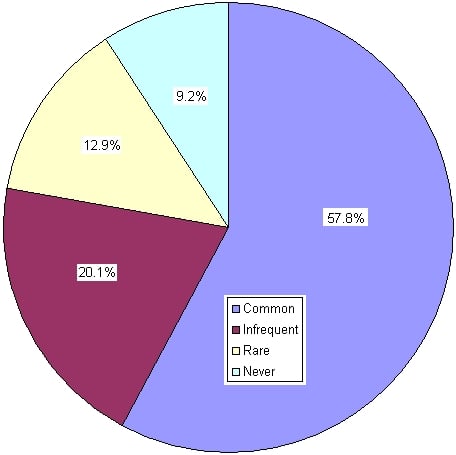

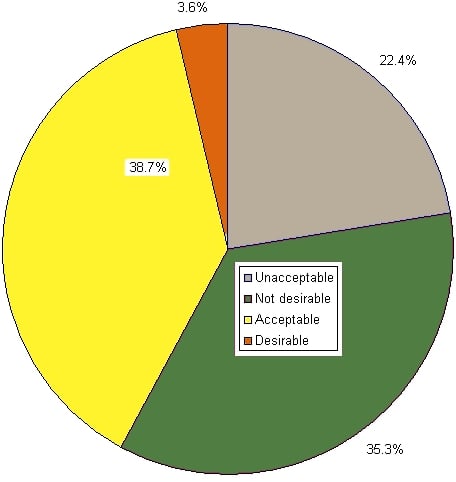

CHART 2. ACCEPTABILITY: Major listing brokers in the same market area choose to charge the same rate or roughly the same rate for services.

"The majority of consumers feel 6 percent or 7 percent is the ‘rule or law.’ If we could publish our company policy on commissions, the consumer would

be better informed to make a decision," said one survey respondent.

But most agents and brokers said they were not bothered by uniformity in commission rates, with 41 percent saying it was acceptable and nearly 13 percent calling it a "desirable" situation. Only 31 percent shared the view that it’s "unacceptable"

for major brokers in the same listing area to charge the same or roughly the same rate.

Agents and brokers said the same was true of commission rates offered to cooperating brokers on the buy-side of a transaction. Among those surveyed, 58 percent said it was common for offers of compensation to be the same or roughly the same among major

listing brokers. Attitudes about that practice were much the same — 30 percent of respondents said such a situation was unacceptable.

"My brokerage allows us to choose percentages offered to (the) other side of transaction," said one agent — implying that others do not. …CONTINUED

Agents and brokers were also seemingly blase about "dual agency" — the practice of the same brokerage or agent representing both the buyer and seller

in a transaction.

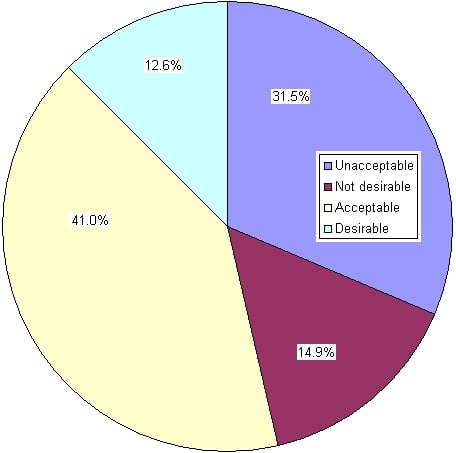

Chart 3. ACCEPTABILITY: An agent represents both the buyer and seller in the same real estate transaction.

While most objected to an agent representing both the buyer and seller — 26 percent said it was unacceptable, and just under 33 percent said it was "not desirable" — more than one in three said it was acceptable.

Two-thirds of those surveyed said it was acceptable for agents in the same office to represent the buyer and seller in the same transaction, but one in four had a problem with that situation, too — 14 percent labeled the practice "unacceptable,"

and 11 percent stated it was "not desirable."

"One broker in our area provides a financial incentive — in the form of higher commission splits — to agents who sell in-house listings," said one survey respondent. "Consumers lose."

