HouseCanary, a real estate data analytics and valuation provider, has raised $31 million in Series B funding, bringing the company’s 2017 funding total to $64 million.

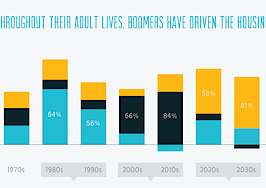

Currently, HouseCanary has access to more than 40 years of data on more than 100 million properties across the United States, and the company uses that information along with proprietary algorithms to provide home price insights and forecasts within a margin of error of 2.5 percent or less.

“HouseCanary’s unique technology represents an industry revolution, bringing access to transparent and actionable data to all segments of the largest asset class in the world,” said HouseCanary CEO Jeremy Sicklick in a statement.

The company plans on using the funds to further develop its proprietary technology and forecasting models — the bread and butter of HouseCanary’s platform.

“Our focus is to nail down what is the value of every property and how is the value changing, and enable real estate professionals to use this tool to make better decisions either on the lending or investing side,” Sicklick told Inman.

HouseCanary

According to the CEO, HouseCanary has whittled its margin of error down to 2.5 percent, a number he hopes to shrink with a greater investment in proprietary data and more streamlined feedback loops.

“Every percentage point that you are off, matters,” he said. “What we try to do is get to a much higher level of accuracy than you’ve been able to find from some of the other companies out there for what is a $30 trillion asset class, but then also to be super transparent with the accuracy by area, by price segment, where we’re confident, where we’re less confident — so you can know where you can actually use and apply this information to property values.”

Sicklick says agents and brokerages use HouseCanary to help sellers and buyers determine listing prices and understand how the value of the property will be reconciled with the appraiser valuation.

Moreover, the platform provides agents an opportunity to show past clients their value with a number of resources, including equity forecasts, a timeline of when it would be ideal to sell based on the current and projected housing market outlook, and specific suggestions on what owners can do to increase the value of their home.

Beyond improved valuations, HouseCanary will invest in its appraisal tools, expand its go-to-market strategy and increase its user base.

The funding round was led by PSP Growth, the venture and growth equity arm of PSP Capital, and included participation from Alpha Edison and other existing investors.

“The U.S. real estate industry is poised for incredible innovation-driven transformation, as technology and data reach new segments of the market, opening up new opportunities for residential and commercial real estate alike,” said Penny Pritzker, founder and Chairman of PSP Capital in a press release.

“As a business builder, I recognized the tremendous potential of HouseCanary’s technology, as well as the expertise and vision of their strong management team.”