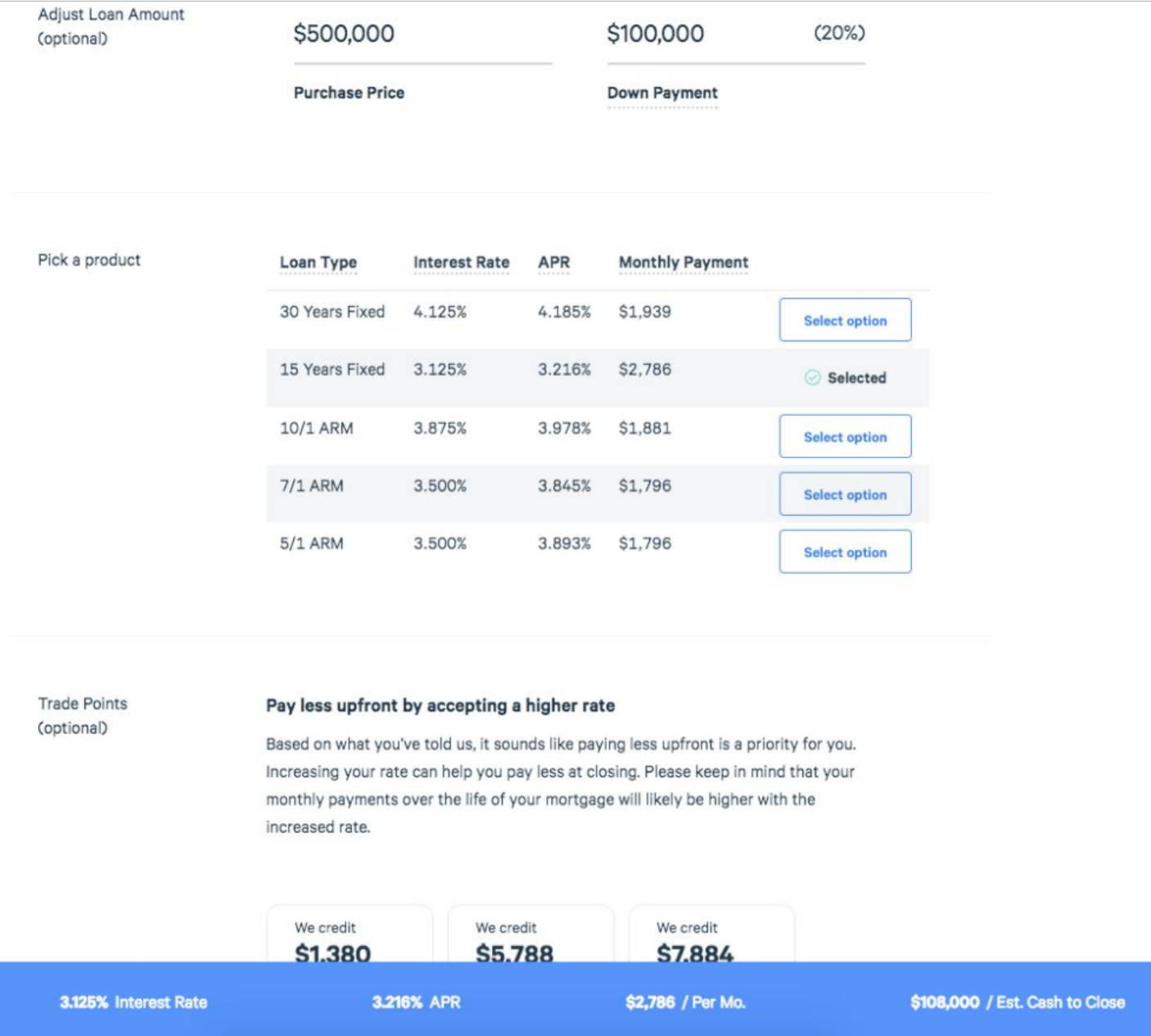

- LendingHome's mortgage tool lets borrowers configure their loan, lock in an interest rate and share their loan status with a real estate agent.

Lenders are increasingly allowing homebuyers to apply for mortgages online, but the underwriting process still typically requires a great deal of communication and paperwork submission.

LendingHome, an online lender that has raised more than $100 million in funding, has debuted new software that the startup says cuts out much of this grunt work by streamlining the mortgage process from beginning to end.

The company has launched the platform to begin lending to everyday homebuyers, branching out from its roots as a lender to home flippers and builders. LendingHome has funded more than $1 billion in loans since launching in 2014.

Platform features

LendingHome’s mortgage tool provides tips and feedback to borrowers and a milestone timeline so they can track the progress of their loans, as well as the ability to lock in an interest rate and share their loan status with a real estate agent.

“The ability to pull that agent into the fold gives that agent access to see exactly where the transaction stands,” said LendingHome CEO Matt Humphrey. The hope is to establish a reputation for ‘reliably moving towards a closing that [agents] can rely on.'”

The application’s education hub explains concepts like debt-to-income and loan-to-value ratios, and answers questions such as whether a borrower needs full-time employment to qualify for certain loans.

Loan specialists are available to walk borrowers through any steps that confuse them, but the startup touts the potential to obtain a mortgage “without picking up the phone.”

Through integrations with financial companies and data providers, the platform can pull in required documents such as bank statements, credit scores and tax returns. Documents that LendingHome can’t retrieve electronically can be uploaded.

“We can instantly underwrite their assets and their bank statements and give them an answer on that piece,” Humphrey said.

The platform’s Trade Points tool lets borrowers configure a loan with the combination of upfront fees and interest rate that best suits their needs, and then request a rate lock with a single click.

Reducing errors, timelines and manual work

LendingHome will only offer conventional loan products to consumers at first, such as mortgages guaranteed by Freddie and Fannie Mae.

But by tapping funds from institutional investors that already buy LendingHome’s fix-and-flip loans, LendingHome hopes to eventually offer innovative products, such as loans tailored to self-employed and foreign borrowers.

LendingHome thinks its system will slash underwriting errors, closing timelines and manual work, with the goal of reducing the origination cost of a loan to as little as $4,000 a pop, compared to an industry average of $8,000, Humphrey said.

That would allow the company to offer lower interest rates and upfront fees than the competition, he said.

This week, loanDepot also announced the unveiling of an end-to-end digital lending platform that came to life after 18 months of work and an $80 million investment.