- Buyers are now spending 29.2 percent of their monthly income for median-priced homes -- 8.2 percent above the average seen from 1985 to 2000.

Buyers are spending 29.2 percent of their monthly income for median-priced homes, according to Zillow’s latest study on affordability in 35 of the nation’s largest markets.

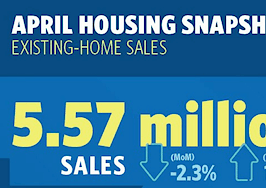

Monthly and quarterly market studies by organizations such as the National Association of Realtors (NAR) and CoreLogic have shown a continuous rise in home prices over the course of nearly 70 months. Furthermore, current peak pricing ($198,000) has surpassed the previous peak value of $196,600, which was reached in April 2007.

With higher home prices come larger down payments that create a barrier to homeownership for aspiring buyers.

“Homes have gotten so expensive in many major cities that even with low mortgage rates, monthly costs for homes that are currently for sale are starting to be unaffordable,” said Zillow Chief Economist Dr. Svenja Gudell in a statement.

“Down payments are a top concern for today’s homebuyers, but the reality is that monthly costs are becoming unaffordable as well. Low inventory is pushing sticker prices higher, and when mortgage rates start to rise, monthly payments will be driven further into unaffordable territory,” he added.

Out of all the studied markets, Los Angeles homebuyers have it the worst — owners would need to spend 46.8 percent of their income on a median-valued home. This is an 11.6 percent increase from what they would have had to spend (35.2 percent) before the housing bubble.

Out of all the studied markets, Los Angeles homebuyers have it the worst — owners would need to spend 46.8 percent of their income on a median-valued home. This is an 11.6 percent increase from what they would have had to spend (35.2 percent) before the housing bubble.

On the other hand, homeowners in Cleveland are spending only 12.7 percent of their income on a median-priced home of $144,000 — well below the current national average.

When it comes to annual home value gains, all 35 markets saw an increase, although some rises were smaller than others. The biggest annual home value gains came in Seattle; Dallas; Tampa, Florida; Detroit and Orlando, Florida. In each of those markets, home values rose by 9.9 percent or more from April of last year.

The smallest annual gains were in Houston; Washington, D.C.; Baltimore and San Jose, California, all of which posted gains below 4 percent.