Check Inman every day for the daily version of this market roundup.

Mortgage rates:

[graphiq id=”b2w6fmfIyNL” title=”30-Year Fixed Rate Mortgage Rates for the Past 6 Months” width=”600″ height=”400″ url=”https://w.graphiq.com/w/b2w6fmfIyNL” link=”http://mortgage-lenders.credio.com” link_text=”30-Year Fixed Rate Mortgage Rates for the Past 6 Months | Credio”]

[graphiq id=”2NvK9Bl9HIF” title=”15-Year Fixed Rate Mortgage Rates for the Past 6 Months” width=”600″ height=”400″ url=”https://w.graphiq.com/w/2NvK9Bl9HIF” link=”http://mortgage-lenders.credio.com” link_text=”15-Year Fixed Rate Mortgage Rates for the Past 6 Months | Credio”]

Home equity rates:

[graphiq id=”kPkTJrAnX5r” title=”Average Home Equity Loan Bank Rates by State” width=”600″ height=”465″ url=”https://w.graphiq.com/w/kPkTJrAnX5r” link=”http://mortgage-lenders.credio.com” link_text=”Average Home Equity Loan Bank Rates by State | Credio”]

[graphiq id=”dP0v3iYOnH” title=”Average Home Equity Loan Credit Union Rates by State” width=”600″ height=”465″ url=”https://w.graphiq.com/w/dP0v3iYOnH” link=”http://mortgage-lenders.credio.com” link_text=”Average Home Equity Loan Credit Union Rates by State | Credio”]

Day-by-day market activity

Friday, March 17

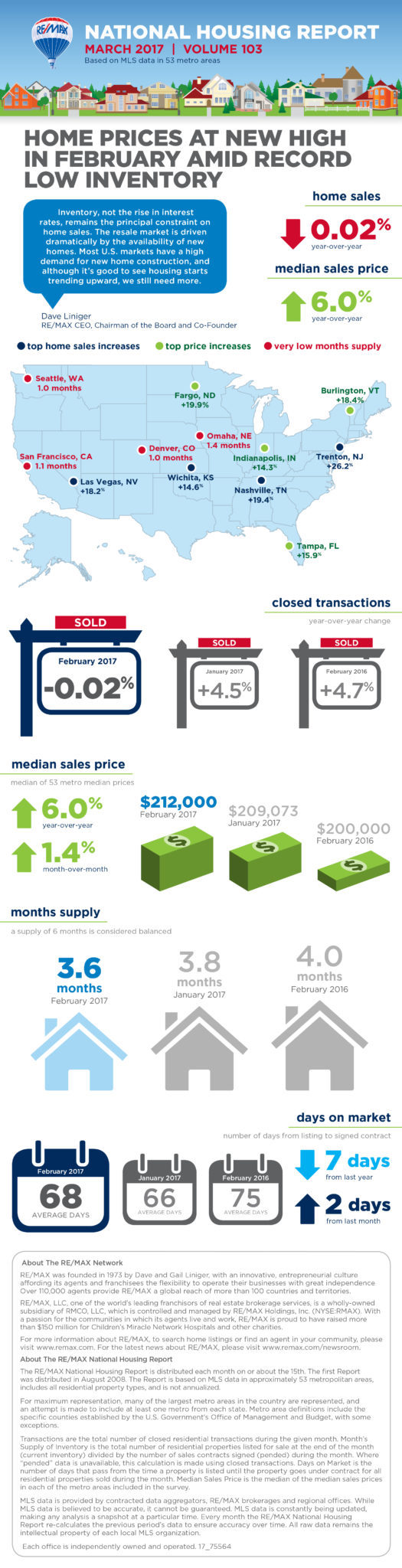

March 2017 Re/Max National Housing Report:

- February 2017 home sales were down 0.02 percent from February 2016.

- Active inventory reached a record low for February, dropping 17.9 percent year-over-year. Average days on market dropped from 75 in February 2016 to 68 in February 2017.

- The median sales price was $212,000, up 6 percent year-over-year.

