- Nationstar's net income for the fourth quarter of 2016 was $198 million -- significantly higher than Q3's $45 million in net income.

- For the year, Nationstar reported $223 million in adjusted pretax income.

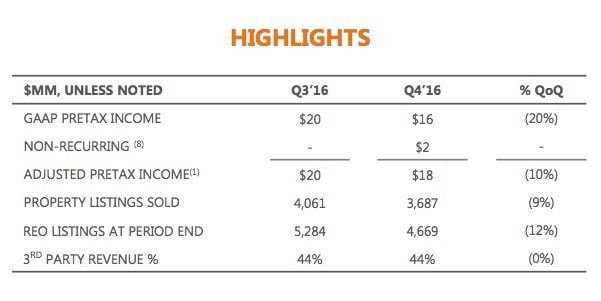

- In Q4, Xome delivered $18 million in adjusted pretax income.

- When asked if Nationstar would sell Xome, Bray said: "We're evaluating that. An $800 million company with a 20 percent margin is worth a very big pile of money."

When Xome arrived on the scene in 2015, purporting to disrupt the real estate industry with an end-to-end platform, nobody was sure what to expect.

By the end of 2016, it’s clear that the Nationstar subsidiary is a powerful performer for the company, and it’s opening up new opportunities — including a new partnership with “a leading ‘sale by owner’ platform.”

Nationstar’s overall health

After expenses, taxes and other negative balance sheet items, Nationstar’s net income for the fourth quarter of 2016 (Q4) was $198 million — significantly higher than Q3’s $45 million in net income.

For the year, Nationstar reported $223 million in adjusted pretax income — the company operated at a loss in Q2 and in Q1.

“Nationstar had an incredible year of success in 2016,” said Jay Bray, Chairman and Chief Executive Officer, in a statement.

“At Xome, we continued to invest in new technologies and grow third-party business,” Bray added. “We enter 2017 with solid momentum and the opportunity to welcome almost 1 million new customers to our servicing platform as we continue on our journey to reinvent the mortgage experience for the customer and enhance our leadership role in residential servicing.”

Xome’s contribution

In Q4, Xome delivered $18 million in adjusted pretax income — $16 million GAAP (generally accepted accounting practices). This was a slight dip from last quarter’s $20 million in pretax and GAAP income, which Nationstar attributed “partially to seasonality as well as a reduction in available inventory.

“Third-party revenues for the quarter, which primarily consist of leading financial institutions, were 44 percent of total revenues, as Xome continues to focus on diversifying its revenue streams and client base,” added the company in a statement.

“For the full year, Xome earned $69 million GAAP pretax income or $77 million adjusted pretax income, while growing title operations, launching new SaaS initiatives and expanding third-party revenues.

“This represents 183 percent improvement in pretax income year over year,” said Bray in the company’s investor phone call.

“The real estate industry lags other industries” to leverage technology, added Bray — which is why he said Nationstar has been investing in an array of real estate technologies.

“As we enter 2017, we believe we have all the pieces in place to connect the residential real estate marketplace. Others are starting to notice.”

There was little information offered on this tantalizing new arrangement other than what was stated in the company’s earnings statement:

“In the fourth quarter of 2016, Xome entered into a referral contract that combines Xome’s real estate brokerage, marketing, technology and transactional expertise with a leading ‘sale by owner’ platform. Through this new program, homeowners who wish to sell their homes themselves will benefit from having access to Xome’s auction platform, real estate agent panel and additional transaction-related services while helping to market and amplify property listings for owners on the site.”

Would Nationstar sell Xome?

After one question about whether Nationstar has ever considered selling its baby, Bray had this to say:

“Xome is a $500 million revenue business, close to a 20 percent margin, and that’s just with the current franchise. If you look at the current spin within Nationstar, Xome has the potential to be a revenue generator of over $800 million. It’s an extremely valuable franchise.

“We have had significant inbound inquiries about [whether] would we sell Xome and what would that look like.

“We’re evaluating that. An $800 million company with a 20 percent margin is worth a very big pile of money.”

And Bray said that making Xome accessible to third-party websites (like the unnamed FSBO platform) were part of its value.