- A Seattle-based brokerage's home valuation tool lets consumers review photos and listing data to choose comparable homes.

- Surefield's founder touts the tool as a way to get a top-notch home valuation "without the hassle of talking to an agent or relying on a secret formula that doesn’t look inside the home."

- The tool's complexity may show consumers the skill required to generate an accurate home valuation.

Two reasons to take online home valuations with a grain of salt: they aren’t explained, and they don’t account for the condition of a home.

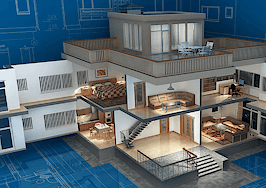

Surefield, a Seattle-based discount brokerage that uses in-house technology to produce online 3-D models, has unveiled a valuation tool that it says eliminates those shortcomings.

Taking on other AVMs

Surefield’s “Pricepoint,” ambitiously touted as a “Zestimate killer” by a Surefield spokeswoman, lets consumers handpick the sold and comparable homes they want to use to value a home based on listing data and photos, arming consumers with the same type of software that agents use to produce price estimates, Surefield claims.

At least one other valuation tool (Redfin’s) also lets anyone select what comparable homes they would like to use for an estimate, but Surefield says its tool — which currently only covers Washington state — offers an unprecedented level of sophistication to prospective buyers and sellers.

“Finally, consumers can get an instant and accurate home valuation without the hassle of talking to an agent or relying on a secret formula that doesn’t look inside the home,” said Surefield CEO David Eraker in a statement. “Pricepoint is the only free tool that gives a totally transparent home valuation without turning you into a lead.”

Screen shot showing Surefield’s home valuation tool.

The irony, of course, is that Surefield is offering the tool, at least in part, to generate leads for its own agents.

Launched in early 2014 by a co-founder of Redfin, Surefield remains a minor player in Seattle, having sold 23 listings in 2015. But its unconventional business model and proprietary 3-D technology have distinguished the firm as an innovator. Surefield’s valuation tool marks the brokerage’s latest attempt to use technology to differentiate itself.

How it works

Users who enter the address and square footage of a property into Surefield’s valuation tool are presented with a preliminary list of 10 nearby recently sold homes and 10 nearby active listings deemed most similar to the address being valued.

The home’s valuation is based on the average price-per-square-foot of all comparable sold homes used for the estimate. But the tool also shows a customizable list of active listings, and their average price, because it’s also “important to see what is currently for sale to analyze competitive inventory levels and prices,” Surefield says.

The tool makes it easy for users to exclude “outliers” from a valuation by examining both the specifications and photos of comparable properties.

Users are encouraged to remove properties whose price per square foot, “lot size by finished area” and beds-to-bathrooms ratios differ substantially from those of the property being valued or the bulk of the comparable homes that can be used for the valuation.

Users also have the option to hone their lists of comparable properties by browsing past or current listing photos of homes. This might enable a person to only choose comparable homes with three bedrooms located upstairs, rather than homes with three bedrooms spread between multiple floors.

Up to the user

Imagine a property is a good-sized, recently remodeled home located in a small-to-average-sized lot in Seattle with partial city and water views, says Surefield spokeswoman Cynthia Nowak. The home’s owner could put together a stellar list of comparable homes by doing the following:

- View the “Lot Size by Finished Area” chart, click on dots with large lots, review their locations and finish levels, “and most likely you will immediately exclude them.”

- Review the “Price Per Square Foot by Finished Area” chart, click on high price-per-square foot homes, see if they have great city views, and if so, weed them out.

- Look at the low price-per-square-foot comparable homes, examine their finish levels through photos and remove those with finish levels that substantially differ from the property being valued.

- Remove homes with bedroom and bathroom ratios that differ substantially from the ratio of the home being valued.

- Consider removing other properties if they have amenities, such as parking, pools and large decks, that the home being valued doesn’t have.

Will most consumers have the bandwidth and know-how to curate comparable homes like this? And what about factoring active listings into a valuation? The tool leaves that up to the user as well.

“To think that you can put somebody in a professional’s shoes in their office with the same software and figure that the average consumer is going to be as accurate” is a stretch, argues Sam DeBord, a team leader at Seattle-based Coldwell Banker Danforth.

Automating another step in the process

Nowak said that, by educating consumers on home values, the tool will enable consumers ready to transact to “come armed with more and better information, saving any agent a lot of time.”

“Ideally, we would like them to contact Surefield, but we also wanted to automate another step in the real estate process,” she added.

Surefield will soon offer consumers the ability to save a valuation they produce with the tool by registering their information on the brokerage’s website.

![How hybrid brokerages are changing real estate [Special Report]](https://inman-www.imgix.net/wp-content/uploads/2015/07/hybridreportheader-1024x454.jpg?fit=crop&crop=entropy&w=266&h=188&usm=20&usmrad=4&auto=format)