In May, we’ll go deep on money and finance for a special theme month, by talking to leaders about where the mortgage market is heading and how technology and business strategies are evolving to suit the needs of buyers now. A prestigious new set of awards, called Best of Finance, debuts this month too, celebrating the leaders in this space. And join Mortgage Brief for weekly updates all year long.

More consumers are finally getting the message that mortgage rates are likely to go down over the next year as the economy cools, but they’re also starting to get more worried about the prospects of a recession and the looming U.S. debt ceiling crisis.

That’s according to two closely watched surveys by the University of Michigan and mortgage giant Fannie Mae.

Preliminary results of the U of M’s Surveys of Consumers, released Friday, show consumer sentiment declined 9 percent in May. A component of the index that measures expectations for the year ahead was down 23 percent from April to May, Joanne Hsu, the director of the surveys, said in releasing the latest numbers.

“While current incoming macroeconomic data show no sign of recession, consumers’ worries about the economy escalated in May alongside the proliferation of negative news about the economy, including the debt crisis standoff,” Hsu said.

University of Michigan Consumer Expectations Index

Monthly and three-month moving averages | Source: University of Michigan.

The Index of Consumer Expectations, which also measures long-run expectations, fell 11.7 percent from April to May to 53.5 — a 3.3 percent decline from a year ago. An Index of Current Economic Conditions fell 5.4 percent from April to May but was up 1.9 percent from a year ago.

Worries that an impasse on raising the U.S. debt ceiling could lead the nation to default on $31.4 trillion in debt are weighing on consumers, Hsu said. A recent Zillow analysis concluded that a U.S. debt default, while unlikely, could push mortgage rates above 8 percent, raising the monthly payments when taking out a new mortgage by 22 percent.

Joanne Hsu

“Throughout the current inflationary episode, consumers have shown resilience under strong labor markets, but their anticipation of a recession will lead them to pull back when signs of weakness emerge,” Hsu said. “If policymakers fail to resolve the debt ceiling crisis, these dismal views over the economy will exacerbate the dire economic consequences of default.”

In a note to clients, Pantheon Macroeconomics Chief Economist Ian Shepherdson said the deterioration in consumer sentiment could also be explained by March’s stock market swoon, rising gas prices through April and “broader uneasiness” in the wake of recent bank failures.

In advising clients to take the dip in the U of M Consumer Sentiment Indexes with a grain of salt, Shepherdson noted that reactions to stock market ups and downs tend to lag by a month or two.

Ian Shepherdson

“Gas prices are now coming back down, and the stock market has recovered almost all the March drop, so it would be reasonable to expect sentiment rebound, at least in part, in June,” Shepherdson said. “Looking further ahead, though, rising layoffs and slower hiring will weigh on confidence, and spending.”

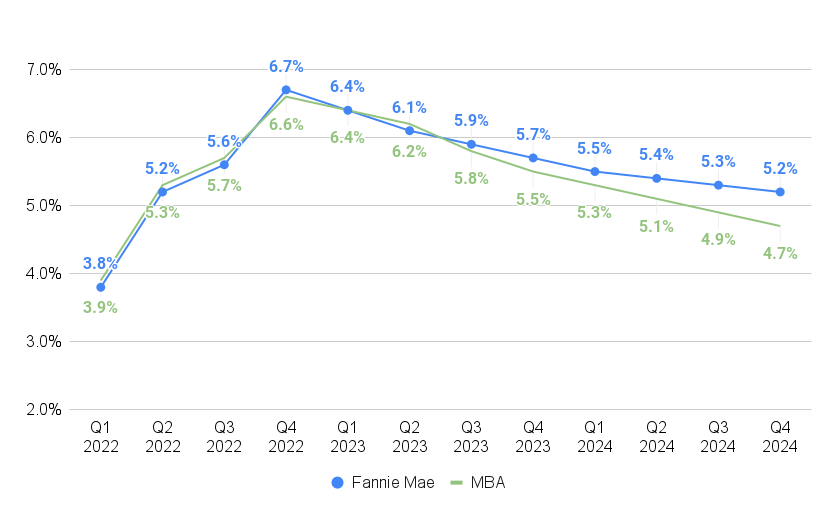

With the Federal Reserve signaling that it’s probably done hiking rates and inflation showing signs of easing, housing industry economists expect mortgage rates to decline this year and next.