Another who objected to agents double-ending deals said, "As an agent or a major broker I need to be able to show and sell the listings of other agents in my brokerage."

When it comes to "behind the curtain" practices in general, another respondent said, "Some things are OK as long as prior disclosure has been made and/or proper authorizations have been made. One size often does not fit all situations."

But another complained that agents sometimes fail to properly explain and disclose agency relationships in time for consumers to make an educated and informed decision: An agent may self-identify as an "exclusive buyer’s agent" even though that

agent may also represent listings or work for a company that takes listings, for example.

The survey suggested that agents aren’t as likely to double-end a transaction by themselves as they are to find themselves in a sale involving another agent in their own office.

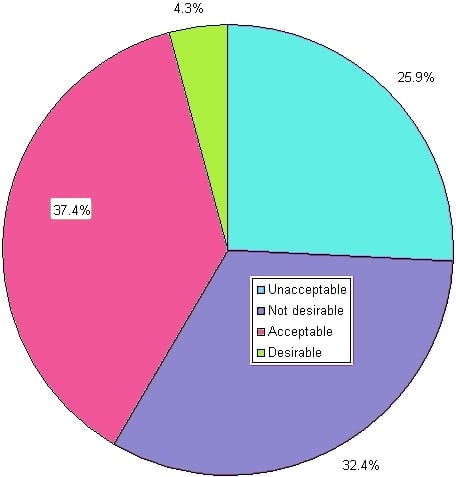

Chart 4. FREQUENCY: An agent represents both the buyer and seller in the same real estate transaction.

While nearly three out of four (73.9 percent) surveyed said it’s "common" for a listing agent and buyer’s agent from the same office to separately represent both the buyer and seller in a transaction, only 41 percent said the same about individual

agents double-ending a deal.

According to the survey, it’s infrequent or rare for agents to give away their clients’ negotiating position. …CONTINUED

Most of those surveyed said listing agents shared their client’s minimum selling price with buyer’s agents infrequently (37 percent) or rarely (39 percent). Only 14 percent said that was a common occurrence.

Similarly, buyer’s agents share client’s maximum purchase price with listing agents only infrequently (35 percent) or rarely (40 percent).

There was little disagreement that sharing a client’s negotiating position is a no-no. Among those surveyed, 83 percent said it was unacceptable for a listing agent to share their client’s minimum selling price. A similar majority — 78 percent — said

it was unacceptable for a buyer’s agent to share their client’s maximum purchase price.

"Sometimes, when disclosing max purchase price for buyer or low selling price for a seller, it is used as a negotiating tool to help the client," said one survey respondent in defense of such practices.

"What if I have client’s permission to divulge maximum price or minimum acceptable?" said another.

The survey also showed that agents and brokers are divided about advising sellers to price properties at below-market value in an effort to draw more buyer interest. Although regulators frown upon setting listing prices that are below what a seller (or a lender, in a short-sale situation) will accept — more than four in 10 of those surveyed said the practice was acceptable (39 percent) or desirable (4

percent).

Only 22 percent characterized pricing a property at below its market value as an unacceptable practice, while 35 percent called such practices "not desirable."

Chart 5. ACCEPTABILITY: Listing agent advises seller to price property at below-market value in an effort to draw more buyer interest.

"I find a lot of agents representing banks price homes way below market value," said one survey respondent who takes issue with the practice.

"I’ll see them sold for much more (tens of thousands more) than the listing price. It just doesn’t seem right to post a price that you won’t sell a house for."

