Real estate coaches and the value of ongoing training have never been more crucial. As 2023 winds down, level up with advice from top coaches, training resources and so much more during Inman’s Coaching and Training Month in October.

Real estate coaches and the value of ongoing training have never been more crucial. As 2023 winds down, level up with advice from top coaches, training resources and so much more during Inman’s Coaching and Training Month in October.

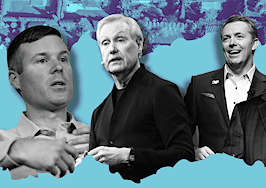

Inman spent all last week breaking down all of the intense moments of the Sitzer | Burnett trial, the repercussions of which will undoubtedly stay with our industry for decades to come. On Day 3, questions shifted and swirled around defendants and their tried-and-true training practices.

“Six percent” bubbled to the top of the conversation repeatedly, and the question begs an honest answer. Is agent training up to snuff regarding seller objections to paying commissions in “hypothetical” conversations, or have agents been conditioned to accept “nothing less” as a standard?

The plaintiffs are confused, dismayed and feel misled. Many are especially sensitive because they didn’t have much home equity and feel they shouldn’t have to pay for a buyer’s agent, especially when that buyer’s agent is negotiating against their bottom line.

What’s under the microscope in these conversations is how agents are trained, especially in their communication with consumers, to convince them to sign listing agreements that expressly agree to continue to abide by the commission structure.

Franchise owners, brokers and coaches alike have all pushed agents to use techniques to sell, but in this new era, selling will have to take a back seat to proper disclosure methods first.

Coffee is for closers

The iconic 1992 movie Glengarry Glen Ross painted a gritty picture of the ugly side of sales. If you wanted the Cadillac, you needed to close the “morons” on the other side of the information card. The prospects would not have filled out the form if they didn’t want you to close them anyway, right?

The movie effortlessly straddles the moral line of not really caring if the clients can afford it because to put food on their table — and to avoid being fired — the sales team has to do whatever it takes to close the sale and get on the board.

Navigating objections smoothly is the calling card of a well-trained sales agent, but let’s walk through two examples that I believe are at the core of what the plaintiffs’ attorneys are circling around in Sitzer | Burnett. Carefully crafted objections do not leave much room for sellers to advocate for themselves or their own bottom line.

I went looking for commission-related objection handlers online in publicly available resources. Here are some I easily found; these include the types of responses that the current trial is drawing attention to.

Note: The following passages contain direct quotes with errors from the original sources. We have retained the errors exactly as they appear in the source for accuracy.

In popular real estate coach and trainer Mike Ferry’s 40 Real Estate Objections Handled, you will find good examples of the type of persuasive sales training that this trial may just unravel.

No. 16. “Will you cut your commissions, other agents will?”

Top Agent Alternative: “Commissions aren’t negotiable with agents that sell homes daily. They are only negotiable with realtors who don’t believe in the services that they offer. Now you told me you had to be gone in 90 days, right? You need a strong service agent that sells homes, right?”

No. 17. “It seems like 7% should be enough to cover your expenses without paying an additional $250 transaction fee.”

“The reason you are going to pay me more is simple. Every house I list for sale sells, and my staff gets them closed, so you walk away with a nice big check in your hand…I mean, that’s what you want, isn’t it?”

The next example comes from Keller Williams’ 6 Seller Objection Scripts That Win Listings:

“I love your marketing plan and how you want to price my home. I’m willing to sign a contract, but why can’t we do it at 3 or 4%?”

Emily Baker, agent at Keller Williams Realty Greater Springfield and KW MAPS Mastery Coach:

Now, if someone cuts their commission, what do you think that they’re cutting? Yes, the marketing. And, can we agree that the right marketing plan is key to finding the one buyer willing to pay the most amount of money, which ultimately would lead to that money in your pocket? Let’s go ahead and sign the paperwork so we can get you the most amount of money.

In both of these examples you can see how agents are encouraged to nullify the seller’s concerns about the full cost of the transaction with promises of more money and a more efficient closing. Neither script explains to the seller that they are free to negotiate.

Retraining your training: Where to start

Cleaning up training practices is going to be a huge undertaking. There are so many books, presentations, videos, materials and gurus on YouTube, you will need to steel your intentions before figuring out what stays and what goes.

- Independent contractors have the right to train themselves for success; brokers have a responsibility to make sure they are disclosing appropriate information and options to clients.

- If you are providing training to your agents, you need to know what is in the content. If it differs from how you want agents to approach this complicated issue, you need to provide clear guidance on what supersedes any previous sales training.

- Lean on your state and local associations for guidance on commission negotiations. Some state associations, like North Carolina Realtors, have creatively addressed commission negotiation issues with forms and best practices that will provide you with a framework to navigate these tricky issues. The Virginia Association of Realtors had a fascinating podcast around zero percent MLS offerings.

- Create your own videos that clearly disclose and explain listing agreements, buyer’s agreements and how consumers can contact governing agencies for their own research. Make this an essential part of how consumers are educated when they begin to work with your brokerage.

- Attorney representation, while another expense, will help create more consumer security in the transaction, and they may have some valuable insights for you moving forward when representing sellers.

Always be closing?

Manipulating consumers to use your services is never OK. Now is the time to determine if your sales and disclosure training are actually canceling each other out.

These practices to sway sellers to comply with a plan for commissions — and the suggestion that their home cannot be sold efficiently without offering “fair” compensation — are carefully integrated into many parts of the training process.

There is a culture problem regarding discussions around commissions in the industry, and this reckoning, although painful for agents who try to do the right thing, appears to be necessary to help consumers understand what they are signing up for.

There is one quote that keeps bothering me from plaintiff Rhonda Burnett, the case’s namesake.

“I paid the buyer’s broker to negotiate against me and my husband, which resulted in a lower sales price.” — Rhonda Burnett

This logic makes sense to me. In this case, the agents were undoubtedly trained to be “good agents,” but sales training that puts an agent’s commission over a consumer’s experience is what’s at the heart of this trial.

Consumers deserve better; agents deserve a commission structure that doesn’t require extensive sales training to get someone to sign off. There is definitely room for improvement.

Rachael Hite is a former agent, a business development specialist, fair housing advocate, copy editor, and is currently perfecting her long game selling homes in a retirement community in Northern Virginia. You can connect with her about life, marketing, and business on Instagram.