- Yardi Matrix's monthly survey report of 119 markets found rents rose in price by double digits for the third straight month, and $10 for the month of June.

- Year-over-year job growth for the six-trailing months in Houston was 0.5 percent in April 2016.

- Lifestyle renter growth in Houston fell below 2 percent, while renter by necessity growth rate came in right below 6 percent.

U.S. apartment rents have increased for the third-straight month, according to Yardi Matrix’s monthly survey of 119 markets. June rent rates increased by exactly $10, or 0.9 percent, to another all-time high of $1,213.

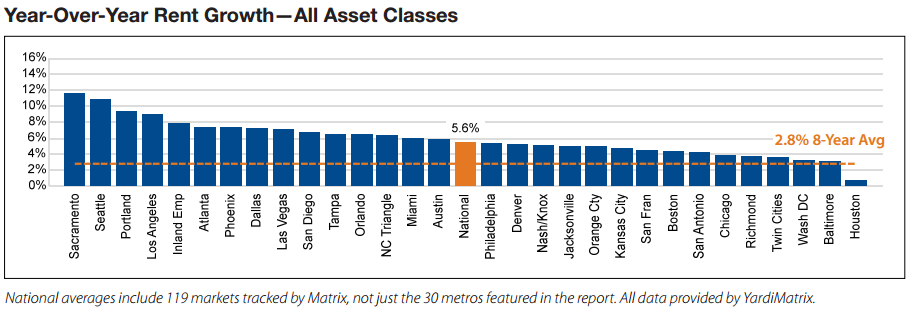

Rents were up 2.7 percent in the second quarter of 2016 and climbed 5.6 percent on an annual basis. Year-to-date rents increased 4.2 percent, which is almost to the tipping point of the forecasted total 2016 growth.

Although home prices increased pretty consistently, rental growth has slowed. Annually, rent growth dipped 30 basis points and is down 110 basis points from the most recent high reported in October. Prices have steadily risen since the start of the year.

Yardi studied the Bretix in its June report as well, but the company doesn’t believe the overseas shift will have much of an impact on the apartment market in the U.S.

On an eight-year average, rent growth was reported by Yardi at 2.8 percent. The only market of the 119 studied that saw annual rents hit a mark below that rate was Houston, where rental growth has slowed substaintially. Compared with the national annual growth of 5.6 percent, Austin and Philadelphia were the two cities closest to the average.

Sacramento came in with the highest year-over-year growth, followed by Seattle, Portland and Los Angeles.

On a trailing 12-month basis in June, rents grew by 6.2 percent nationally. Rents fell by 10 basis points overall, which was largely due to a dip in lifestyle renters from 5.9 percent to 5.8 percent.

Houston rent growth

Houston growth slowed in all sectors of the rental market

Houston rent rates have considerably decreased since the oil industry took a dip. The Texas city is still, however, expected to see a moderate year, according to Yardi.

The occupancy rate in Houston as of May 2016 was reported at 94.8 percent — a sliver higher than the previous month, that sat at 94.7 percent. By the end of 2016, rent growth is forecasted to reach 3.4 percent, putting it in the lower part of the pack.

The slower moving market is largely fueled by the slow growth in jobs. Year-over-year, in a six-month moving average, jobs only grew 0.5 percent in Houston as of April 2016. Compare this to nearby Austin, which saw an increase of 4.5 percent.

![]()