In these times, double down — on your skills, on your knowledge, on you. Join us Aug. 8-10 at Inman Connect Las Vegas to lean into the shift and learn from the best. Get your ticket now for the best price.

Existing-home sales surged 14.5 percent in February, ending a yearlong streak of monthly declines, new data shows.

Sales jumped 14.5 percent between January and February, to a seasonally adjusted annual rate of 4.58 million, according to the National Association of Realtors. Sales were still 22.6 percent lower than February 2022 levels.

It was the first time in a year that existing-home sales did not decline from one month to another.

In February, homebuyers took advantage of modest mortgage rate declines and home prices decreases, experts said.

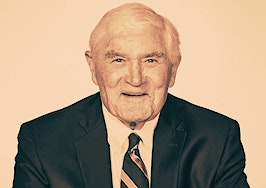

“Conscious of changing mortgage rates, homebuyers are taking advantage of any rate declines,” NAR Chief Economist Lawrence Yun said in a statement. “Moreover, we’re seeing stronger sales gains in areas where home prices are decreasing and the local economies are adding jobs.”

The median existing-home sale price decreased 0.2 percent from the previous year to $363,000, marking the first time in 131 consecutive months — nearly 11 years — that prices were lower on a year to year comparison — ending a record streak of annual price increases.

Industry experts said they expected to see more annual decreases in both prices and home sales throughout 2023.

“We continue to expect large year-over-year declines in home sales for the first half of this year,” Keller Williams Chief Economist Ruben Gonzalez said in a statement. “We also expect to see year-over-year declines in home prices for the next several months.”

Total housing inventory charted for the end of February was 980,000, the same amount registered for the end of January and representative of a supply of 2.6 months at the current sales rate. The historically low inventory is resulting in the return of bidding wars in some markets, according to NAR.

“Inventory levels are still at historic lows,” Yun said. “Consequently, multiple offers are returning on a good number of properties.”

Properties typically remained on the market for 34 days in February, up from 33 days in January and 18 days in February 2022.

February’s increase was driven primarily by mortgage rate fluctuations. The average rate for a 30-year fixed rate mortgage was 6.60 percent as of March 16, according to Freddie Mac. That marks a decrease from 6.73 percent the previous week but is higher than the 4.16 rate from one year ago.

“While large swings in mortgage rates continue to challenge potential buyers and potential sellers, spring homebuying season started early this year with motivated buyers wanting to take advantage of even the smallest improvements in housing affordability,” Zillow Senior Economist Orphe Divounguy said in a statement. “Buyers are out in force, but sellers – unwilling to trade a low mortgage rate for today’s higher rate – are staying on the sidelines and that means inventory remains lower than normal for this time of year.”

Existing-home sales rebounded in all four U.S. regions. The Northeast saw sales increase 4 percent from January to an annual rate of 520,000, which was 25.7 percent lower than its levels last year. Existing-home sales in the Midwest climbed 13.5 percent monthly to an annual rate of 1.09 million, which was 18.7 lower than its 2022 levels.

The South saw sales jump 15.9 percent from their January levels to an annual rate of 2.11 million, which remained 21.3 percent lower than their levels last year, while sales in the West ballooned 19.4 percent to an annual rate of 860,000, down 23.8 percent from the previous year.

The median home sale price for existing homes was $366,100 in the Northeast, $261,200 in the Midwest, $342,000 in the South and $541,100 in the West.