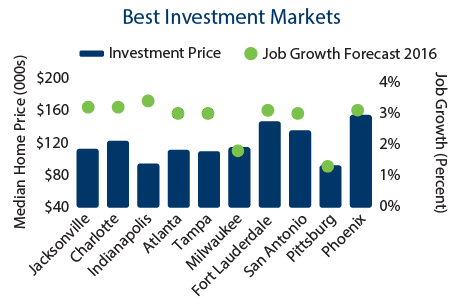

- South and Midwestern cities concentrated the list of markets with the biggest opportunity for return.

- Los Angeles rents are expected to increase 3.3 percent in 2016, following a 5.4 percent increase in 2015.

- L.A.'s job market is forecasted to see an addition of 80,000 jobs to the local community in 2016.

The multi-family and single-family rental markets are continuing to make headway throughout the nation, according to a report recently released by HomeUnion. While the end of 2015 was somewhat rocky for the U.S. economy, it has regained traction through the start of 2016 to prepare itself for what economists believe to be a promising year.

An interest rate hike is still expected from the Federal Reserve following the late 2015 bump that was the first increase seen in the past decade. On top of that, employment and the labor market are having a good year.

Rental demand and investor opportunity

By calculating job growth figures and supply and demand in cities throughout the nation, HomeUnion ranked the top cities on combination of investment opportunity and return in 2016. Jacksonville took the top spot, followed by Charlotte and Indianapolis.

Southern and Midwestern cities were represented on the list for biggest opportunity, with Milwaukee also getting a top spot. Fort Lauderdale, San Antonio and Phoenix also ranked high for investment markets.

Southern and Midwestern cities were represented on the list for biggest opportunity, with Milwaukee also getting a top spot. Fort Lauderdale, San Antonio and Phoenix also ranked high for investment markets.

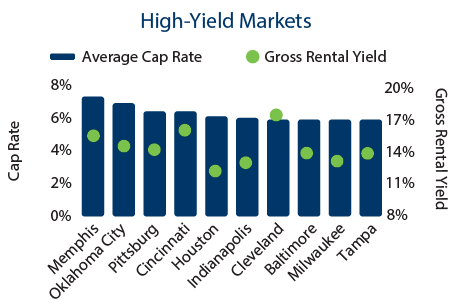

Few cities made both lists for opportunity and high demand of rental units. Fort Lauderdale was the only market to snag a spot on both.

The Bay Area made a big apperance on the list of high-demand markets, with San Franciso, San Jose, and Oakland all pricing high and having strong demand for rentals.

Milwaukee, Tampa and Indianapolis were all ranked as high-yield real estate markets. While San Antonio didn’t make the list of where investors are prone for high returns, its nearby neighbor, Houston, did make the cut.

And for markets with a high upside potential, Fort Lauderdale ranked in the no. 1 spot. Baltimore, Chicago, Miami and the Inland Empire are also markets where the possible earning potential is strong.

And for markets with a high upside potential, Fort Lauderdale ranked in the no. 1 spot. Baltimore, Chicago, Miami and the Inland Empire are also markets where the possible earning potential is strong.

Nationwide in 2015, 300,000 of the 460,000 new households created were rental properties, taking vacancy to an increadibly low rate below 5 percent, which is widely considered full occupancy.

Los Angeles rental market conditions

The Los Angeles housing market continutes to fare well, HomeUnion says. California was home to the nation’s leading employment growth through 2015, and L.A. ranked as the Golden State’s top job growth market.

Vacancy for the rental market is tightening, particularly in areas west of downtown. Generally, construction of apartments is centered in a few submarkets offering mostly luxury units.

HomeUnion estimates that rents will rise 3.3 percent by the end of 2016 to $2,457 per month. Last year prices climbed 5.4 percent.

Vacancy is still tight at 4.2 percent in L.A., and more jobs are expected to be created to fuel even more demand for housing in the metro. About 114,100 jobs were created in 2015, and 80,000 total job spots are expected to be added this year.

Investors in Los Angeles County particularly look to the coast for opportunities in places like Hermosa Beach, Redondo Beach and Manhattan Beach, HomeUnion says.