In these times, double down — on your skills, on your knowledge, on you. Join us Aug. 8-10 at Inman Connect Las Vegas to lean into the shift and learn from the best. Get your ticket now for the best price.

Severely limited housing inventory and high mortgage interest rates have throttled the Spring homebuying season, according to a new report from Redfin.

Typically the hottest homebuying season, new listings were down 19 percent during the four-week period ending May 7, the report reads. Pending home sales were down 16 percent compared to last year for the same period, suggesting homebuyers and sellers alike are still being held back by mortgage rates north of 6 percent.

However, the scant amount of homes for sale has created a homebuying environment that feels hotter than it is in reality, with buyers who are willing to pay more for mortgages facing intense competition for the few homes on the market.

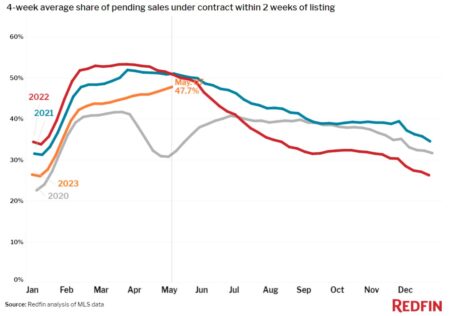

Nearly half of the homes that did sell during the four-week period ending May 7 did so within weeks. That share has increased over the last month — unusual for this time of year when homebuying activity usually starts to wind down from the highs of spring.

Nearly half of the homes that did sell during the four-week period ending May 7 did so within weeks. That share has increased over the last month — unusual for this time of year when homebuying activity usually starts to wind down from the highs of spring.

Mortgage purchase applications are up 5 percent from the same time last year, the report notes.

A separate report from Zillow released this week declared that the drought of new listings is driving prices back up and has brought about the return of a seller’s market.

Taylor Marr | Redfin

“This spring’s housing market is hot but cold, with scant listings making it less active than usual but fast and competitive at the same time,” Redfin Deputy Chief Economist Taylor Marr said in a statement. “The good news is that buyers are out there, trying to find a seat in a game of musical chairs. The bad news is there aren’t enough chairs.

“A lot of potential home sales are locked up until mortgage rates come down to a level for which current owners would be willing to trade in their 3% rate. The problem is that’s unlikely to happen anytime soon, as although inflation is steadily coming down from last year’s record-high levels, it’s still above target.”

While the national housing picture is defined by low inventory, each market is different. Austin Redfin agent Gabriel Recio said in the report that he has seen demand pick up and there has been enough inventory to keep competition manageable.

“I’ve seen an influx of homebuyers enter the market over the last month,” Recio said. “The rejuvenation is partly because people got tired of waiting for mortgage rates to come down and partly because they feel it’s a good time to get a home without much competition. Many of today’s buyers are people moving in from other states, and some are investors.”

The Federal Reserve raised interest rates for the 10th time at its most recent meeting as it wages its war on inflation, but recent bank failures and a potential debt ceiling showdown have caused the central bank to signal that it may be done raising rates for now.