Thursday, March 16

Attom Data Solutions Foreclosure Activity for February 2017:

- Overall foreclosure activity in February dropped to a new 11-year low, the lowest since November 2005.

- States with a year-over-year increase included New Jersey (up 16 percent); Delaware (up 14 percent); Louisiana (up 12 percent); Alabama (up 10 percent); and Hawaii (up 8 percent).

- Three of the nation’s 20 largest metro areas posted year-over-year increases in foreclosure activity: Houston (up 97 percent from an abnormally low Feb 2016); San Francisco (up 25 percent); and New York (up 9 percent).

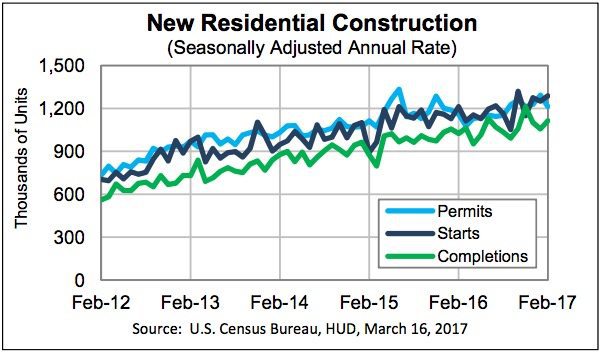

- Privately-owned housing units authorized by building permits in February were at a seasonally adjusted annual rate of 1,213,000, 6.2 percent below the revised January rate but is 4.4 percent above the February 2016 rate.

- Privately-owned housing starts in February were at a seasonally adjusted annual rate of 1,288,000, 3.0 percent above the revised January estimate and is 6.2 percent above the February 2016 rate.

- Privately-owned housing completions in February were at a seasonally adjusted annual rate of 1,114,000, 5.4 percent above the revised January estimate and 8.7 percent above the February 2016 rate.

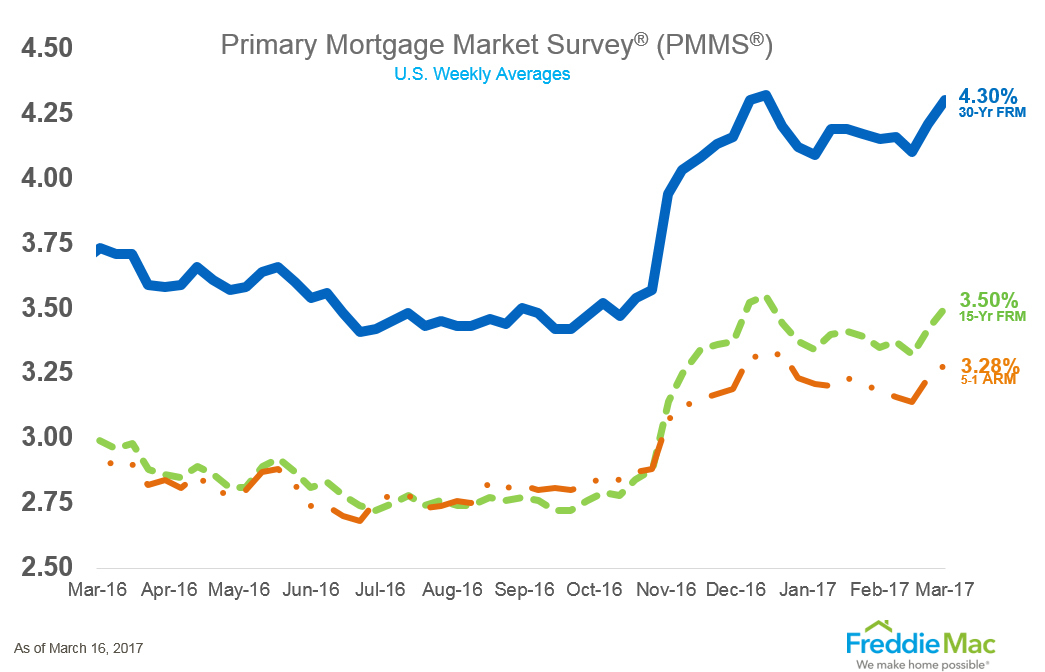

Freddie Mac’s Primary Mortgage Market Survey:

- The 30-year fixed-rate mortgage (FRM) averaged 4.30 percent with an average 0.5 point for the week ending March 16, 2017.