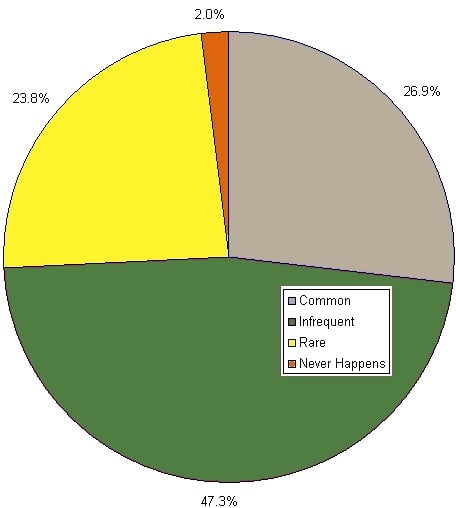

But most brokers and agents said sellers in their market are advised to price properties below market value only infrequently (47 percent) or rarely (24 percent).

Chart 6. FREQUENCY: Listing agent advises seller to price property at below-market value in an effort to draw more buyer interest.

…CONTINUED

Agents and brokers were more likely to get riled about listing agents who have business relationships with investors, and seek to sell directly to those investors at below-market value — a practice sometimes described as "property flopping."

Nearly nine out of 10 survey respondents viewed such business relationships as unacceptable (66 percent) or not desirable (21 percent). But one in four said such relationships are common.

One survey respondent noted that investors are getting bank-owned (REO) properties without listing agents ever notifying the public about the property’s for-sale status, said one survey taker.

More than eight out of 10 responded that it was unacceptable or not desirable for brokerages to reward agents for referring clients to mortgage, title insurance or settlement services companies. Although such rewards are generally prohibited by the Real Estate Settlement Procedures Act (RESPA), about one in three said such practices are common.

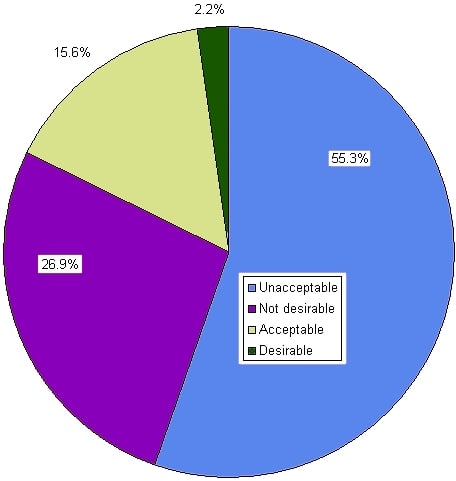

Chart 7. ACCEPTABILITY: Brokerage enters into marketing agreement with mortgage lender, title company, home warranty, or settlement service provider that rewards agents for referring clients to that company.

"Major brokerages often offer mortgage, title and other services, (but) don’t reward agents for referring to affiliated companies because it is not legal to do so," said one survey respondent. Instead, they pressure agents to refer clients to

in-house services.

Also frowned upon in the survey: listing agreements that stipulate buyers will prequalify with a lender that the listing broker has an interest in or relationship with — a requirement 63 percent said was "unacceptable" and 24 percent viewed

as "not desirable."

Most said such requirements were infrequent (36 percent) or rare (28 percent), although 27 percent said the practice was common in their market.

Chart 8. FREQUENCY: Brokerage enters into marketing agreement with mortgage lender, title company, home warranty, or settlement service provider that rewards agents for referring clients to that company.

…CONTINUED

There was little love for per-transaction flat fees that brokerages sometimes charge agents or consumers, with 42 percent calling them "unacceptable" and 32 percent viewing

them as "not desirable." Nearly one in four said such fees, sometimes dubbed "ABC fees," are "acceptable."

Inman News readers were nearly unanimous in their disdain for practices that could be described as deceptive or misleading.

Only a handful stated it was OK for a listing agent to tell buyers that others were interested in a property or offers were pending when that was not the case.

Nine out of 10 said it was clearly a no-no to continue to market a property that’s already sold in order to attract clients.

A similar number said it was unacceptable for agents not to identify themselves as such in online conversations or marketing and advertising.

Vague or unsubstantiated claims by agents or brokers about their market share — such as being the "top agent" or the "No. 1 agent" in their market — were also frowned upon, although nearly one in three called such claims "not

desirable" rather than "unacceptable."

How prevalent are such deceptions?

