News Corp., the parent company of realtor.com owner Move, announced Thursday that it brought in $2.48 billion in revenue during the final three months of 2019 — a figure that falls slightly short of analysts’ expectations.

In an earnings report, the company — which is best known for owning The Wall Street Journal — said that its revenue declined 6 percent year-over-year during the quarter that ended on Dec. 31. News Corp.’s net income during that period was $103 million, compared to $119 million during the same time in 2018.

Leading in to Thursday’s announcements, analysts had expected News Corp. to have earned $2.49 billion in revenue, which would have represented a dip of 5.2 percent. Ultimately the company came close, but didn’t quite hit those numbers.

However, it wasn’t all bad news; News Corp. also posted adjusted earnings per share of $0.18, far surpassing analyst expectations of a 38.9 percent year-over-year decline to $0.11.

Robert Thomson

During a phone call to discuss the earnings with investors, News Corp. CEO Robert Thomson acknowledged that the firm’s numbers were “somewhat soft” but said that the outcome was also “anticipated.”

The earnings report further attributes revenue declines to “a sluggish Australian economy.” News Corp. operates both media and real estate businesses in Australia.

The company also reported Thursday that revenue from its real estate services division fell 5 percent year-over-year to $17 million. In the earnings report, the company tied the decline to “foreign currency fluctuations.”

Revenue at Move specifically fell 1 percent, which the company attributed to “lower revenues from software and services.”

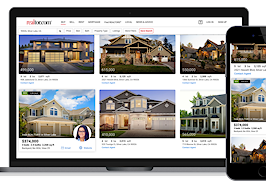

Nevertheless, there was good news as well from the firm’s real estate business: realtor.com is growing.

The company’s earnings report revealed that in the final months of 2019, realtor.com’s mobile and web-based sites had about 59 million unique users, representing a 9 percent increase year-over-year. Mobile traffic represented more than half of those users.

Thomson added during his call that for most of 2019 realtor.com also gained audience share compared to competitors such as Zillow and Trulia.

And Thomson said that “indicators for the property market are encouraging,” indicating the company’s real estate businesses should have productive quarters in the coming months.

Prior to the earnings report, News Corp. stock was trading at just below $14.50 per share — which was up both for the day and year-over-year. The stock ticked up slightly after hours in the first minutes after the earnings were announced.

Credit: Google

News Corp. previously fell short of analyst expectations the last time it reported earnings, in November, when it revealed it brought in $2.34 billion in revenue. However, the company did say at the time that Move, specifically, saw revenue grow during the quarter.

News Corp. has also had a mixed record over the past year when it comes to earnings. Last February, the company beat analyst expectations when it announced that its revenue had grown 21 percent year-over-year. Three months later, however, the firm fell short of expectations, though it did tout “healthy growth” for its real estate revenues.

Then in August, News Corp. once again beat analyst expectations.

News Corp. acquired Move in 2014 in a $950 million-deal. It continued beefing up its real estate business in 2018, when it bought Opcity, a real estate lead generation technology platform.

In Thursday’s earnings report, News Corp. stated that “Move continues to see improvements in all key metrics with the Opcity product, including close rates.”

Update: This post was updated after publication with additional information from News Corp.’s earnings report and the company’s call with investors.