Banks and credit unions now have the option to “launch, replace, or augment” their lineup of home loans by integrating Rocket Mortgage’s digital mortgage application inside an online banking platform developed by Q2 Holdings Inc.

It’s the latest in a series of initiatives and deals by the nation’s biggest mortgage lender, creating new opportunities to make loans to homebuyers.

Matt Flake

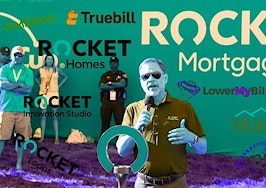

“We’re excited to add a premier brand like Rocket Mortgage to our Q2 Innovation Studio ecosystem,” said Q2 CEO Matt Flake in a statement Thursday. “This partnership, giving customers easy access to Rocket Mortgage’s best-in-class digital offerings, adds another marquee solution to the Q2 Innovation Studio and provides an important and timely new option for our bank and credit union customers.”

The Q2 Partner Marketplace Program lets financial institutions deploy applications from a catalog of pre-integrated, third-party products with no up-front investment.

Nashville, Tennessee-based community bank Fourth Capital is the first Q2 customer to add Rocket Mortgage’s digital home loan application to its mobile and online banking app, the companies said.

Brian Heinrichs

“We are thrilled to bring the Rocket Mortgage experience to our customers through the Q2 platform,” said Fourth Capital CEO Brian Heinrichs in a statement. “Bringing cutting-edge solutions to our clients with market-leading partners enhances our vision of providing digital tools with human touch.”

In addition to integrating Rocket Mortgage’s digital application “in a fraction of the time of a traditional third-party integration,” the partnership promises live mortgage assistance from inside Q2’s online banking platform.

Rocket Mortgage “takes care of everything related to the loan and servicing,” providing a new source of non-interest income for participating banks and credit unions, the companies said.

Bob Walters

“Rocket Mortgage is focused on using technology to create certainty and simplicity in the home loan process — one of the most complex transactions most Americans will experience,” said Rocket Mortgage CEO Bob Walters, in a statement. “In this new partnership with Q2, we are able to help more consumers achieve the American Dream of homeownership — right inside the digital banking platform they already use.”

Rocket repositions as a ‘fintech’

Rocket Mortgage and other lenders have seen rising interest rates take a bite out of the lucrative business of refinancing homeowners’ existing loans. During the second quarter, parent Rocket Companies slashed $300 million in expenses to stay profitable, as mortgage originations plunged 59 percent to $34.54 billion.

At the beginning of the year, Rocket Cos.’ CEO Jay Farner was already seeking to reassure investors that the company was moving to reposition itself as a fintech platform, leveraging its $1.27 billion acquisition of personal finance app Truebill to maximize “the lifetime value of the client” by marketing a range of products to them.

Through Truebill, which is rebranding as Rocket Money this month, Rocket can offer consumers who want to consolidate high-interest debt at lower rates the option of taking out a home equity loan or a personal loan, for example. Rocket subsidiary Rocket Loans offers personal loans of $2,000 to $45,000, while Rocket Mortgage’s new home equity loan lets homeowners take out 10- or 20-year, fixed-rate loans of $45,000 to $350,000.

Rocket Mortgage market share 2009-2021

Source: Rocket Cos. investor presentation

But that doesn’t mean Rocket Mortgage isn’t determined to continue growing its market share of the shrinking, but still gigantic mortgage market. At the time of Rocket’s Truebill acquisition, about three-quarters of the personal finance app’s clients were renters, allowing Rocket to market mortgages to them when they’re ready to buy.

To help achieve Farner’s goal of surpassing rival Wells Fargo and becoming the number one retail provider of purchase mortgages in the next 12 to 18 months, Rocket Mortgage has also been pursuing other partnerships like the new deal with Q2.

Rocket Mortgage announced in October that it was partnering with Salesforce to make its mortgage origination technology available as an end-to-end “mortgage-as-a-service” to any lender with licensed mortgage loan officers through Salesforce Financial Services Cloud.

On Aug. 5, Rocket Mortgage announced an exclusive deal with Santander Bank, which is now directing its nearly 2 million customers to Rocket if they’re looking for a mortgage.

Walters said at the time that the agreement with Santander was “just the beginning of what we believe will be a long relationship between our companies as we innovate together to develop more ways to delight our clients.”

Get Inman’s Extra Credit Newsletter delivered right to your inbox. A weekly roundup of all the biggest news in the world of mortgages and closings delivered every Wednesday. Click here to subscribe.