Homeownership is often touted as one of the best ways to build wealth. However, a new study published by HomeTap on Tuesday reveals that the majority of homeowners feel “house rich and cash poor,” resulting in added stress about their ability to maintain a household and build generational wealth.

HomeTap is a platform that offers homeowners an alternative to HELOC loans by offering an investment equal to 10 to 15 percent of a home’s value. Homeowners are expected to pay back the investment within 10 years, whether they sell or not.

Based on a survey of 700 homeowners, the study shows that 73 percent of homeowners feel “house rich and cash poor” some of the time, due to stagnant wage growth that fails to keep up with the rising cost of living.

Despite the fact 63 percent of homeowners have relatively low mortgage rates ranging from 3 to 7.5 percent and have anywhere from $10,000 to $50,000 in home equity (28 percent), the majority feel they have no good options to turn equity into cash.

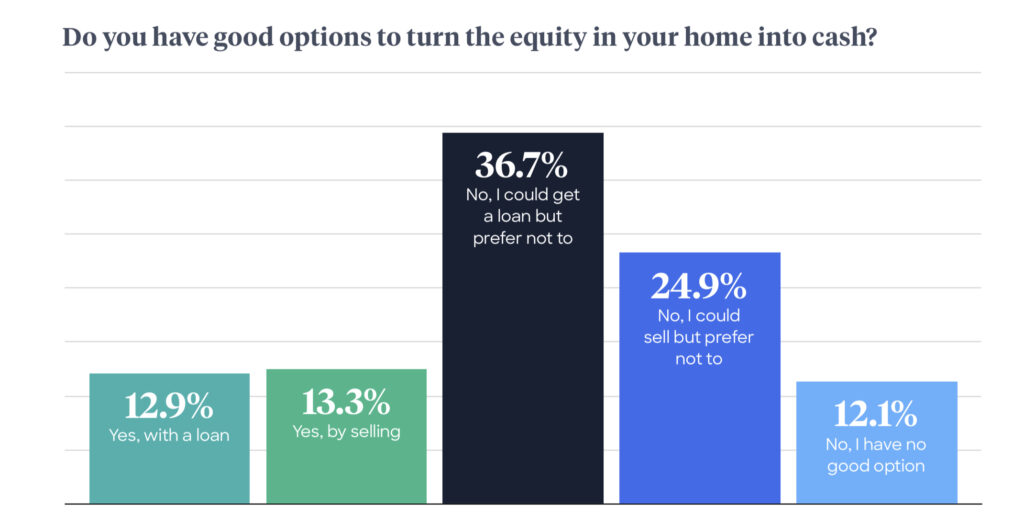

Sixty-one percent of homeowners said they could apply for a loan or sell their home to access equity, but preferred not to.

On the other hand, 26.2 percent of homeowners said they’d be willing to apply for a HELOC (home equity line of credit) or sell their current home. Lastly, 12.1 percent of homeowners said they couldn’t take advantage of either option.

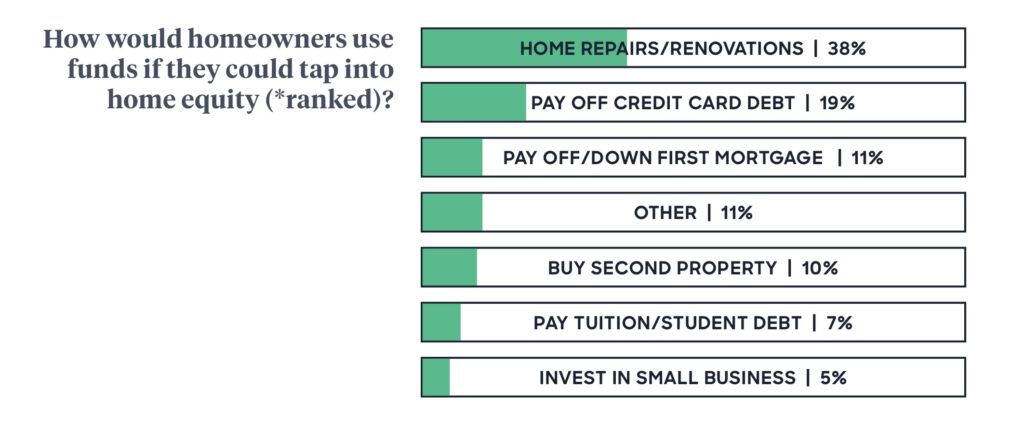

The difficulty in accessing equity is hindering homeowners’ ability to build home value through repairs and renovations and achieve other financial goals, such as paying down debt and saving for college.

Thirty-eight percent of homeowners say they’d make much-needed home repairs if they could access their equity. Another 19 percent said they’d pay off credit card debt, and 11 percent said they’d pay down their mortgage.

On a generational basis, millennials, gen-Xers, and baby boomers share the same fears, with a majority reporting they’re “very stressed” about the anticipated cost of home repairs and the security of their future income.

However, there are some differences. Millennials were the most stressed about declining or flat home values (31 percent), and gen-Xers were worried about their ability to afford property taxes.

Meanwhile, baby boomers, who often had the most equity and most stable financial outlook, were only “a little” or “moderately” stressed about home repairs and property taxes.

Although 57 percent of homeowners said there’s no “obvious solution to the house-rich, cash-poor problem,” HomeTap said homeowners can mitigate some of the stress they’re feeling by understanding home value trends, reevaluating what they can afford, and finding ways to increase their income.

“This study from Hometap makes clear that homeowners think there’s a problematic gap between housing costs and income,” HouseCanary CEO Jeremy Sicklick said. “What homeowners need to keep in mind is that on average, home values tend to increase steadily across the U.S.”

“It seems likely that homeowners will start to see their properties as usable financial assets that allow them to be more authoritative in managing their financial situations,” Sicklick added.

When it comes to reevaluating what you can afford, HomeTap says most homeowners mistakenly conflate loan approval with affordability.

When it comes to reevaluating what you can afford, HomeTap says most homeowners mistakenly conflate loan approval with affordability.

“Lenders will likely approve you for a loan amount with payments of up to 30 or 35 percent of your pretax income,” moneyunder30 blogger David Weliver explained. “Don’t just assume that just because the bank approved it, you can afford it.”

“They are two very different things,” he added while noting a homeowner’s mortgage payment should be at or below 28 percent of their pre-taxed monthly income.

When it comes to increasing income, millennials have the advantage since they’re younger and have the room to job hop — which, on average, yields more significant income growth (+5.2 percent) than waiting for a raise (+3.1 percent).

Beyond homeowner’s individual choices, HomeTap says the solution to “house rich, cash poor” phenomenon is raising wages to a level where homeowners can comfortably afford their mortgage and overall cost of living.

“Unless wages start to rise relative to home values, we’ll see more homeowners falling into the house rich, cash poor category,” the report concluded.