CoreLogic today released its Home Price Index (HPI) and HPI Forecast data for November 2017, which boasted 7 percent year-over-year growth. November is the fourth consecutive month with year-over-year increases measuring more than 6 percent. Gains were solid month-over-month also, at 1.0 percent.

CoreLogic chief economist Dr. Frank Nothaft says home price growth is unlikely to slow down, making it harder for first-time buyers to find affordable starter homes.

“Rising home prices are good news for homesellers, but add to the challenges that homebuyers face,” Nothaft said in a statement. “Growing numbers of first-time buyers find limited for-sale inventory for lower-priced homes, leading to both higher rates of price growth for ‘starter’ homes and further erosion of affordability.”

Looking ahead, home prices are expected to increase by 4.2 percent year-over-year by November 2018 and decrease by 0.4 percentage points in December 2017.

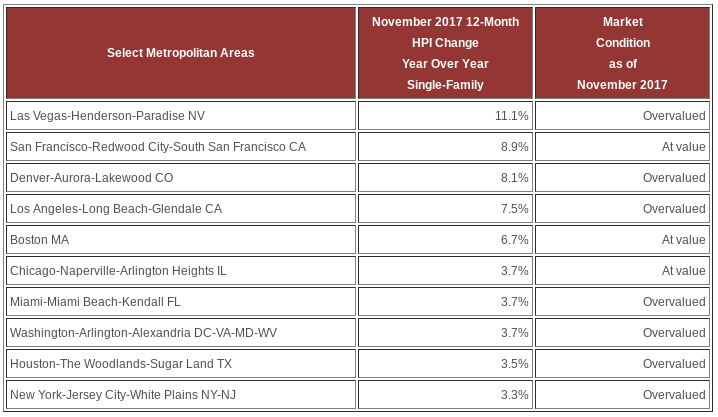

According to CoreLogic’s Market Condition Indicators (MCI) data, 37 percent of the nation’s 100 largest metropolitan areas have overvalued housing stock. Another 36 percent were undervalued, and 26 percent were at value.

The MCI analysis categorizes home prices in individual markets as undervalued, at value or overvalued by comparing home prices to their long-run, sustainable levels, which are supported by local market fundamentals such as disposable income, explains CoreLogic.

Las Vegas was the most overvalued market with an 11.1 percent year-over-year increase in single-family home prices. Denver, Los Angeles, Miami, Washington, D.C., Houston and New York City were also overvalued with home price growth ranging from 3.3 to 8.1 percent year-over-year.

San Francisco, Boston and Chicago were at value, with home price growth ranging from 3.7 to 8.9 percent year-over-year.

CoreLogic president and CEO Frank Martell says home price growth won’t slow down until residential starts ramp up and provide new inventory.

“Without a significant surge in new building and affordable housing stock, the relatively high level of growth in home prices of recent years will continue in most markets,” he said. “Although policymakers are increasingly looking for ways to address the lack of affordable housing, much more needs to be done soon to see a significant improvement over the medium term.”

About the CoreLogic HPI

The CoreLogic HPI is built on industry-leading public record, servicing and securities real-estate databases and incorporates more than 40 years of repeat-sales transactions for analyzing home price trends.

Generally released on the first Tuesday of each month with an average five-week lag, the CoreLogic HPI is designed to provide an early indication of home price trends by market segment and for the “Single-Family Combined” tier representing the most comprehensive set of properties, including all sales for single-family attached and single-family detached properties.