At Inman Connect Las Vegas, July 30-Aug. 1, 2024, the noise and misinformation will be banished, all your big questions will be answered, and new business opportunities will be revealed. Join us.

Despite the median asking rent declining for 11 consecutive months, renters are still shelling out $305 more per month for a 0-2 bedroom unit than they would have pre-2020. According to Realtor.com’s latest market report, the median asking rent in June declined 0.4 percent year over year to $1,743 per month — the lowest median asking rent seen since August 2022.

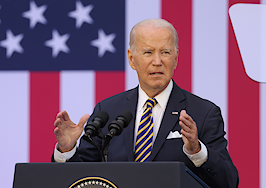

Danielle Hale

“Rents have been steadily falling for almost a year, though the pace of the decline has slowed,” Realtor.com Chief Economist Danielle Hale said on Thursday. “But rental costs have risen significantly since before the pandemic, and inflation has further strained renters’ budgets, underscoring the need for more supply to meet demand and to keep renters from contributing an increasing percentage of their incomes to housing costs.”

Florida renters have experienced the most significant rise in housing costs, with Tampa-St. Petersburg-Clearwater, Florida (+39.5 percent) and Miami-Fort Lauderdale-Pompano Beach, Florida (+39.2 percent) posting double-digit median rent growth since 2019.

In Tampa, for example, the median asking rent in June was $1,752 — a $496 increase from 2019. That increase means the typical Tampa household is spending 8.6 percent more of their monthly gross income on rent.

Indianapolis-Carmel-Anderson, Indiana(+37.5 percent); Pittsburgh (+37.4 percent); Sacramento-Roseville-Folsom, California (+35.8 percent); Virginia Beach-Norfolk-Newport News, Virginia, North Carolina (+32.5 percent); New York-Newark-Jersey City, New York, New Jersey, Pennsylvania (+31.3 percent); Cleveland-Elyria, Ohio (+30.6 percent); Raleigh-Cary, North Carolina (29.8 percent); and Birmingham-Hoover, Alabama (+29.3 percent), rounded out the top 10 markets with the highest rent increases since 2019.

Unsurprisingly, renters in the South experienced the best affordability in June.

The most notable year-over-year declines were all in the South. Austin, Texas (-9.5 percent), San Antonio, Texas (-8.2 percent), and Nashville, Tennessee (-8.1 percent) led the way in median rent declines, thanks to robust multifamily building trends.

Rent trends were a mixed bag for the West and East Coasts, with Los Angeles (-1.9 percent) and San Francisco (-4.2 percent) experiencing slight annual declines and New York City (+0.6 percent) experiencing an edge up in rents after considerable declines earlier in the pandemic.

Rents rose in the Midwest, with Indianapolis (+4.4 percent), Milwaukee (+3.7 percent) and Minneapolis (+3.7 percent) leading the way.