- Panama City Beach ranked with the highest ROI for short-term rental properties, and seven total Florida cities ranked within the top 20.

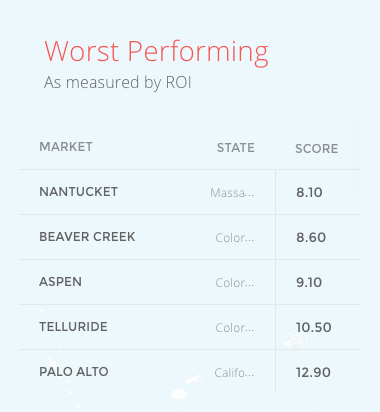

- Some of the nation's most expensive cities, like New York, Palo Alto and Washington D.C., rank low on the list for short-term rental investment opportunities because of high property prices.

- Coastal cities ranked among the best performing for short-term rental investment due in part to their vacation economy.

Even if the reason isn’t to purchase a home specifically for rental purposes, some homebuyers are interested in the possibility of bringing in some extra cash. Rented.com recently released its Best Places to Buy Rental Property in 2016, finding the best cities, vacation spots and small towns to own a short-term rental property.

Measuring 120 markets where short-term rental demand is high, the report maps out the best markets for investment purposes. Rented.com pulled data from Everbooked, including insurance, taxes, property prices, average rental income and more.

While the larger markets are certainly strong, some of the smaller markets are even more promising for short-term rental incomes, according to the report. Rented.com ranked cities based on their ROI, pinning spring break hub Panama City Beach, Florida, in the top spot with an ROI score of 94.5. The Sunshine State saw seven cities make the top 20, including Palm Coast, Daytona Beach and Fort Meyers.

Miami Beach ranked no. 24 with an ROI score of 68. The estimated rental income here is $56,900. And while that’s significantly more than the estimated rental income reported in some of the Florida cities reported, the investment buyers will have to put some more money up front for a property in Miami Beach.

The no. 3 best place for short-term rental investment was reported as Galveston, Texas, just south of Houston. The Gulf Coast vacation town received an ROI score of 91.8 and an estimated rental income of $33,400. Corpus Christi, Austin, Dallas and Fort Worth also ranked as profitable cities in Texas.

West Coast short-term rentals

According to the study, one of the worst performing markets is Palo Alto, California, which got an ROI score of 12.9 despite having an estimated rental income of $71,400. In nearby San Francisco, the ROI is a bit higher, at an estimated $79,300 income and a score of 43.9. The City by the Bay ranks in the no. 73 position.

Conditions are much stronger in Southern California for short-term renters. Los Angeles ranked no. 10 on the list for best investment cities with an ROI score of 81.3. The estimated rental income in L.A. is $43,600.

East Coast short-term rentals

Washington D.C. and its surrounding cities ranked on the lower end for short-term rental investment opportunities. The District itself was ranked no. 99 with an ROI score of 28.5. Nearby Alexandria, Virginia, ranked just a couple spots higher at no. 97, with an ROI score of 29.5 and an estimated rental income of $43,000. In the no. 75 spot, Arlington, Virginia, got an ROI score of 43.3 and an estimated rental income of $48,600.

A few hours away in New York City, the estimated rental income for a property is a whopping $96,900, but the city ranked in the 106 spot with an ROI of 24.1 because of high property prices. Brooklyn ranked just slightly higher, in the no. 98 spot with an ROI score of 29.2 and an estimated rental income of $48,400.