On Wednesday, January 31, the Court of Appeals for the District of Columbia Circuit upheld the constitutionality of the Consumer Financial Protection Bureau (CFPB) ending a two-year debate over the CFPB’s power structure, which stemmed from an ongoing lawsuit between the Bureau and New Jersey-based mortgage lender PHH Mortgage Corporation over the lender’s captive reinsurance practices.

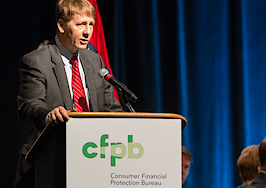

The much-watched case stemmed from a 2015 decision in which then-CFPB director Richard Cordray decided to fine PHH to the tune of $109 million over PHH’s practice of taking reinsurance fees as kickbacks, resulting in higher insurance premiums for paying consumers.

PHH sought to overturn the fine by challenging the authority of CFPB and its leadership in court, leading to several decisions that finally culminated in this week’s ruling. Although CFPB won the battle surrounding its constitutionality, it lost the war when it came to the $109 million fine: The court vacated it, saying that Cordray misinterpreted Real Estate Settlement Procedures Act (RESPA) rules. Here’s what the court documents say:

The panel was unanimous, however, in overturning the Director’s interpretation of RESPA.

It held that Section 8 permits captive reinsurance arrangements so long as mortgage insurers pay no more than reasonable market value for reinsurance. And, even if the Director’s contrary interpretation (that RESPA prohibits tying arrangements) were permissible, the panel held, it was an unlawfully retroactive reversal of the federal government’s prior position. Finally, according to the panel, a three-year statute of limitations applies to both administrative proceedings and civil actions enforcing RESPA.

The panel opinion, insofar as it related to the interpretation of RESPA and its application to PHH and Atrium in this case, is accordingly reinstated as the decision of the three-judge panel on those questions.

PHH celebrated the ruling, maintaining that they have never violated RESPA or any laws relating to their mortgage reinsurance activities, which they ended in 2009.

“The decision by the full D.C. Circuit Court of Appeals to uphold the panel’s ruling to overturn former Director Cordray’s decision under RESPA with respect to our former mortgage reinsurance activities, which includes vacating the $109 million penalty, is an important and gratifying outcome for PHH and the industry,” PHH said in a statement.

“We continue to believe that we complied with RESPA and other laws applicable to our former mortgage reinsurance activities in all respects,” PHH added. “Regarding the remand, we will continue to present, if necessary, the facts and evidence to support our position that mortgage insurers did not pay more than reasonable market value to PHH affiliated reinsurers.”

What happened?

When the CFPB was founded in 2011, it began overseeing RESPA compliance, and then began the work of completing any unfinished investigations from the U.S. Department of Housing and Urban Development (HUD), which originally oversaw RESPA. One of these investigations focused on PHH.

The CFPB said PHH took reinsurance fees as kickbacks, resulting in consumers paying higher insurance premiums. Furthermore, the CFPB claimed PHH charged consumers additional percentage points for not using one of their mortgage insurance partners, and PHH pressured mortgage insurers to “purchase” its reinsurance with the understanding or agreement that the insurers would then receive borrower referrals, as noted in a previous Inman report.

PHH argued they acted based on HUD’s 1997 letter on RESPA-compliant captive reinsurance, a letter that PHH says became regarded by the industry as the standard.

In 2014, Administrative Law Judge Cameron Elliot ruled in CFPB’s favor, saying that PHH accepted kickbacks in violation of RESPA Sections 8(a) and 8(b) on loans closed after July 2008, resulting in an injunction and disgorgement (giving up wrongfully obtained profits causally related to the proven wrongdoing) of about $6.4 million.

Despite Judge Elliot ruling in CFPB’s favor, Cordray filed an appeal saying that PHH should be responsible for loans closed before 2008, ranging all the way back to 1995, when PHH first began the practice.

Cordray presided over CFPB and PHH’s appeals, which was within his power as the director. Cases are tried by an administrative law judge (ALJ) from the CFPB’s Office of Administrative Adjudication (OAA), an independent adjudicatory office within the bureau.

The director of the CFPB (Cordray, at that point) — the same person who initiates an administrative proceeding — hears any appeals that may arise from the proceeding. The director also has the power to overrule an ALJ’s ruling. (This has raised a lot of questions about the scope of the CFPB director’s authority and whether there are adequate checks and balances of its power.)

Cordray ruled that PHH should pay $109 million in disgorgement of the premiums it paid to the reinsurers.

In response, PHH filed and was granted a motion of stay in the D.C. Circuit Court, and before oral arguments started, the court asked the plaintiffs and defendants to be prepared to discuss a number of questions that surround CFPB’s constitutionality, which included:

- What independent agencies now or historically have been headed by a single person?

- If an independent agency headed by a single person violates Article II as interpreted in Free Enterprise Fund v. PCAOB (2010), what would the appropriate remedy be?

- Would the appropriate remedy be to sever the tenure and for-cause provisions of the Dodd-Frank Act? Or is there a more appropriate remedy? And how would the remedy affect the legality of the director’s action in this case?

That case ended with CFPB being declared unconstitutional and the fine being tossed out in October 2016. Then, in February 2017, the case was reheard, and CFPB was declared constitutional and the fine was temporarily reinstated.

What now?

The battle between PHH and CFPB is over, something the National Association of Realtors (NAR) and other industry supporters lauded, saying that the final ruling should prevent any future confusion about RESPA compliance when it comes to marketing service agreements.

“The National Association of Realtors is pleased with the court’s reinstatement of its previous decision affirming that payments to settlement service providers are permitted by RESPA, so long as those payments are for goods and services actually furnished or performed and are made at fair market value,” said NAR President Elizabeth Mendenhall said in an emailed statement.

“We’re hopeful this much-needed clarity will address any and all uncertainty moving forward for real estate professionals who have entered into marketing service agreements with settlement and other service providers.”

The Mortgage Bankers Association also released an official statement saying the CFPB now owes the industry clear guidance on how to stay RESPA compliant.

“MBA is gratified the Court recognized that the CFPB violated the law when it tried to change longstanding RESPA rules through the enforcement process rather than by issuing a new rule or guidance,” said MBA chairman David Motley in a statement.

“This decision notwithstanding, the Bureau still owes the industry clear and constructive guidance on its view of the permissibility under RESPA of arrangements like marketing services agreements.

“Greater regulatory clarity and consistency on this front will benefit consumers and lenders alike.”

For more on the history of this case, see CFPB v. PHH, explained.