The company behind the digital signature frequently used in real estate may open itself up to shareholders in the next six months.

On Monday, TechCrunch broke the news that the electronic signature company has confidentially filed an IPO (initial public offering) and is planning to go public in the next six months.

An IPO is the first stock of a private company that is offered to the public. Its release is often the initial test of how investors will react to the company on the market.

Typically, an IPO is a milestone for a privately-owned company — going public can raise large funds and spread standing among multiple shareholders. DocuSign, which launched in San Francisco in 2003, has raised more than $500 million since then. It was often rumored that the company would go public soon.

According to TechCrunch’s sources, DocuSign used a provision of the JOBS (Jumpstart Our Business Startups) Act to privately file an IPO that it will announce weeks before the company goes public. DocuSign declined Inman’s request for comment on the IPO.

But while the news about the IPO comes as a surprise, it will likely have “only a modest effect” on the real estate industry or DocuSign’s users in general, said Jay Ritter, an IPO expert and University of Florida professor, in an interview with Inman.

“DocuSign’s rumored IPO will give the company more capital to expand and thus facilitate the growing use of electronic signatures,” Ritter said. “The IPO will also allow pre-IPO investors to cash out, and make it easier for the firm to make acquisitions.”

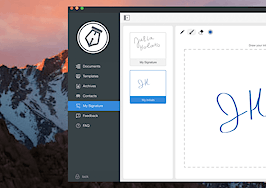

DocuSign’s services are commonly used in real estate transactions. Its “Transaction Room” software aims to help real estate brokers “make every deal digital.” According to the company’s website, DocuSign is the “official and exclusive provider of electronic signature services” through the National Association of Realtors benefits program. The real estate section of the site also says that of the 5.7 million real estate transactions in 2015, more than 2.5 million of those transactions were closed using DocuSign.

Real estate franchisor Re/Max has had an agreement with DocuSign since 2011 and, in 2016 began using an exclusive version of DocuSign’s “Transaction Rooms” to organize online documents related to real estate contracts. A few months after announcing this “strategic alliance,” Re/Max and DocuSign expanded the partnership to offer more services for brokers who need to exchange documents.

Pete Crowe, Re/Max’s vice president of communications and marketing, told Inman that the company wishes DocuSign “all the best with their intended IPO” but declined to comment on how this would affect the partnership.

In the last year, file sharing company Dropbox, software company Zuora and online security company Zscaler have all filed IPOs.