- This is up from last week when it averaged 4.21 percent.

- A year ago at this time, the 30-year FRM averaged 3.73 percent.

Wednesday, March 15

Mortgage Bankers Association’s Weekly Applications Survey:

- Mortgage applications increased 3.1 percent from one week earlier for the week ending March 10, 2017.

- The refinance share of mortgage activity increased to 45.6 percent of total applications from 45.4 percent the previous week.

- The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances increased to its highest level since April 2014, 4.46 percent, from 4.36 percent.

Ellie Mae’s Origination Insights Report for February 2017:

- Home loans for purchases increased to 57 percent in February, up from 53 percent in January.

- The average time to close all loans decreased to 46 days in February, down from 51 days in January.

- Average FICO scores dropped with the average FICO score on all closed loans at 720.

Tuesday, March 14

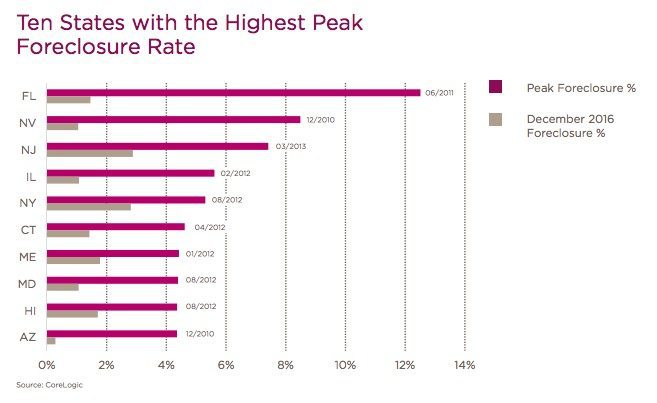

CoreLogic’s National Foreclosure Report: March 2017:

- 2.6 percent of all mortgages were in serious delinquency (90+ days past due and in foreclosure) in December 2016.

- This represents about 1 million homes.

- The peak serious delinquency involved 3.7 million homes in 2010.

Mortgage Bankers Association’s February 2017 mortgage applications for new home purchases:

- Mortgage applications for new home purchases increased 2.2 percent compared to February 2016.

- Compared to January 2017, applications increased by 16 percent relative to the previous month.

First American Real Estate Sentiment Index for Q1 2017:

- Confidence for transaction volume growth over the next 12 months increased 0.4 percent from Q4 2016 and increased 0.63 percent compared with a year ago.

- Confidence for growth in purchase transaction volume over the next 12 months increased 6.5 percent from last quarter and 3.7 percent compared with a year ago.

- Prices across all property types are expected to grow by 2.5 percent over the next 12 months, which is up from last quarter’s expectation of a 1.7 percent increase.

Quicken Loans Home Price Perception Index (HPPI) and Home Value Index (HVI) for February 2017:

- According to the HPPI, appraised values were 1.69 percent less than what homeowners estimated in February.

- In January, appraiser opinions were 1.47 percent lower than homeowner expectations.

- Home values rose 0.55 percent from January to February, according to the National HVI, and increased 2.95 percent compared to the previous February.

Berkshire Hathaway HomeServices’ Homeowner Sentiment Survey for Q1 2017:

- 61 percent of current homeowners are satisfied with the state of the U.S. economy today, a 13 percent increase from the last wave of the survey (fielded shortly before the December interest rate announcement).

- 84 percent of current homeowners and 81 percent of prospective homeowners agree that increasing interest rates are a challenge facing the real estate market today, a 7 percent and 3 percent increase from the last wave of the survey, respectively.

- If mortgage rates were to go up, 39 percent of current homeowners and 65 percent of prospective homeowners say they are more likely to feel anxious, rather than indifferent about such a hike.

Email market news to press@inman.com.