In these times, double down — on your skills, on your knowledge, on you. Join us Aug. 8-10 at Inman Connect Las Vegas to lean into the shift and learn from the best. Get your ticket now for the best price.

Each week on The Download, Inman’s Christy Murdock takes a deeper look at the top-read stories of the week to give you what you’ll need to meet Monday head-on. This week: NAR’s membership fee hike and balancing your budget.

As individuals and business owners, many of us have been tightening our belts over the last few months, both to meet current market realities and to prepare for what looks like a challenging couple of years. Yet it’s also necessary to balance that belt-tightening with appropriate spending that gets results and keeps you moving forward.

This week on The Download, we take a look at NAR’s newly approved fee hike, then offer the best advice from our contributors on how you can run your business more efficiently, cutting the costs that make sense without sacrificing the essentials.

NAR membership dues would rise with inflation under new proposal by Andrea Brambila

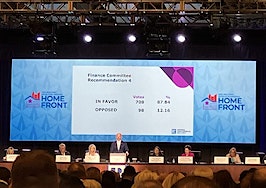

Despite ending 2022 with a record-high number of members and a “strong financial position,” according to its Treasurer Greg Hrabcak, NAR put forth a proposal at its midyear conference that would tie dues to the Consumer Price Index (CPI), setting the stage for annual fee hikes.

While NAR’s current financial position looks rosy, Hrabcak said that the increase in fees would be needed if the next few years unfold as predicted. Based on NAR Chief Economist Lawrence Yun’s analysis, the organization anticipates an estimated 15 percent decline in membership in the near future, resulting in an estimated budget deficit of as much as $15 million in 2024.

Andrea Brambila walks you through the rationale and decision-making process in her coverage of the trade group’s gathering.

EXTRA: NAR votes to raise membership dues in alignment with inflation

As the passage of this NAR fee hike makes it more expensive to do business, you may be hunkering down and focusing on spending and budgeting — especially if the spring market hasn’t been as generous as in years past.

Fortunately, Inman always offers you the best advice when it comes to running your business more efficiently and taking care of your dollars and cents. Check out the latest:

The art of balancing marketing spend when times are tough

The key to successful marketing lies in striking the right balance between cutting costs and investing in growth. While financial reversals may tempt you to lower spending across the board, a more surgical approach is preferable so that you can continue to lead gen and grow your business in the months and years ahead. Leadership consultant Chris Pollinger helps you find the right balance so that you can make all the right moves.

EXTRA: Beat the broker blame-game. Hold onto agents in a tough market

Overspending? Here’s how real estate agents can rein it in

You can’t just stop spending money, but you may not be able to sustain your current level of spending, especially if you’re having a slow spring. Let Darryl Davis help you decide what’s necessary, what’s extra and what you should plan for next so that you can build accountability and discipline in your financial affairs.

EXTRA: Real-world ways this tech-forward firm is using ChatGPT

7 ways another recession will shape a generation of real estate agents

Tough times build tough people and offer an unparalleled opportunity for you to become more resilient and knowledgeable about the way you do business. Let Jimmy Burgess take you through the challenges you’ll face in the months to come and help you navigate them with grace as you build perseverance.

EXTRA: 7 timeless principles for explosive business growth

Want more? Never miss Agent Edge. Subscribe here.