Inman Connect is moving from Las Vegas to San Diego in 2025 and it’ll be bigger, better, and bolder than ever before. Join us for Inman Connect San Diego on July 30-Aug. 1, 2025 with the brightest minds in real estate to shape the future of the industry. Reserve your spot today for an exclusive discount.

A 50-year high in multifamily housing starts has yielded great rewards for renters as rent growth cools and a growing share of landlords sweeten leases with discounts and other amenities. According to Zillow’s latest market report, 33.2 percent of rentals on the portal included concessions in July, a 23 percent increase from the year before.

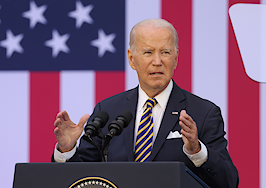

Skyler Olsen | Photo credit: Zillow

“Builders have stepped up and built an incredible number of homes in response to soaring rents during the pandemic, and renters are now seeing the benefits,” Zillow Chief Economist Skylar Olsen said in a written statement. “Now is a great time for renters to find a deal, with more new apartments hitting the market than at any time in the past several decades.”

Nearly 60,000 multifamily rental units came online in June, with more than 882,900 units still under construction. The last time the U.S. multifamily market saw a building boom of this magnitude was in 1973, when new privately owned housing starts for buildings with five units or more reached a peak of 919,700 in July.

However, multifamily builders have been slowing their pace as quarterly vacancy rates (6.6 percent) hit the highest level since winter 2021.

Due to increased inventory, multifamily rent growth fell for the second consecutive month in July, dropping to 5.1 percent — a far cry from the double-digit rent increases seen in 2020 and 2021.

Raleigh, North Carolina (53.3 percent); Charlotte, North Carolina (53 percent); Atlanta (52.2 percent); Salt Lake City (50.9 percent); Nashville, Tennessee (50.8 percent); and Austin, Texas (50.5 percent) led the way in the share of rentals with concessions. Meanwhile, San Jose, California (-9.7 percent) had the biggest decline in rentals with concessions, signaling an increasingly competitive market.

GOBankingRates’ latest report shed some light on California’s rental market as renters grapple with an increasingly complicated answer to an age-old question: Rent or buy? The report said California’s for-sale and rental markets are some of the most expensive in the nation, with renters and homeowners facing monthly costs of living in the high four figures.

In San Jose, the median household has an annual income of $136,010. If a homeowner purchases an average-value home ($1,472,661), they can expect to pay $8,720 per month on mortgage payments, assuming they offer a 10 percent down payment and secure a conventional 30-year loan at an average rate. Meanwhile, renters are paying an average of $3,243 on rent.

When other costs of living are factored into the equation, the typical homeowner’s monthly cost of living in San Jose ($11,159) is 49.08 percent higher than the typical renter’s ($5,682), making renting the best deal.

Olsen said the trend could hold throughout the rest of 2024 as “a slowing job market and lower mortgage rates” impact the market.