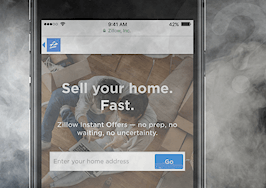

On Monday, Zillow launched a test in Orlando and Las Vegas. The product we’re testing, Zillow Instant Offers, enables potential sellers to receive non-binding quotes from up to five investors (some of whom will fix and flip; others who will rent out the properties) and compare the offers side-by-side with a CMA from a real estate agent.

Greg Schwartz

Judging by the activity on social media, you’ve probably heard about the test.

It seems like just about everyone is joining the conversation. While some folks see an opportunity to grow their businesses, others see mysterious intentions on our part.

Some on social media are speculating that this product is anti-agent. That’s simply not true. Our bacon and eggs come from serving the industry: 70 percent of our revenue is from working with more than 80,000 agents, teams and brokers who advertise with Zillow Group.

Some are wondering if we’re making money from the test itself. We’re not. Investors charge fees and disclose those to consumers, but we’re just trying to learn.

We want to continue the discussion with facts rather than speculation. We believe in agents, and we always encourage consumers to work with them.

We come in peace.

Specifically, we require all buyers to be represented by an agent, and we aggressively encourage sellers to have representation through language on our site, email and phone calls offering to connect them with an agent.

What’s more, if you ask any agent who is creating CMAs for these potential sellers, they’ll say this is going to be a great way to generate leads.

We agree.

So why test a product that will obviously create headaches for us?

I promise you it’s not because of haste, idealism or lack of care. It’s because we believe change isn’t to be feared but rather directed. We believe we are at the tipping point of an enormous wave of consumer-driven change — again — and we intend to navigate it successfully in cooperation with our agent, broker and MLS partners.

A movement which we call “Integrated Experiences” is sweeping industries, and real estate is no exception. People are looking for easier, less stressful and more integrated experiences — experiences that provide transparency and control, and leverage technology to enable great outcomes. I’m not talking about technology for technology’s sake — I’m talking about responding to real consumer wants. We must, and will, address real consumer wants.

We’ve all watched with interest over the last decade as startups focused on disrupting the real estate transaction launch, and then subsequently fail. But something different is happening in the last couple years.

Silicon Valley has recently invested $1.05 billion into the notion that the real estate transaction will be disrupted by serving sellers in a more streamlined and non-traditional fashion.

I’ll let Inman News list out all the startups focused on the space, but let me point out — these startups are gaining traction. They’re well-funded, and they’re responding to the changing expectations of consumers.

We believe these changing expectations are real and sustainable or we wouldn’t be taking on this test.

If they are real, the stuff we create in response will wire in real estate agents and delight consumers. Not just because you’re our bread and butter, but because we believe the consumer benefits from having agents involved.

We’re testing Zillow Instant Offers to find definitive answer to questions we hear a lot:

- How badly do homesellers want an easier transaction? We suspect that, while the idea appeals to them, most of the consumers who try Zillow Instant Offers will end up selling their home on the open market, with an agent to maximize their sale proceeds.

- How will investors interact with the consumer? Will they send high initial offers and then lower them after inspection? The investors we’ve selected for this test say “no way.”

- Will agents really submit high CMAs to win the deal and then reduce the price to reflect reality? The Premier Agents we’ve selected say they have a lot more value to offer than that.

- How much will sellers be willing to pay in investor fees? This we simply don’t know yet. Keep in mind, the investor fees are just that, investor fees. Zillow takes no cut of the fees.

As an aside, the conversations we’ve been having with agents and brokers behind closed doors are a lot different than the ones you see on social media. We’ve encountered a lot of pragmatic agents and brokers looking for a path to generate profit through a dependable and high scale source of seller leads for listing agents.

In fact, while pre-briefing a prominent broker last week, he first asked if his firm could exclusively provide the agents to do the CMAs, and speculated that his agents would always outsell an investor to get the listing. Then he leaned back, chuckled, and asked why Zillow would test a product that would cause us obvious industry headaches.

But he got it. He understood what this is about — and he is opportunistically testing new ideas to see if there is profit for him.

Every Zillow Instant Offer will have an agent associated with it on the buy side, and we aggressively (through phone calls and email) encourage the seller to get representation.

We are testing this product in an industry-centric fashion because we believe sellers and buyers are best served when they have a talented real estate agent representing their interests. This isn’t pandering; this is a firmly held belief of our company.

I’m certain that if we focus on managing the consumer-driven change ahead of us, we will build a large and profitable revenue stream for growth-oriented real estate agents, brokers and our company.

Greg Schwartz is the Chief Business Officer at Zillow Group.