After the biggest surge in mortgage rates in 40 years, houses are now less affordable than they were at the peak of the 2006 housing bubble, which is likely to dent home sales and cool the pace of homebuilding this year, Fannie Mae economists said Thursday.

In their latest economic and housing outlook, Fannie Mae economists said that while mortgage rates may have peaked, they expect a “meaningful slowdown” in home sales for the second and third quarters of 2022, followed by a slowdown in new home construction.

Not until next year do economists with Fannie Mae’s Economic and Strategic Research Group expect to finally see a “a large deceleration in home price growth,” with some regions likely to see price declines. While there’s a chance of a “modest recession” later this year or next, Fannie Mae economists don’t see a downturn of the magnitude of the Great Recession of 2007-09 on the horizon.

Doug Duncan

“Rising mortgage rates are reducing affordability through higher mortgage-related costs, all while house prices continue to grow,” said Fannie Mae Chief Economist Doug Duncan, in a statement. “Historically, rapid and substantial rises in mortgage rates have had the effect of slowing activity, which we reflect in our forecast. Not only is the worsening affordability of homes a problem for potential entry-level homebuyers, but current homeowners are less likely to trade in their existing lower-rate mortgages and list their homes for sale, both of which will likely weigh on sales.”

Home sales projected to drop 11 percent this year

Source: Fannie Mae housing forecast, May 2022.

Fannie Mae economists now expect 2022 home sales to total 6.1 million, a 3.7 percent reduction from their April forecast. The latest forecast for 2023 home sales is 5.4 million, down 4.5 percent from April’s forecast.

If the latest forecast proves to be accurate, home sales would decline 11.1 percent this year and by another 11.6 percent in 2023.

Mortgage rates have soared 2.19 percentage points since December — the fastest increase for such a short period of time since 1981, Fannie Mae economists noted. That means the monthly mortgage payment for a homebuyer purchasing the median-priced home has increased by more than $500 over that time.

But the expected slowdown in home sales is “not entirely about diminished purchasing power,” Fannie Mae economists said in commentary accompanying their forecast. “The rapid rise in mortgage rates creates a large ‘lock-in’ disincentive to purchase a new home on the part of potential move-up buyers.”

Even moving to a similarly priced home means “a much higher mortgage payment, discouraging such a choice,” Fannie Mae economists said.

“Our analysis of new listings of homes put on the market shows an 8.4 percent decline in April on a year-over-year basis, down from a 3.8 percent decline in March, suggesting that this disincentive may now be on the minds of many existing homeowners.”

Home price appreciation expected to trend down

Source: Fannie Mae housing forecast, May 2022.

In April, Fannie Mae economists said they believe home price appreciation peaked at 19.8 percent during the first quarter of 2021, and will cool to 10.8 percent by the final three months of the year. But there is a “downside risk” to those projections, which are revised every three months, with the next update in July.

“Home prices relative to median household incomes, even when controlling for mortgage rates, are now more deviated from the historical norm than the peak experienced in 2006,” Fannie Mae economists said. “We believe this points to the unsustainability of current house prices relative to longer-run fundamentals, and with rising interest rates this suggests strong downward pressure on continued house price appreciation.”

Home price appreciation is currently expected to drop into the single digits next year, falling to 3.2 percent by the fourth quarter of 2023.

But given the “significant variation” in regional home prices, 3.2 percent national home price appreciation “implies that some regions will likely experience price declines,” Fannie Mae economists said.

That doesn’t mean Fannie Mae economists see housing markets headed for another bust in the years ahead, as homes remain in short supply relative to demographic demand, and there’s not been the speculative overbuilding that characterized the last housing bubble.

“To be clear, even if home prices were to decline in coming years, we are not anticipating a reoccurrence of the housing market or economic turmoil seen during the 2008 financial crisis, as conditions are considerably sounder today,” Fannie Mae economists said. “The 2008 crisis was a negative feedback loop of poor mortgage credit quality, foreclosures, and overleveraging of real estate and financial firms that led to a financial crisis and a strong resultant contraction in employment. These factors are not present today. Credit quality is much better, and both the real estate and the financial system are less leveraged.”

Mortgage rates may have peaked

Source: Forecasts by Fannie Mae, the National Association of Realtors and the Mortgage Bankers Association.

