We’ll add more market news briefs throughout the day. Check back to read the latest.

Most recent market news

Thursday, October 12

- The 30-year fixed mortgage rate on Zillow Mortgages is currently 3.72 percent, up one basis point from this time last week.

- The 30-year fixed mortgage rate rose last Thursday, then hovered around 3.77 percent before falling back to the current rate early this week.

- The rate for a 15-year fixed home loan is currently 3.0 percent, and the rate for a 5-1 adjustable-rate mortgage (ARM) is 3.07 percent.

- The rate for a jumbo 30-year fixed loan is 3.93 percent.

“Mortgage rates rose last week despite a weak jobs report,” said Zillow senior economist Aaron Terrazas. “Though the U.S. economy lost jobs in September – the first loss in seven years – the decline was attributed to hurricane effects in the Southeast, and other data point to a strong labor market. Rates fell back early this week as political rhetoric lowered the odds of tax reform, at least for now. This week, markets will closely watch inflation data due Friday, as well as several speeches by FOMC voters that could provide more clarity on the likelihood of a December interest rate hike.”

Zillow’s real-time mortgage rates are based on thousands of custom mortgage quotes submitted daily to anonymous borrowers on the Zillow Mortgages site and reflect the most recent changes in the market. These are not marketing rates, or a weekly survey.

News from earlier this week

Tuesday, October 10

CoreLogic Loan Performance Insights July 2017 Update

- The U.S. foreclosure rate remains at a 10-year low as of July, but the rate across the largest the 100 largest metros varies from 0.1 percent (Denver) to 2.2 percent (New York).

- Overall mortgage delinquency rate fell to 0.9 percentage points year over year.

- Early-stage delinquencies declined 0.3 percentage points year over year.

- As of July 2017, the foreclosure inventory rate was 0.7 percent, down from 0.9 percent in July 2016.

Corelogic Chief Economist Frank Nothaft said in the report, “Even though delinquency rates are lower in most markets compared with a year ago, there are some worrying trends. For example, markets affected by the decline in oil production or anemic job creation have seen an increase in defaults. We see this in markets such as Anchorage, Baton Rouge and Lafayette, Louisiana where the serious delinquency rate rose over the last year.”

CoreLogic Housing Credit Insights Q2 2017 Update

- Purchase mortgage loans are still high quality in terms of credit risk.

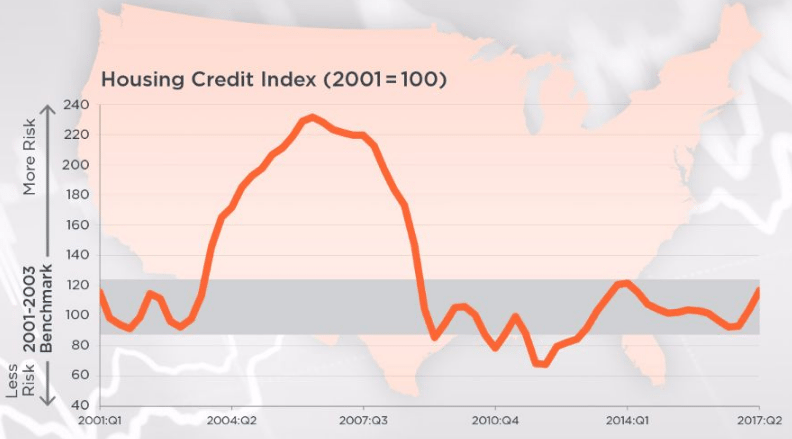

- In Q2 2017, the HCI increased to 117, up 20 points from Q2 2016. Even with this increase, the level of credit risk in Q2 2017 is still within a range of the HCI for the period of 2001 to 2003.

