This article was shared here with the permission of Mike DelPrete for Inman Intel, a data and research arm of Inman offering deep insights and market intelligence on the business of residential real estate and proptech. Subscribe today.

As Zillow’s Listing Showcase rolls out, it’s becoming clear that it will play a central role on the seller side of the business as it unlocks new premium revenue streams.

Why it matters: Zillow’s goal is to double its revenue and customer transaction share by 2025 — a significant undertaking — and Listing Showcase appears to be a foundational component of that strategy.

Listing Showcase is sold to agents on a subscription basis, and each geographic “zone” has a limited number of subscriptions available.

- One subscription includes five new Showcase Listings per month (which include photos, a 3D tour, interactive floorplans, and enhanced visibility).

- Subscription prices vary by thousands of dollars depending on the market, but the average appears to be around $3,000 per month.

- Exclusivity is an important cornerstone of Listing Showcase: It’s possible for one agent or team to purchase all of the available subscriptions in a zone.

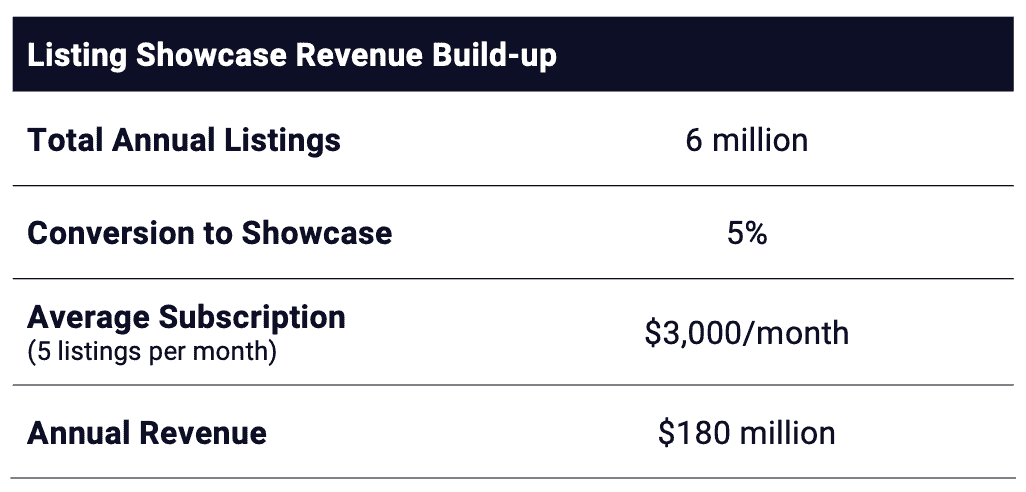

The revenue opportunity is significant, measured in hundreds of millions of dollars per year.

- Assuming 6 million total listings per year, converting 5 percent of them to showcase listings at an average subscription of $3,000 per month, the revenue potential is $180 million per year. (Zillow’s existing premier agent business is about $1.2 billion.)

And by the way: Listing Showcase doesn’t cannibalize Zillow’s existing business — listing pages still have tour requests which are routed to paying premier agents.

Perhaps most importantly, the launch of Listing Showcase gets Zillow’s paying customers on the premium product flywheel, a concept very familiar to its international portal peers.

- Once customers start paying for premium placement (listings and exposure), they usually end up paying more and more over time.

- This is ARPL (average revenue per listing), and it keeps going up, driven by consumer demand and agent exclusivity — it’s the growth engine of international real estate portals like REA Group in Australia, Rightmove in the U.K., and Hemnet in Sweden.

Zillow’s goal is to double its customer transaction share — a transaction that Zillow monetizes — from 3 percent to 6 percent of the market.

- Zillow reported that it had 5 percent of buyer customer transactions in 2021, and, as outlined above, if it’s able to capture 5 percent of seller listings, the goal of 6 percent of all buyer and seller transactions is within reach.

The bottom line: Up until now, the path to Zillow’s lofty goals hasn’t been entirely clear – but Listing Showcase is providing tangible clarity.

- Listing Showcase doubles down on what the business actually is (a high-margin online advertising platform) and not something it isn’t (an unprofitable, low-margin iBuyer or mortgage company).

- In other words, Listing Showcase is strategically aligned to Zillow’s DNA and sustainable competitive advantage; it is competing where it can win.

Mike DelPrete is a strategic adviser and global expert in real estate tech, including Zavvie, an iBuyer offer aggregator. Connect with him on LinkedIn.