Zeenat Sidi, a veteran of SoFi, Capital One and RBC, will serve as president and chief operating officer of loanDepot’s new operating unit, mello, the company announced Thursday. Mello will oversee loanDepot’s customer contact center and a performance marketing engine that together, are in contact with 1 million customers a day and distribute more than 10 million leads a year.

Zeenat Sidi

The move to create the new unit, according to the announcement, is a bid to expand loanDepot’s business “above and beyond mortgage products” and create “customers for life.” The unit will oversee customer relationships, develop new unsecured loan products, and house the company’s real estate brokerage, title and insurance businesses.

The mello business unit “will develop innovative digital-first secured and unsecured lending products leveraging loanDepot’s diverse customer engagement channels, extensive performance marketing assets, and proprietary technology stack to deliver a fast and frictionless way for customers to fulfill their financial needs,” loanDepot said.

Unsecured loans — which unlike mortgages, don’t require borrowers to put up collateral — include personal loans, which swelled to a record $167 billion in outstanding balances during the fourth quarter, according to TransUnion. Although loanDepot did not specify what types of unsecured loans it will offer, SoFi offers a suite of secured and unsecured loans ranging from mortgages and auto loans to personal loans, credit cards and student loans.

Anthony Hsieh

“Accelerating delivery of multiple new products and services — above and beyond mortgage products — through our mello operating unit, will allow us to give consumers access to a complete suite of digital-first homeownership products and services from a company they already know and trust,” loanDepot CEO Anthony Hsieh said in a statement.

New mello products and services “will create a flywheel effect, putting us in a distinct and industry-unique position to create customers for life by serving their financial needs in a holistic way,” Hsieh said.

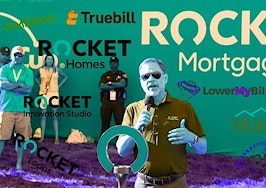

Rocket Cos., the parent company of the nation’s largest provider of home loans, Rocket Mortgage, is also making moves to reposition itself as a fintech company that will maximize “the lifetime value of the client.”

Rocket, which spends about $1 billion a year on marketing, says its pending $1.27 billion acquisition of personal finance app Truebill, announced in December, will allow it to market real estate services, mortgages and other loans to Truebill’s 2.5 million members.

The new mello business unit will also house loanDepot’s ancillary businesses:

- Mello Home Services LLC, a captive real estate referral business launched in 2018

- LD Settlement Services LLC, loanDepot’s captive title and escrow business, which the company acquired in 2016

- MelloInsurance Services LLC, a captive insurance program launched in the third quarter of 2020 to sell homeowners and other insurance policies

Hsieh called Sidi a “high-caliber leader with a proven track record in financial services and digital transformation. By moving some of our most important infrastructure elements under her leadership … we can blend our proprietary assets and mortgage-adjacent businesses together in a powerful way.”

Last year, LoanDepot’s rolled out a “Grand Slam” offer, bundling real estate brokerage, mortgage and title insurance services and offering cash rebates of up to $7,000.

“Customers want bundled options and appreciate complementary homeownership products and services being readily available from one source,” Hsieh said. “We created the mello operating unit because we believe developing new products and services is important for the marketplace.”

Calling loanDepot a “pioneer and leader in digital financial services,” Sidi said she is “honored and excited to join Anthony and Team loanDepot. Together, we will build upon loanDepot’s already-strong foundation and exceptional set of differentiated assets to create a suite of innovative digital-first products and services that complement the company’s core mortgage originations and servicing platform.”

The Real Estate Settlement Procedures Act (RESPA) governs business referrals related to or part of settlement services involving federally related mortgage loans.

Kickbacks for referrals are illegal, but mortgage lenders with affiliated title and escrow companies are permitted to sell “a package of settlement services at a discount,” the Consumer Financial Protection Bureau, which enforces RESPA, notes on its website. Consumers can’t be required to purchase bundled services, and each company must also make those services available separately.

Get Inman’s Extra Credit Newsletter delivered right to your inbox. A weekly roundup of all the biggest news in the world of mortgages and closings delivered every Wednesday. Click here to subscribe.