More than nine out of 10 agents and brokers surveyed said listing agents do create fictional interest or offers on a property. While most said it was infrequent (31 percent) or rare (30 percent), only 7 percent said it "never happens," and 32

percent said the practice was "common."

Similarly, most of those surveyed said it’s not unheard of for listing agents to continue to market properties that have already sold in order to drum up business for themselves, although only 23 percent identified the practice as common.

Agents seem to be conscientious about identifying themselves as employed in the field when engaging in online advertising and marketing, and only slightly less so when involved in online conversations. Most of those surveyed said it was infrequent (36

percent) or rare (32 percent) that agents failed to do so in online conversations.

"(I) just had a broker not disclose that he was an agent while asking a question on Trulia," said one survey respondent. "A BROKER! When I called him on it, he said he didn’t have to. Maybe there should be periodic mandatory testing to

make sure agents and brokers have retained what they learned and should know — not just (continuing education requirements)."

More than half of those surveyed said it was common for agents and brokers to make vague or unsubstantiated claims about their market share — only 2 percent said such claims were "rare."

Agents and brokers were nearly unanimous in their stance regarding listing agents representing properties located in states where they are not licensed — but only 2 percent said the practice is common.

It was far more common, however, for clients or prospective clients to be unaware of agents’ previous ethical infractions, licensing violations, or ongoing investigations against them. More than 70 percent of those surveyed said it was "common"

for clients to be left in the dark about such issues.

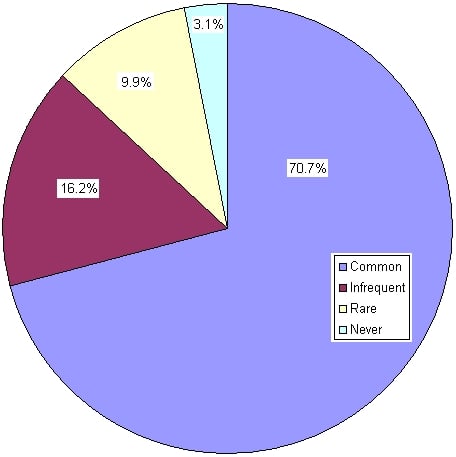

Chart 9. FREQUENCY: Clients and/or prospective clients are unaware of agent’s previous real estate licensing violations, suspensions, etc.

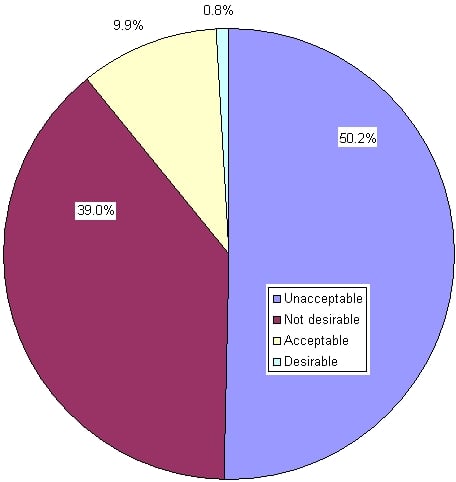

Chart 10. ACCEPTABILITY: Clients and/or prospective clients are unaware of agent’s previous real estate licensing violations, suspensions, etc.

"Self-policing is the rule in the industry, but agents do not want to call out others for fear of being blackballed themselves," said one survey respondent.

"We personally turned in an agent to our state board and the board was friends with the broker so (the board), in turn, investigated us. It is a bit corrupt, and so a separate entity needs to be set up to research and find violations so that our

professional standards can be maintained."

