The share of homeowners in forbearance plans has declined for 10 weeks in a row, as the pace of borrowers leaving forbearance picks up and new requests for relief ease.

As of May 2, 4.36 percent of mortgage holders were seeking relief from their monthly payments in a forbearance plan, down from 4.47 percent the week before and 8.55 percent in June, according to the latest survey by the Mortgage Bankers Association.

But 2.2 million homeowners were still in forbearance plans, and close to half of those who have requested extensions haven’t made a payment in 12 months or more, the MBA’s Forbearance and Call Volume Survey revealed.

Mike Fratantoni

“Many homeowners continue to struggle and are falling farther behind on their obligations each month,” said MBA Chief Economist Mike Fratantoni. “We expect that a robust economic and job market recovery over the next several months will help these families regain their jobs and their incomes.”

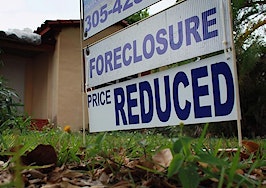

Many homeowners who were granted forbearance during the pandemic are scheduled to hit 18-month program eligibility limit at the end of September. Some borrowers will be in danger of losing their homes to foreclosure if they can’t resume payments.

The Consumer Financial Protection Bureau has proposed a moratorium on foreclosures through Dec. 31, 2021 — a rule that would apply not only to government-backed loans, but for servicers of private loans.

Most homeowners who were granted COVID forbearance won’t be expected to make up their missed payments all at once. Depending on the type of loan they have, they may be able to enter into a repayment plan, apply for a loan modification, or defer repayment until they refinance or sell their home.

“Homeowners who have exited forbearance and been able to take up their original payment again are performing at almost the same rate as the overall mortgage servicing portfolio,” Fratantoni said.

Outcomes for borrowers exiting forbearance from June 1, 2020, through May 2, 2021. Source: Mortgage Bankers Association.

More than one-fourth of borrowers who have exited forbearance since June 1 have had past-due balances deferred until they sell their home, refinance their mortgage, or reach the end of its original term. But 14.8 percent of borrowers who exited forbearance after missing payments failed to set up a mitigation plan with their loan servicer.

Homeowners and renters can learn more about their options on the Consumer Financial Protection Bureau’s website.