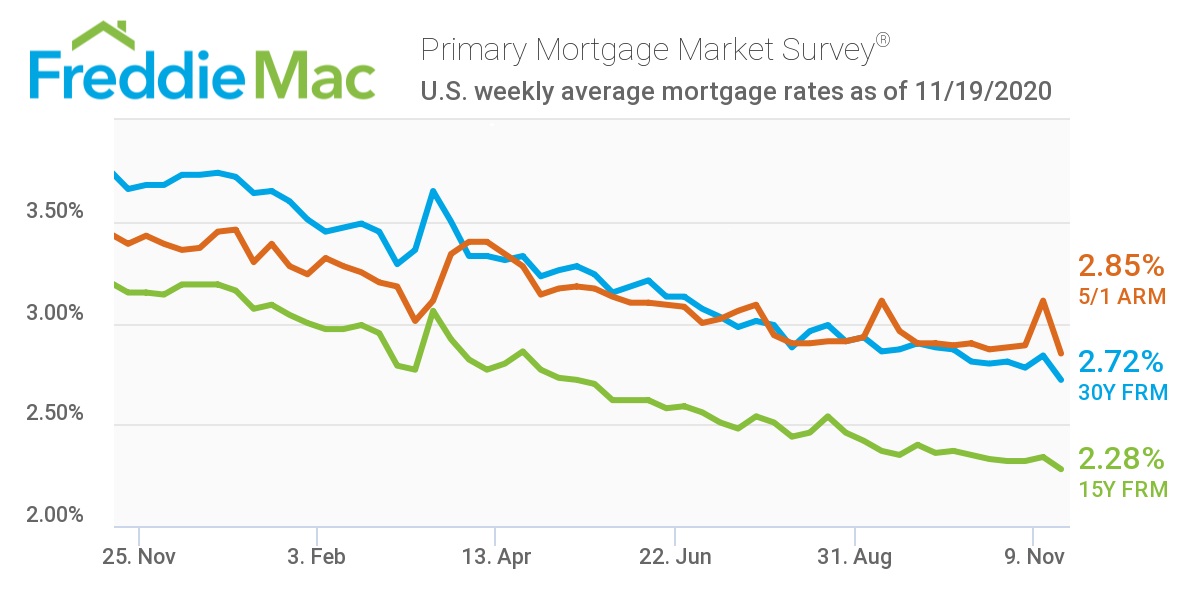

For the 13th time in 2020, mortgage rates set a new weekly record low on Thursday, according to data that Freddie Mac has been compiling for nearly 50 years. The average rate for a 30-year fixed-rate mortgage hit 2.81 percent for the week ending November 19, a drop from 2.84 percent the week prior.

“Weaker consumer spending data, which accounts for the majority of economic growth, drove mortgage rates to a new record low,” Sam Khater, Freddie Mac’s chief economist, said in a statement. “While economic growth remains unstable, strong housing demand continues to have a domino effect on many other segments of the economy.”

The 15-year fixed-rate mortgage averaged 2.28 percent, down from 2.34 percent last week and 3.15 percent a year ago at this time. The 5-year Treasury-indexed hybrid adjustable-rate mortgage averaged 2.85 percent, down from last week’s 3.11 percent and the 3.39 percent it averaged a year ago at this time.

The 15-year fixed-rate mortgage averaged 2.28 percent, down from 2.34 percent last week and 3.15 percent a year ago at this time. The 5-year Treasury-indexed hybrid adjustable-rate mortgage averaged 2.85 percent, down from last week’s 3.11 percent and the 3.39 percent it averaged a year ago at this time.

ICE Mortgage Technology — formerly Ellie Mae — meanwhile also reported the average interest rate on all home loans hitting 2.9 percent in October. It’s the first time the average mortgage rate dropped below 3 percent since the company began tracking the data in 2011.

“We are continuing to see interest rates decline now dipping below three percent for the first time since we have tracked this data,” Joe Tyrrell, president, ICE Mortgage Technology, said in a statement. “The market clearly remains ripe for refinances as 60 percent of all closed loans are refis this month, indicating that homeowners are still looking to capitalize on the opportunity to reduce their monthly payments.”