2019 was a whirlwind year for real estate, filled with battles for dominance, unprecedented levels of venture capital investments, and sweeping industry reforms.

Next year will be just as wild as low mortgage rates spur bidding wars, climate change impacts homeowners and buyers and more cities carve out car-free communities, according to Redfin Chief Economist Daryl Fairweather.

Let the bidding wars begin

This year ushered in historically low mortgage rates, which strengthened buying power and bolstered buyer demand. Fairweather said 2020 will bring much of the same as 30-year fixed mortgage rates stabilize at 3.8 percent. However, sluggish housing starts and stagnant homeowners will spur more intense bidding wars from buyers looking to nab what little inventory is left.

Daryl Fairweather

“We expect about one in four offers to face bidding wars in 2020 compared to only one in 10 in 2019,” Fairweather said. “This increase in competition will push year-over-year price growth up to 6 percent in the first half of the year, considerably stronger than the 2 percent growth seen in the first half of 2019.”

Bidding wars will be most intense in affordable markets that have experienced population booms as residents from expensive, coastal metros search for respite.

Fairweather singled out Charleston and Charlotte as the two metros that will experience the most significant rise in home price growth due to increased buyer demand, as evidenced by a 104 percent increase in Redfin listing searches for those areas.

Jacie Paulson

“The fact that we have an international airport means that companies are more willing to allow their remote employees to live here because it is easy to travel back and forth to headquarters,” explained Redfin agent and team manager Jacie Paulson. “We also have a strong local economy with jobs at Boeing, Volvo, and in the military.”

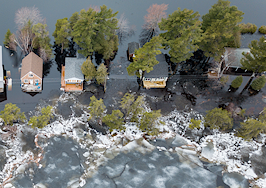

Climate change will impact consumers and cities alike

Climate change has been at the forefront of everyone’s minds as hurricanes ravaged the Southeast and nearby Bahamas, and wildfires scorched California. Beyond the immediate impact of lives and property lost, consumers and cities have been feeling the sting of more long-lasting effects, such as the cost of rebuilding and increasing insurance rates.

Irma Jalifi

“More people are becoming hyper-sensitive to flood insurance and its costs,” said Houston Redfin agent Irma Jalifi.“They’re thinking about how the weather will change over the next decade and whether there will be more historic floods like we’ve experienced recently. I had a buyer back out of a deal because he found out the property required flood insurance.”

As homeowners and buyers begin factoring climate change into their decisions, some cities are taking matters into their own hands by reducing their carbon emissions — a main component of greenhouse gases that contribute to global warming.

Fairweather points to recent moves by San Francisco and New York City to create car-free corridors or curtail traffic levels. San Francisco’s Market Street will be car free in 2020, leaving room for wider bike lanes and sidewalks for pedestrians. Only taxis and car hailing services will be allowed to drive on the street. Meanwhile, next year New York City will begin charging drivers anywhere from $11 to $25 to drive into Manhattan during prime business hours, as a way to curtail traffic and emissions.

The face of homeownership will begin to evolve

According to a National Association of Realtors study published in July, homeownership rates have hovered around 64 percent for the past few years with white men and women having the highest homeownership rate at 68 percent. Meanwhile the homeownership rates for Asians (59.7 percent), black men and women (41.5 percent), American Indians (56.3 percent), and Hispanics (46.2 percent) have lagged behind.

However, that trend is slowly changing for one group of homeowners — Hispanics.

Fairweather said the majority of new homebuyers are Hispanic and the group has increased its homeownership rate by 3.3 percent since 2015, the highest growth rate of any other racial group in the U.S. Furthermore, home prices have increased 21 percent in majority-Hispanic neighborhoods — 8.5 percentage points higher than growth seen in majority-white neighborhoods.

As a result, Fairweather expects Hispanic homeowners to begin gaining more equity than their white counterparts as they continue to strengthen their buying power.

“Hispanic families will likely benefit from home-equity gains for generations to come,” she said. “Hispanic Americans could tap their home equity to finance their children’s education or to start businesses. Over time, this will improve economic equality for Hispanic Americans.”