We’ll add more market news briefs throughout the day. Check back to read the latest.

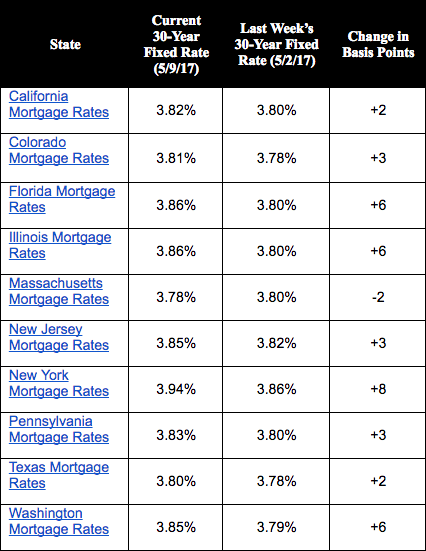

Mortgage rates:

[graphiq id=”b2w6fmfIyNL” title=”30-Year Fixed Rate Mortgage Rates for the Past 6 Months” width=”600″ height=”400″ url=”https://w.graphiq.com/w/b2w6fmfIyNL” link=”http://mortgage-lenders.credio.com” link_text=”30-Year Fixed Rate Mortgage Rates for the Past 6 Months | Credio”]

News from earlier this week

Tuesday, May 9

CoreLogic Loan Performance Insights

CoreLogic Loan Performance Insights

- Serious delinquency and foreclosure rates hit lowest levels since 2007

- The 30 days or more delinquency rate for February 2016 was 5.5 percent.

- In February 2017, 5.0 percent of mortgages were delinquent by at least 30 days or more including those in foreclosure. This represents a 0.5 percentage point decline in the overall delinquency rate compared with February 2016.

CoreLogic Loan Performance Insights

CoreLogic Loan Performance Insights

Quicken Loans’ Home Price Perception Index (HPPI)

- Quicken Loans’ National HPPI shows appraised values were 1.90% lower than homeowners estimated in April

- Home values rose 1.06% nationally in April, with a 5.08% year-over-year increase, according to the Quicken Loans HVI (Home Value Index)

- The 30-year fixed mortgage rate on Zillow® Mortgages is currently 3.84 percent, up four basis points from this time last week.

- The 30-year fixed mortgage rate rose five basis points on Friday, then hovered around the current rate for the rest of the week.

“Mortgage rates rose last Friday after a strong jobs report made it very likely that the Fed will hike interest rates again in June, but edged slightly lower after centrist Emmanuel Macron won the French presidential election, reducing financial market risk in Europe,” said Erin Lantz, vice president of mortgages at Zillow, in a statement. “This week, markets are likely to focus on several Fed speeches and inflation data due Wednesday, but rates should remain stable overall.”

Email market reports to press@inman.com.