As the coronavirus crisis drags on, a new report has found that multitudes of homeowners are unprepared for the next potential disaster: flooding.

The report, published last week by LendingTree-owned consumer research firm ValuePenguin, specifically found that dozens of U.S. cities have minuscule flood insurance coverage rates. In Boise, Idaho, for example, ValuePenguin found that there was only one active flood insurance policy despite there being more than 8,700 homes in a 100-year flood plain. That gives Boise a 0 percent coverage ratio.

After Boise, Riverside, California, was the second worst city for flood insurance coverage ratios, with only 344 active policies despite more than 40,000 homes in a 100-year flood plain.

Detroit, St. Louis and Cleveland rounded out the top five, and all had similarly abysmal flood insurance coverage rates. However, numerous other cities also landed somewhere on the list; Boston, for example, has 5,323 active flood insurance policies but 134,685 homes in a 100-year floodplain — giving it a ratio of 4 percent.

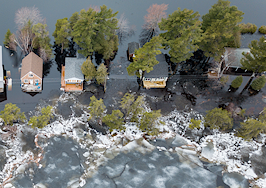

Flooding in Craig, Missouri, on March 22, 2019. Credit: Scott Olson and Getty Images

Overall, the report found that across the 100 largest metropolitan areas in the U.S., there are only four active policies for every 100 homes in active flood zones. The level of preparedness varies across regions, with the lowest coverage rates “found primarily in cities and states that haven’t experienced catastrophic flood damage in a long time.”

However, on the other end of the spectrum, New Orleans has 162,149 active policies but only 7,473 homes in a 100-year floodplain. That amounts to a coverage ratio of nearly 2,170 percent.

Other cities that had higher than 100 percent coverage ratios include Colorado Springs, Colorado; Provo, Utah; Sacramento, California; El Paso, Texas, and Honolulu.

The report argues that a handful of cities ended up with widespread coverage because “the recent memory of severe flood events likely prompted homeowners who live outside the 100-year floodplain to purchase flood insurance as well.”

ValuePenguin’s report is based on an analysis of data from the National Flood Insurance Program (NFIP), the Federal Emergency Management Agency (FEMA) and New York University. It additionally notes that while a “100-year floodplain” might “not sound so dangerous, a homeowner in the floodplain actually has a 26 percent chance of being flooded over the duration of a 30-year mortgage.”

An upscale neighborhood in Houston, Texas, that flood in the aftermath of Hurricane Harvey. Credit: Jim Dalrymple II

Flood insurance has become an increasingly challenging issue in recent decades. Hurricanes Katrina, Sandy, Harvey and others all left a multitude of homes underwater, and just this month a dam breach caused massive flooding in Michigan.

In addition to the weather events that led to such disasters, flood insurance is further complicated by a federal insurance program that for years has desperately needed reform. Currently, most homeowners get insurance through the NFIP, but the program has limits on the amount of coverage it offers and has also faced budget shortfalls.

Lawmakers have been trying to reform the program for years though the process is still ongoing. And growing concerns about climate change have made the issue more pressing, even as a final solution remains elusive in congress.