The We Company, which is the parent company of the co-working platform WeWork, is setting up a new real estate investment fund for commercial projects around the world.

Titled Ark, the new investment platform will have a fund of $2.9 billion, $1 billion of which comes from Canadian-based investor unit Ivanhoé Cambridge. The fund will allow the We Company, which has last been valued at $47 billion but reported a $1.93 billion loss in 2018, to buy property for various WeWork services and spaces.

The move to start the platform comes not long after the We Company confidentially began preparing for an initial public offering (IPO). Ark will be majority owned by The We Company and chaired by Steven Langman, managing director of the Rhone Group. The $1.8 billion real estate portfolio that is getting taken on by Ark will include buildings such as the Lord & Taylor department store in New York — a surprising step given that the company has previously focused exclusively on renting office spaces.

“The company will get a really good deal,” WeWork co-founder Adam Neumann told the Financial Times. “My family office will get a bad deal.”

Ark has enlisted Wendy Silverstein, of New York REIT, as chief investment officer alongside Rich Gomel, a WeWork executive, as managing partner. Gomel told The Real Deal that the fund will “allow [them] to provide different partnership options for the real estate community” although it is not revealing where it plans to target those investments.

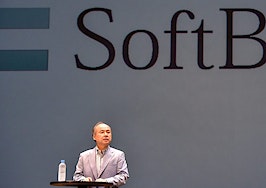

Back in January, Japan-based SoftBank invested $2 billion into WeWork, bringing the total money it put into the company to $10.5 billion. That said, the investment was lower than some who were familiar with the matter expected. Given WeWork’s recently reported losses, its decision to expand in this way comes at a time when some investors are questioning WeWork’s profitability in the current economy.