View Complete Survey Results

…CONTINUED

Acceptability of Real Estate Practices (ranked in order of most unacceptable)

| Un- accept- able |

Not desir- able |

Accept- able |

Desir- able |

Total re- sponses |

|

|---|---|---|---|---|---|

| Listing agent agrees to represent properties located in a state where the agent is not licensed. | 95.4% | 3.2% | 1.2% | 0.2% | 500 |

| Listing agent tells buyer that there are other buyers interested or other offers pending on the property when there are not. | 94.6% | 3.6% | 1.2% | 0.6% | 503 |

| Agent does not identify self as agent in online marketing/advertising. | 94.1% | 5.1% | 0.6% | 0.2% | 490 |

| Listing agent continues to market sold properties as active to attract new clients. | 89.2% | 8.4% | 2.2% | 0.2% | 498 |

| Agent does not identify self as agent in online conversations. | 86.6% | 11.6% | 1.6% | 0.2% | 491 |

| Agent encourages real estate purchase that is beyond buyer’s upper limit. | 83.7% | 14.8% | 1.4% | 0.0% | 492 |

| Listing agent shares client’s minimum selling price with buyer’s agent. | 83.0% | 11.7% | 4.2% | 1.0% | 495 |

| Buyer’s agent shares client’s maximum purchase price with listing agent. | 78.4% | 14.3% | 7.3% | 0.0% | 496 |

| Listing agent offers different level of compensation to buyer’s agent based on that agent’s brokerage company, fee structure or business model. | 73.0% | 16.1% | 10.3% | 0.6% | 504 |

| Agent offers services to real estate consumer despite being aware the consumer is already accepting services from another agent. | 68.3% | 24.8% | 6.5% | 0.4% | 492 |

| Listing agent has business relationship with investors and actively seeks to sell directly to those investors at below-market value. | 66.3% | 21.3% | 11.0% | 1.4% | 502 |

| Agent or broker makes vague or unsubstantiated claims about market share (example: "top agent" or "No. 1 agent"). | 63.5% | 31.6% | 4.7% | 0.2% | 493 |

| Listing agreement stipulates that buyers will prequalify with a mortgage lender or lenders that the listing broker has an interest in or relationship with. | 63.4% | 23.8% | 11.6% | 1.2% | 500 |

| Buyer’s agent does not show homes with lower-than-typical cooperating compensation offered by listing broker. | 61.8% | 28.5% | 8.5% | 1.2% | 492 |

| Brokerage offers mortgages, title insurance, or settlement services through affiliated company and rewards agents for referring clients to that company. | 55.7% | 26.9% | 14.8% | 2.6% | 494 |

| Brokerage enters into marketing agreement with mortgage lender, title company, home warranty, or settlement service provider that rewards agents for referring clients to that company. | 55.3% | 26.9% | 15.6% | 2.2% | 494 |

| Listing agent regularly engages in pocket listings. | 54.0% | 32.7% | 12.7% | 0.6% | 489 |

| Buyer’s agent does not show clients homes listed by certain brokerage companies based on reputation or past experiences. | 52.9% | 34.0% | 11.5% | 1.6% | 497 |

| Clients and/or prospective clients are unaware of agent’s previous real estate licensing violations, suspensions, etc. | 50.2% | 39.0% | 9.9% | 0.8% | 484 |

| Buyer’s agent shows own listings, or company’s own listings, preferentially to buyers. | 48.1% | 34.0% | 16.7% | 1.2% | 497 |

| Clients and/or prospective clients are unaware of agent’s ethical infractions, rulings and penalties related to mediation/arbitration hearings. | 47.7% | 39.9% | 10.9% | 1.4% | 486 |

| Buyer’s agent refuses to represent client in purchase of for-sale-by-owner home. | 46.8% | 31.6% | 19.8% | 1.8% | 491 |

| Clients and/or prospective clients are unaware of current investigations/allegations of licensing violations against agent. | 46.0% | 34.3% | 17.9% | 1.8% | 487 |

| Agent recommends service provider to client without full knowledge of the quality or value of the service provided. | 44.4% | 51.7% | 3.7% | 0.2% | 493 |

| Broker charges special pertransaction fee to agents or consumers in addition to commission splits/regular cost of services. | 42.5% | 32.3% | 23.4% | 1.8% | 492 |

| Listing agent temporarily removes then relists property on MLS in an effort to attract new buyers and/or reset days on market. | 41.7% | 34.9% | 21.6% | 1.8% | 501 |

