With over 20 years of experience, 1,200 transactions, and $750 Million in residential sales, Jay Rooney has seen it all when it comes to dealing with paper checks and bank wires.

“There is nothing that creates more inefficiencies and liabilities in the real estate business than dealing with paper checks and wires,” he said. “Check and wire fraud are constant threats, and managing and accounting for paper checks and wires is a nightmare for everyone involved in a real estate transaction.”

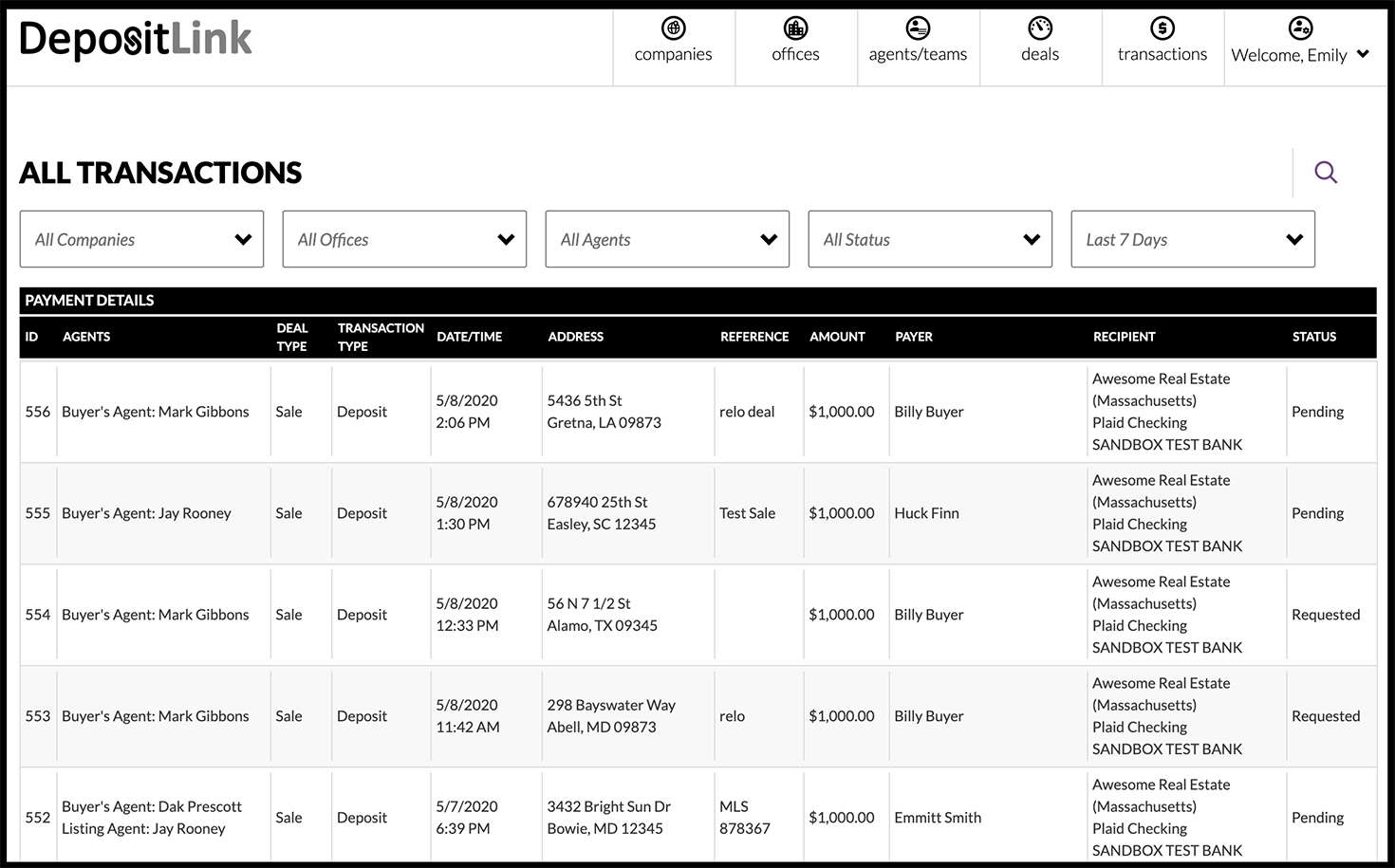

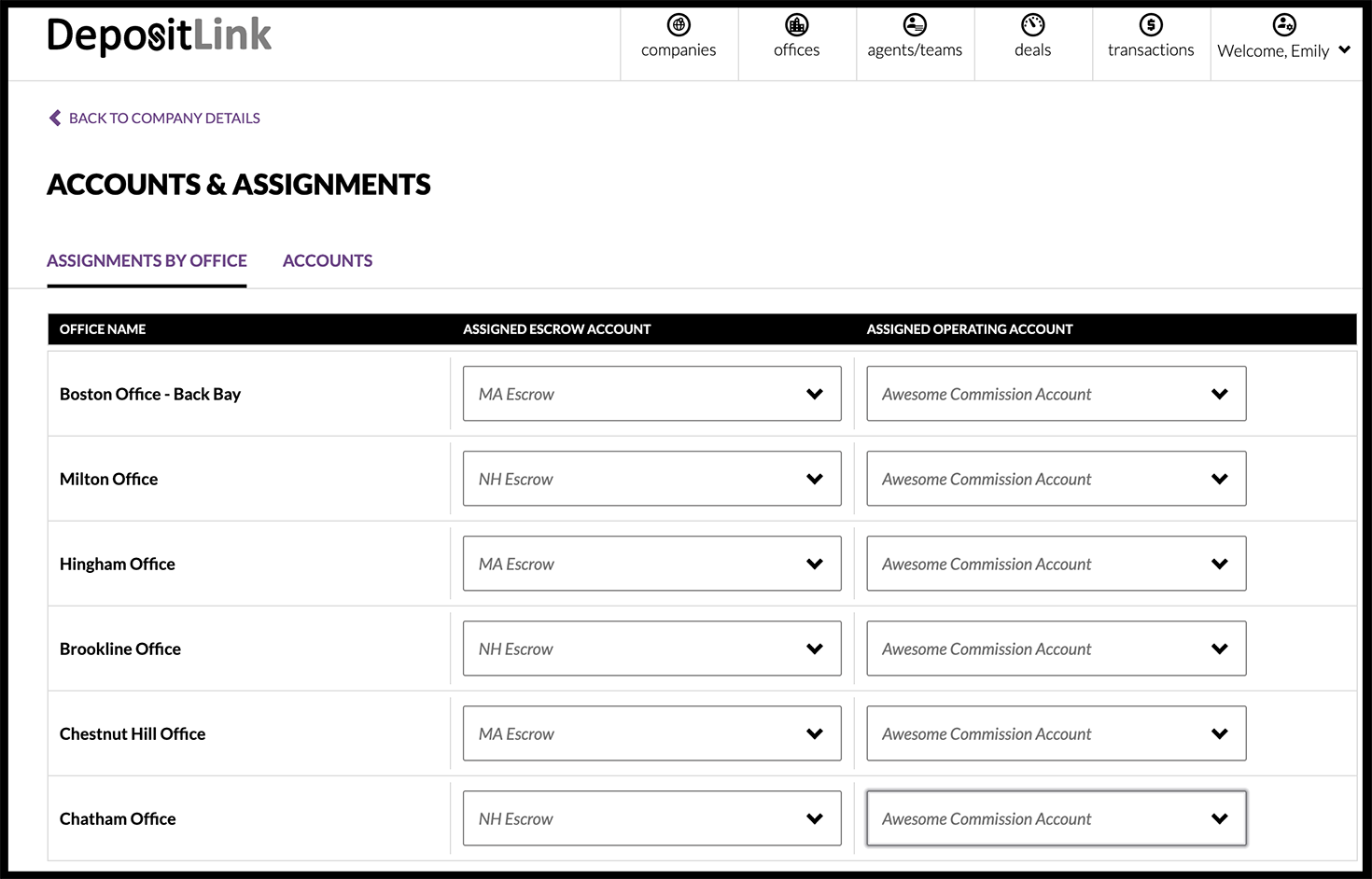

Rooney is the CEO and Founder of DepositLink, a safe, secure, and easy way for real estate companies and escrow holders to collect earnest money deposits and commissions electronically through the ACH network. DepositLink’s mobile responsive website can be used on a smartphone, laptop, or any other internet accessing device.

DepositLink solves the inefficiencies

As Rooney noted, paper checks are a source of frustration for everyone involved in the transaction, from the buyers to the agents to escrow, title, and accounting. DepositLink brings real estate transactions into the 21st century by allowing all parties to transfer funds in real-time from the comfort of their home.

“We’ve been looking for a solution like this for years,” said Paul Mydelski, Founder and Chairman of Leading Edge Real Estate. “By offering an electronic transfer of funds, our agents get paid faster, and we reduce the liability and inconvenience of paper checks.”

Listing agents, buyers agents, and even tenant’s agents have unique options to request money for the exact type of transaction they are involved in.

