This post has been republished with permission from Mike DelPrete.

From a transaction volume standpoint, the pandemic of 2020 was not kind to iBuyers. Overall volumes and market share are set to drop by 50 percent compared to 2019, a reflection of the iBuyer business model coming to a complete standstill followed by a slow recovery.

This drop stands in sharp contrast to the overall U.S. housing market, which is on fire. Overall transaction volumes are running well above last year’s levels.

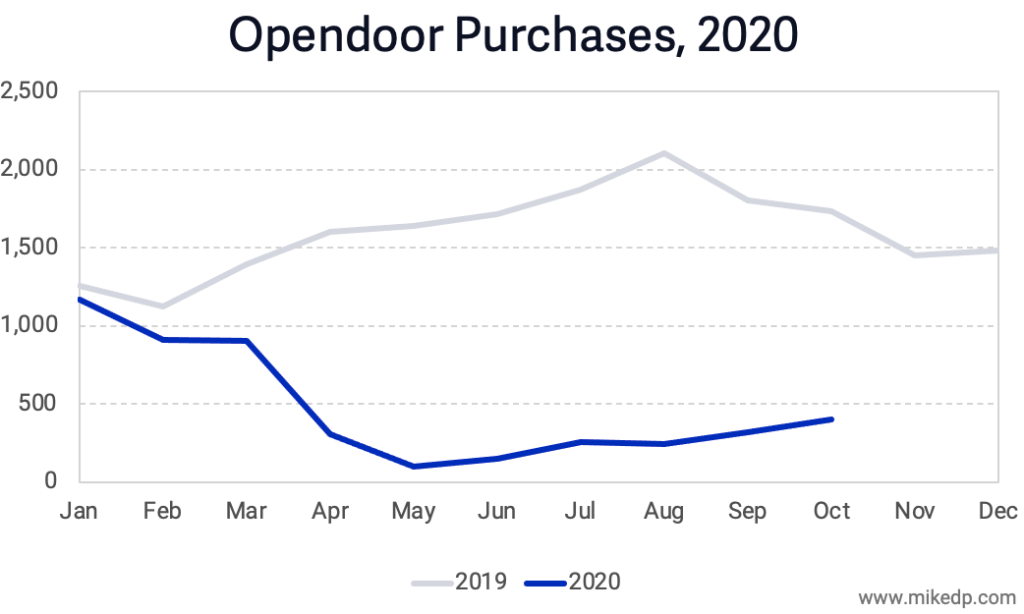

All of the major iBuyers saw a significant drop in 2020 compared to 2019, but Opendoor stands out for several reasons. First, it remains the largest iBuyer, with around double the transactions of its closest competitors. But it also saw the biggest year on year drop in volumes: down about 60 percent from 2019.

This is a reflection of both Opendoor’s high-flying activity in 2019 and its painfully slow post-lockdown recovery. Opendoor’s purchases are still down over 70 percent from the same time last year. Recovery is slow, much slower than the overall market.

Segment market share continues to shift among the big four iBuyers. Opendoor’s share of the market is down to 50 percent — a gradual decline from 2018 as new players entered the market and the overall segment grew rapidly. Zillow has made a strong entrance, while Offerpad has maintained its position.

The pandemic of 2020 affected real estate in a variety of unprecedented ways. The drop in iBuyer market share and transaction volumes isn’t a failure of the model, but it is a result of the model. The iBuyers face a slow climb back to the levels of 2019 as they conservatively ramp up operations in a new uncertain housing market.

Want more on iBuyers? Check out the newly released iBuyer Report.

Mike DelPrete is a strategic adviser and global expert in real estate tech, including Zavvie, an iBuyer offer aggregator. Connect with him on LinkedIn.