- Inventory shortages have hit the housing market hard, but as a new study by Trulia shows, the starter-home market has especially suffered.

- The number of available starter homes decreased 12.1 percent from last year. Furthermore, starter-home owners are dedicating 38.5 percent of their income to mortgage payments -- 2.5 percent more than what lenders recommend.

First-time homebuyers have had a heck of a time finding homes to buy during the past couple of years — and that’s not about to get any better, according to recent research by Trulia.

In Q4, national housing inventory dropped for the sixth consecutive quarter, declining 9.1 percent from 2015.

But the inventory shortage is disproportionately impacting the starter-home market — the number of available starter homes dropped 12.1 percent over the past year.

Meanwhile, the median purchase price for those homes skyrocketed, making the dream of homeownership out of reach, or at least harder to obtain.

Buyers who are looking for a trade-up home are being hit hard as well. The number of trade-up homes on the market has declined 12.9 percent year-over-year. The share of those homes has dipped an additional 1.2 percent year-over-year to a 24 percent share.

The number of premium homes on the market decreased 5.6 percent from 2015, but the share of those homes increased from 49.9 percent to 51.1 percent in 2016.

Some experts are forecasting that first-time buyers will capture a greater share of the market in 2017, but if Trulia’s research holds true throughout the upcoming year, those experts’ hopes may soon be thrown in the trash.

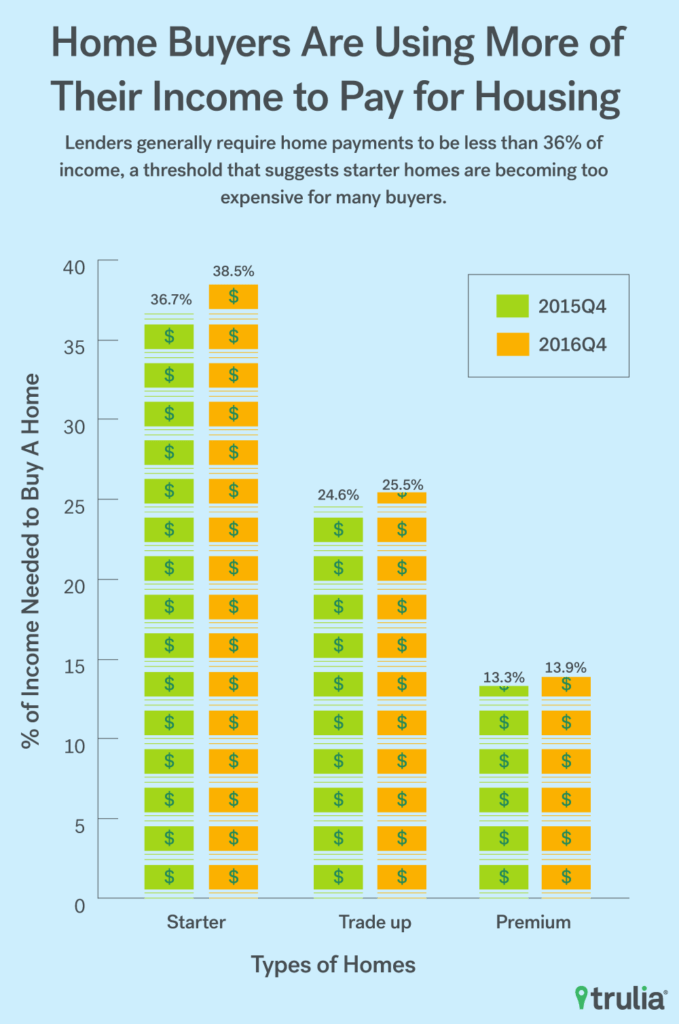

As seen in the graphic above, lenders usually require monthly mortgage payments to account for less than 36 percent of a homeowner’s income.

But starter-home owners, who are also most likely first-time buyers, are being priced out of homeownership.

This quarter, starter-home owners are spending 38.5 percent of their take-home income on mortgage costs — 2.5 percent above the recommended share prescribed by lenders. Furthermore, it’s 13 percentage points higher than what trade-up homeowners pay, and a staggering 24.6 percentage points higher than what premium-home owners shell out each month.

Finally, the starter-home inventory shortage is squeezing residents on the East and West coasts in cities such as Sacramento, California, plus San Francisco, San Diego, Los Angeles and Miami.