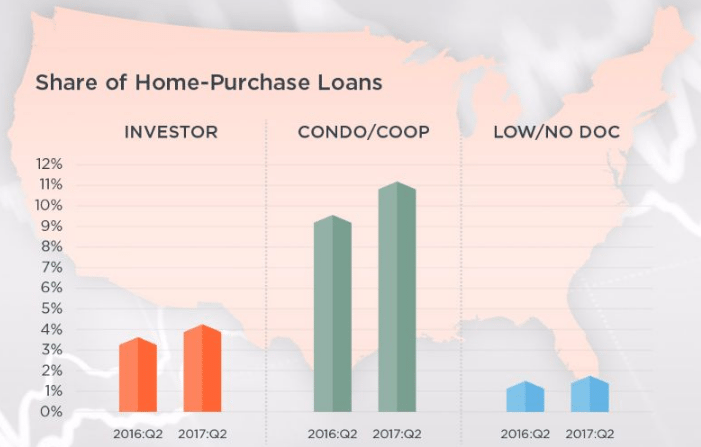

- The investor share of home-purchase loans increased from 3.6 percent in Q2 2016 to 4.2 percent in Q2 2017.

- The share of home-purchase loans secured by a condominium or a co-op building increased from 9.6 percent in Q2 2016 to 11.1 percent in Q2 2017, making loans appear riskier.

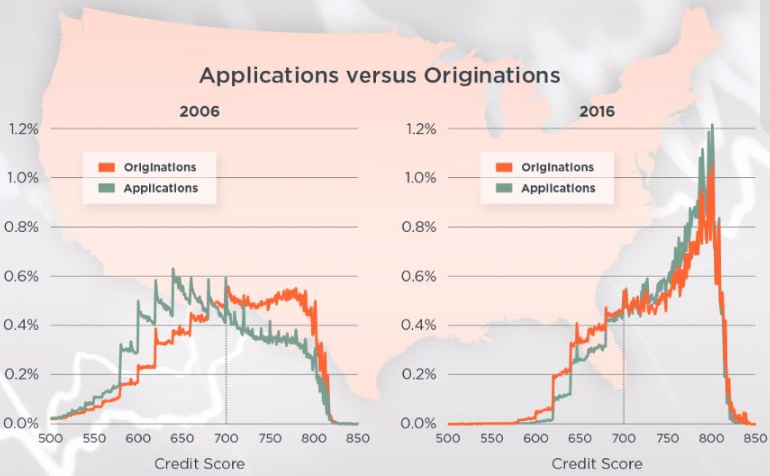

- Applications in the lower credit score range are almost non-existent in 2016 when compared to 2006. Applicants may be “self-removing” themselves from the applicant pool. This may explain some of the decline in new-loan credit risk.

- The average credit score for homebuyers increased 9 points year over year between Q2 2016 and Q2 2017, rising from 736 to 745.

Corelogic Chief Economist Frank Nothaft said in the report, “Mortgage risk for new originations increased modestly in the second quarter of 2017, but much of this rise was due to a small shift in the mix of loan types to more investor and condominium loans, which have slightly higher risk attributes. Despite the somewhat higher risk of new origination loans, purchase mortgage underwriting remains relatively clean with an average credit score of 745 and low delinquency risk.”

Mortgage Bankers Association (MBA) Mortgage Credit Availability Index

- The MCAI increased 0.7 percent to 181.4 in September.

- Credit availability for conforming and conventional loans saw the greatest increase in September (both were up 1.5 percent.

- Credit availability for jumbo loans increased 1.4 percent while credit availability for government loans increased 0.2 percent.

- Of the four component indices, the Conforming MCAI and the Conventional MCAI saw the greatest increase in availability over the month (both up 1.5 percent), followed by the Jumbo MCAI (up 1.4 percent) and then the Government MCAI (up 0.2 percent).

“Mortgage credit availability increased in September due to continuing updates to conforming loan programs as well as agency jumbo programs that have been phased in over the last few months,” said Lynn Fisher, MBA’s Vice President of Research and Economics. “For the year to date, the supply of credit has increased only modestly in the non-jumbo space while it has expanded significantly among jumbo programs.”

Email market reports to press@inman.com.