“Our platform has intuitive user flows based on anything you would possibly do to request money during a transaction for a rental or a sale,” said Darrell West, Depositlink Partner and CFO. “We’ve reduced the wasted time it takes to collect and deposit paper checks or to send a wire to seconds… and we do it with bank-level privacy and security.”

Securing an insecure process

One of the fastest-growing cybercrimes in the U.S. is wire fraud in real estate. The FBI says nearly 12,000 people were victims of wire fraud in the real estate and rental sector in 2018 (a 17% uptick from the year before), with losses totaling more than $150 million.

An unforeseen benefit of the platform has also emerged: helping everyone involved in the transaction comply with the social distancing and lockdown requirements enduring the COVID-19 epidemic. DepositLink does away with in-person exchanges of checks.

A solution where everyone in the transaction wins

“When we started down the path of seeking out a more secure, convenient way for our clients to put down an earnest money deposit on their dream home, we were excited to find DepositLink,” said Kim Luckow of BHHS Professional Realty. “Since that first conversation, a pandemic has changed the world and how people interact. We are still selling real estate because people need homes, but our priorities are to eliminate risk to our clients, keep them safe, and make things as easy on them as we can. DepositLink is going to help us accomplish that.”

The future of transactions is here now. The global pandemic merely moved the timeline of normalizing the electronic transfer of funds in the real estate transaction. Rooney doesn’t see the industry moving backward once the crisis is over.

“The new buyer demographic is Millennial,” he said. “That means digital solutions will be a required way of doing business. And DepositLink is here to deliver that convenience and confidence going forward.”

Learn more about DepositLink.