| Agent refers clients to other agent without knowledge of the quality of service, value that agent offers. | 41.3% | 53.2% | 5.5% | 0.0% | 494 |

| Listing agent accepts listing with unrealistic asking price for the marketing opportunity — the ability to prospect for new clients. | 39.8% | 47.8% | 12.4% | 0.0% | 498 |

| Referring agent does not disclose to real estate consumer the referral fee that the referring agent will receive. | 37.6% | 30.4% | 29.4% | 2.7% | 490 |

| Major listing brokers in the same market area choose to charge the same rate or roughly the same rate for services. | 31.5% | 14.9% | 41.0% | 12.6% | 483 |

| Major listing brokers in the same market area choose to offer the same commission rate or roughly the same rate to cooperating brokers on the buyside of the transaction. | 29.7% | 14.1% | 40.0% | 16.2% | 482 |

| Buyer’s agent does not show for-sale-by-owner homes. | 29.6% | 38.8% | 27.6% | 4.0% | 497 |

| Agent encourages real estate purchase at the upper range of buyer’s financial capacity. | 26.5% | 49.7% | 23.2% | 0.6% | 491 |

| An agent represents both the buyer and seller in the same real estate transaction. | 25.9% | 32.4% | 37.4% | 4.3% | 506 |

| Listing agent advises seller to price property at below-market value in an effort to draw more buyer interest. | 22.4% | 35.3% | 38.7% | 3.6% | 496 |

| Agent is personally engaged in buying or selling homes while working with clients who are also buying or selling homes. | 15.9% | 28.9% | 49.4% | 5.8% | 484 |

| Listing agent is from the same office as the buyer’s agent in the same real estate transaction. | 13.9% | 11.4% | 67.1% | 7.6% | 502 |

Frequency of Real Estate Practices (ranked in order of most common)

| Com- mon |

Infre- quent |

Rare | Never happens |

Total re- sponses |

|

|---|---|---|---|---|---|

| Listing agent is from the same office as the buyer’s agent in the same real estate transaction. | 73.9% | 22.2% | 3.9% | 0.0% | 360 |

| Clients and/or prospective clients are unaware of current investigations/allegations of licensing violations against agent. | 72.7% | 15.3% | 8.5% | 3.4% | 352 |

| Clients and/or prospective clients are unaware of agent’s ethical infractions, rulings and penalties related to mediation/arbitraction hearings. | 71.4% | 15.0% | 10.5% | 3.1% | 353 |

| Clients and/or prospective clients are unaware of agent’s previous real estate licensing violations, suspensions, etc. | 70.7% | 16.2% | 9.9% | 3.1% | 352 |

| Referring agent does not disclose to real estate consumer the referral fee that the referring agent will receive. | 59.8% | 23.2% | 13.0% | 4.0% | 353 |

| Major listing brokers in the same market area choose to offer the same commission rate or roughly the same rate to cooperating brokers on the buyside of the transaction. | 58.0% | 19.1% | 13.4% | 9.4% | 350 |

| Major listing brokers in the same market area choose to charge the same rate or roughly the same rate for services. | 57.8% | 20.1% | 12.9% | 9.2% | 348 |

| Listing agent accepts listing with unrealistic asking price for the marketing opportunity — the ability to prospect for new clients. | 57.3% | 33.8% | 7.5% | 1.4% | 358 |

| Agent or broker makes vague or unsubstantiated claims about market share (example: "top agent" or "No. 1 agent"). | 56.1% | 27.6% | 14.1% | 2.3% | 355 |

| Listing agent temporarily removes then relists property on MLS in an effort to attract new buyers and/or reset days on market. | 52.8% | 31.7% | 13.6% | 1.9% | 360 |

| Buyer’s agent does not show for-sale-by-owner homes. | 50.0% | 33.0% | 14.0% | 3.1% | 358 |