After rising faster this year than in any period since 1981, some economists think mortgage rates may have plateaued. While forecasters at the National Association of Realtors see rates continuing to inch up slightly in 2023, economists at Fannie Mae and the Mortgage Bankers Association are expecting mortgage rates to ease some next year.

Fannie Mae economists expect the Federal Reserve to continue raising the short-term federal funds rate 50 basis points at a time, for “as long as these labor market metrics do not show signs of excessive weakening.”

With unemployment at 3.6 percent, it may take a recession for unemployment to return to its historical norm of around 4.5 percent, Fannie Mae economists warned.

Last month, Fannie Mae economists warned of the possibility for a “modest recession” in the second half of 2023. Now, they see a risk that a recession could come sooner, as consumer spending “is increasingly constrained by elevated inflation and a rapidly rising rate environment.”

“Many households, disproportionately including those at the lower end of the income distribution, likely have little remaining savings to draw down,” Fannie Mae economists warned. “A surge in credit card balances over the past two months suggests that many consumers are increasingly stressed by the high inflation and are maintaining consumption growth by turning to credit. This trend is unsustainable. Therefore, without some sustained price relief on durable goods, energy, and food in coming quarters such that real income growth can return to positive territory, the possibility of a late-2022 recession becomes more likely.”

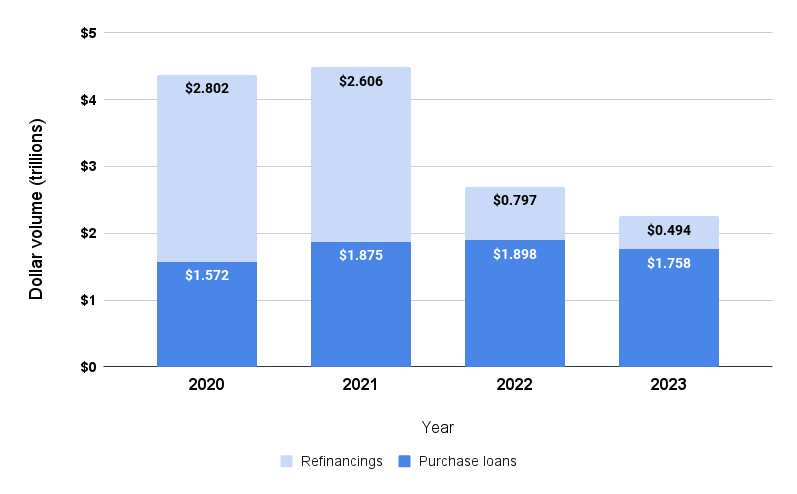

Mortgage originations expected to fall by 40 percent this year

Source: Fannie Mae housing forecast, May 2022.

Should it pan out, Fannie Mae’s latest forecast could be painful for mortgage lenders, who have already been hard hit by the end of the mortgage refinancing boom.

Thanks to rising mortgage rates, Fannie Mae expects mortgage originations to fall by 40 percent this year, to $2.695 trillion. Although rising home prices are denting home sales, they should help drive 1.2 percent growth in 2022 purchase loan originations, to $1.898 trillion. Mortgage refinancings are projected to fall by 69 percent this year, to $797 billion.

But both purchase loan originations and refinancings are expected to fall next year, with 2023 purchase loan originations now expected to fall 7.4 percent, to $1.758 trillion, and refinancings to drop another 38 percent, to $494 billion.

“At the current mortgage rate of 5.3 percent, we estimate that only 1.4 percent of outstanding loans have a refinance incentive of at least 50 basis points,” Fannie Mae economists said. “What remains of refinancing activity we expect to be dominated by cash-out refinances. We estimate that cash-out refinances made up 51 percent of the refi market in March and anticipate the share to rise moving forward.”

Some mortgage lenders have downsized in recent months to adjust to lower refinancing volume, including Better, Pennymac, Guaranteed Rate, Keller Mortgage, Mr. Cooper and Wells Fargo. In reporting first quarter earnings, executives at Rocket Companies Inc. said they expect buyout offers made to 2,000 employees will save $180 million a year, while LoanDepot executives said they don’t expect to turn a profit this year and will lay off workers and suspend the company’s quarterly dividend.

Get Inman’s Extra Credit Newsletter delivered right to your inbox. A weekly roundup of all the biggest news in the world of mortgages and closings delivered every Wednesday. Click here to subscribe.