Mortgage rates expected to ease

Source: Mortgage Bankers Association, Fannie Mae Housing Forecast, April 2023

With the economy looking likely to enter a “modest” recession, economists at Fannie Mae and the Mortgage Bankers Association (MBA) expect mortgage rates will keep retreating from 2022 peaks in the months ahead.

But until recently, a monthly survey of consumers by Fannie Mae has shown that most Americans — perhaps shell-shocked by last year’s abrupt runup in mortgage rates — have been expecting mortgage rates to keep going up.

The latest Fannie Mae National Housing Survey suggests that consumers are finally getting the message that mortgage rates are more likely to go down than up in the months ahead — particularly if the economy falls into a recession.

Source: Fannie Mae National Housing Survey

Fannie Mae’s latest National Housing Survey shows that the percentage of Americans who think mortgage rates will go up in the next 12 months fell to 47 percent in April, down from 51 percent in March and 73 percent a year ago.

Although only 22 percent of those surveyed thought mortgage rates will go down in the next 12 months, that’s almost double the 12 percent who said the same in March. While 31 percent think mortgage rates will stay the same over the next year, the “net share” of those who think mortgage rates will ease increased by 13 percentage points from March to April.

Doug Duncan

Fannie Mae Chief Economist Doug Duncan thinks the rise in the number of consumers who expect rates to decline could be due to “a combination of factors,” including an awareness of decelerating inflation, expectations that monetary conditions could soon ease, “and, of course, actual mortgage rate declines during the month.”

Duncan said consumers’ more optimistic outlook of where mortgage rates are headed was the primary driver in the largest increase in Fannie Mae’s Home Purchase Sentiment Index (HPSI) in more than two years.

Fannie Mae HPSI at highest level since May 2022

Fannie Mae Home Purchase Sentiment Index, April 2023 | Source: Fannie Mae.

The HPSI, which also measures home price expectations and homebuyer and seller sentiment, jumped 5.5 points in April to 66.8, its highest level since May 2022.

“However, the bump in optimism may prove to be temporary, as consumers continue to report uncertainty about the direction of home prices — and we know that high home prices remain the primary reason given by consumers who think it’s a bad time to buy a home,” Duncan said in a statement.

The HPSI distills six questions from the Fannie Mae’s National Housing Survey into a single number. All six components of the HPSI improved from March to April, although most Americans think it’s still not a good time to buy a home.

Source: Fannie Mae National Housing Survey

Although the net share of consumers who think it’s a good time to buy increased by 6 percentage points from March to April, only 23 percent said it’s a good time to buy, up from 20 percent in March. More than three in four consumers surveyed in April — 77 percent — thought it was a bad time to buy, down from 79 percent in March.

“Until affordability improves for a larger swath of the homebuying public, we believe home sales will remain subdued compared to previous years,” Duncan said.

Source: Fannie Mae National Housing Survey

Recent strength in home prices is a positive for sellers, although many are reluctant to put their homes up for sale and give up the low rates on their existing mortgages. The “lock-in effect” has constrained inventories and helped prop up home prices in many markets.

The percentage of respondents who said it was a good time to sell increased from 58 percent in March to 62 percent in April, while the percentage who said it was a bad time to sell decreased from 40 percent to 38 percent. The net share of those who said it was a good time to sell increased 5 percentage points from March to April.

Source: Fannie Mae National Housing Survey

The resilience of home prices during the spring homebuying season may explain a 5 percent increase in the net share of those surveyed by Fannie Mae who said they expect home prices will go up in the next 12 months.

The percentage of respondents who said they expect home prices will go up in the next 12 months increased to 37 percent in April, up from 32 percent in March. The percentage who said they expect home prices will go down also increased from 31 percent to 32 percent. Only 31 percent said they expected home prices to stay the same, down from 35 percent in March.

Source: Fannie Mae National Housing Survey

With unemployment near historic lows, only 21 percent of Americans surveyed by Fannie Mae in April said they were worried about losing their jobs, the same percentage as in March and down from 24 percent in February. But looking back a year, when only 11 percent expressed concerns about losing their jobs, nearly twice as many people are worried about their job security.

Source: Fannie Mae National Housing Survey

The net share of those who said their household income was significantly higher in April than it was 12 months ago increased 4 percentage points from March. Nearly one in four (24 percent) said their household income was significantly higher, up from 20 percent in March, while the percentage who said their household income was lower was unchanged at 11 percent.

Get Inman’s Mortgage Brief Newsletter delivered right to your inbox. A weekly roundup of all the biggest news in the world of mortgages and closings delivered every Wednesday. Click here to subscribe.