| Buyer’s agent shows own listings, or company’s own listings, preferentially to buyers. | 49.6% | 30.7% | 16.1% | 3.7% | 355 |

| Agent encourages real estate purchase at the upper range of buyer’s financial capacity. | 46.5% | 34.9% | 14.9% | 3.7% | 355 |

| Agent is personally engaged in buying or selling homes while working with clients who are also buying or selling homes. | 41.4% | 35.7% | 20.7% | 2.3% | 353 |

| An agent represents both the buyer and seller in the same real estate transaction. | 40.9% | 40.9% | 17.1% | 1.1% | 362 |

| Brokerage offers mortgages, title insurance, or settlement services through affiliated company and rewards agents for referring clients to that company. | 39.7% | 24.4% | 25.2% | 10.8% | 353 |

| Brokerage enters into marketing agreement with mortgage lender, title company, home warranty, or settlement service provider that rewards agents for referring clients to that company. | 37.9% | 25.4% | 24.3% | 12.4% | 354 |

| Buyer’s agent does not show homes with lower-than-typical cooperating compensation offered by listing broker. | 37.0% | 39.3% | 20.3% | 3.4% | 354 |

| Agent recommends service provider to client without full knowledge of the quality or value of the service provided. | 34.0% | 37.1% | 25.8% | 3.1% | 353 |

| Agent refers clients to other agent without knowledge of the quality of service, value that agent offers. | 33.1% | 39.9% | 22.1% | 4.8% | 353 |

| Listing agent tells buyer that there are other buyers interested or other offers pending on the property when there are not. | 31.8% | 31.0% | 30.2% | 7.0% | 358 |

| Agent offers services to real estate consumer despite being aware the consumer is already accepting services from another agent. | 29.5% | 31.5% | 32.6% | 6.5% | 356 |

| Buyer’s agent refuses to represent client in purchase of for-sale-by-owner home. | 27.2% | 37.9% | 29.5% | 5.3% | 356 |

| Listing agreement stipulates that buyers will prequalify with a mortgage lender or lenders that the listing broker has an interest in or relationship with. | 27.1% | 36.0% | 27.7% | 9.1% | 361 |

| Listing agent advises seller to price property at below-market value in an effort to draw more buyer interest. | 26.9% | 47.3% | 23.8% | 2.0% | 357 |

| Listing agent has business relationship with investors and actively seeks to sell directly to those investors at below-market value. | 25.7% | 37.7% | 31.8% | 4.7% | 358 |

| Listing agent regularly engages in pocket listings. | 23.4% | 40.9% | 31.4% | 4.3% | 350 |

| Listing agent continues to market sold properties as active to attract new clients. | 22.9% | 34.9% | 31.3% | 10.9% | 358 |

| Agent does not identify self as agent in online conversations. | 20.5% | 36.1% | 32.4% | 11.1% | 352 |

| Buyer’s agent does not show clients homes listed by certain brokerage companies based on reputation or past experiences. | 20.1% | 39.9% | 32.9% | 7.1% | 353 |

| Agent does not identify self as agent in online marketing/advertising. | 17.0% | 34.3% | 34.6% | 14.2% | 353 |

| Agent encourages real estate purchase that is beyond buyer’s upper limit. | 16.6% | 34.6% | 36.9% | 11.8% | 355 |

| Listing agent offers different level of compensation to buyer’s agent based on that agent’s brokerage company, fee structure or business model. | 15.1% | 27.7% | 34.7% | 22.4% | 357 |

| Buyer’s agent shares client’s maximum purchase price with listing agent. | 14.7% | 35.3% | 40.4% | 9.6% | 354 |

| Listing agent shares client’s minimum selling price with buyer’s agent. | 13.8% | 36.8% | 39.0% | 10.4% | 356 |

| Listing agent agrees to represent properties located in a state where the agent is not licensed. | 2.0% | 11.0% | 45.5% | 41.6% | 356 |

CORRECTION: The original version of this report contained three charts with incorrect data. Charts 1, 2 and 9 have been updated.