- NAR wants HUD to make changes to its Community Development Block Grants assessment process and to clarify the process by which disabled people can request reasonable accommodations for service animals.

- It also asks that HUD reconsider whether lifetime mortgage insurance premiums are necessary and to lower premiums, and addresses PACE loans and FHA condo policy tweaks.

When President Donald Trump signed Executive Order 13777, “Reducing Regulation and Controlling Regulatory Costs,” it’s a fair bet that he intended the Department of Housing and Urban Development (HUD) to take a close look at its rules and regulations in order to determine what’s necessary and what’s excessive.

Now, the National Association of Realtors (NAR) has weighed in with a letter from NAR President William Brown to HUD Secretary Ben Carson, outlining the regulatory areas of housing that should take priority.

“NAR recognizes that there is a need to review HUD’s rules and regulations and make sure they are well crafted and tailored to achieve their intended goals in an efficient and considerate manner,” Brown wrote.

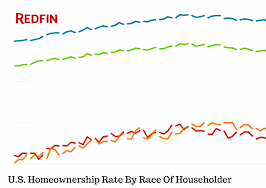

“Through a multitude of initiatives, HUD develops strong, safe communities and provides access to affordable housing for millions of Americans. For many groups traditionally underserved by the private housing market, including low to moderate-income, minority and first-time homebuyers, HUD, through the Federal Housing Administration (FHA), offers the only path to homeownership,” he added.

Fair Housing and service animals

Brown wrote that although the Fair Housing Act has been a law for almost 50 years — and zoning based on race has been outlawed for nearly a century — there is still “palpable and measurable segregation in our housing markets.”

And there’s one area of Fair Housing that really hasn’t been tackled yet in real estate — reasonable accommodations for service animals for people with disabilities.

“Difficulties have arisen regarding how a person requests a reasonable accommodation, especially in the area of service and assistance animals, and the information that may be required to determine if such a request is reasonable,” Brown wrote. “Several firms offer online notices that purport to state that an assistance animal is needed by an individual. There is no uniformity in who may make the diagnosis and prescription of the need for an assistance animal.”

He described the current advice from HUD surrounding how to deal with service animal requests:

- The person with the disability makes a request.

- The property manager or owner may ask for medical proof (a provider’s note) stating that the person has a disability and requires a service animal.

“Clearer guidance is needed for all involved,” wrote Brown, “especially concerning the qualifications for the medical provider whose note and advice is part of the accommodation request. In addition, some medical providers are providing this advice and notice over the internet without having examined the person seeking the accommodation.”

NAR also expressed some concerns with HUD’s plans for affirmatively furthering fair housing through Community Development Block Grants, which provide “annual grants on a formula basis to 1,209 general units of local governments and states.”

“NAR has concerns with how HUD advises localities on the types of activities that would address continued fair housing issues as well as the lack of sufficient time to fully engage the participation of interested parties,” Brown wrote.

He added that “HUD in its guidance to local governments on how to complete the assessment, includes numerous prescriptive suggested strategies such as enacting inclusive zoning or prohibiting discrimination based on source of income. While those may well be appropriate strategies in some communities, NAR believes HUD should not be identifying specific approaches to addressing housing disparities. That solution should be ‘homegrown.'”

NAR is concerned with this practice specifically because “HUD should not be stating a preference or recommendation for one type of action over another,” but instead should be requiring the community’s assessment, the community’s input and a set of actions “that can be measured relative to those fair housing issues.”

Brown also wrote that HUD doesn’t give local communities enough time to complete the assessment process. “This type of analysis and public input must be extended to allow for a more complete review of the fair housing issues, opinions and recommendations of the public and to provide the public adequate time to review the report of the local government,” he wrote. “NAR recommends that HUD, working with local government representatives and interested parties, do an analysis of the time necessary to complete this assessment.”

Mortgage insurance premiums

In many markets, a 20-percent down payment just isn’t feasible — in some, even 10 percent can be a stretch for some buyers. The Federal Housing Administration (FHA) has a loan program for borrowers who have less than 10 percent of the home’s price for their down payment — but it requires those buyers to pay mortgage insurance premiums for the entire lifetime of the loan.

“Under the 1999 Homeowners’ Protection Act, private mortgage insurance cancels once a borrower reaches 78 percent loan to value (LTV), as there is sufficient equity in that home that even if the homeowner eventually defaults, the value of the home in combination with the premiums paid in advance will cover any losses,” Brown wrote.

Therefore, he questioned whether that lifetime loan requirement was really necessary. “FHA and its borrowers would greatly benefit from eliminating the life of loan requirement. Cancellation of the premium would reduce the borrower’s monthly payments, providing them with more cash on hand so they may better withstand economic shocks and thereby reduce defaults, which harm the strength of the Mutual Mortgage Insurance Fund (MMIF).”

He also encouraged FHA to “lower the historically high annual insurance premiums, reducing cost for borrowers and improving their chances to withstand life events that could otherwise lead to default.”

Condos

NAR sees condos as “safe investments,” with low serious delinquency rates, and also believes that they can often be “the most affordable homeownership option for first time buyers, small families, single people, urban residents, and older Americans,” Brown wrote.

So NAR is urging FHA to tweak its regulations to allow spot loans for non-FHA approved condo projects and to ease the re-certification process for condo projects. FHA did roll out some proposed changes in September 2016, and NAR is asking the administration to “prioritize the release of condominium regulations that ease the restrictions on condominium project approval and purchase.”

The spot loans in non-FHA approved projects “will help buyers interested in older buildings, as well as in newer construction, which often do not have FHA approval, greatly benefiting many communities across the country.”

The association is also asking FHA to allow updates to current FHA application information when projects are re-certifying instead of completely re-submitting the application, which is what they currently have to do. This tweak “will create a more streamlined, less costly process,” and the association is also asking that the administration consider a five-year approval period instead of the three years in the proposal. This “would reduce the burden to condominium associations and entice many more buildings to apply for FHA approval, while still maintaining safety and soundness concerns,” Brown wrote.

Property Assessed Clean Energy (PACE) loans

In July of last year, FHA issued guidance that “allowed for the approval of mortgages for the purchase or refinance of properties with PACE obligations, provided they meet certain requirements.” One of the requirements is that the PACE loan obligation won’t take precedence (or “first lien position”) over the FHA mortgage, but Brown points out in the letter that “the guidance does provide that delinquent PACE loan amounts will take a first lien position in instances of default or foreclosure.

“Allowing any loan amount to hold a senior priority over FHA undermines the government’s collateral position and disrupts the secured lending process,” he added, noting that PACE loans don’t have the same Consumer Financial Protection Bureau disclosure requirements, and that some borrowers “may not fully understand the consequences of assuming an increased financial obligation on their tax bill. Thus, the lack of adequate disclosures increases the risk of borrower delinquency, which could lead FHA to incur higher mortgage defaults and increased systemic risk.” Brown urged FHA to rescind the guidance, Mortgagee Letter 2016-11.

“NAR strongly supports HUD in its mission to increase homeownership and provide shelter and support for millions of families,” he concluded, adding that the association appreciates the opportunity to comment.