- South and Midwestern cities concentrated the list of markets with the biggest opportunity for return.

- In San Francisco, 48,000 jobs are to be created in 2016 – a 4.4 percent increase over last year.

- Rental increases in San Francisco are forecasted to ease to 5.4 percent in 2016, a significant drop from 8.8 percent last year.

The multi-family and single-family rental markets are continuing to make headway throughout the nation, according to a report recently released by HomeUnion. While the end of 2015 was somewhat rocky for the U.S. economy, it has regained traction through the start of 2016 to prepare itself for what economists believe to be a promising year.

An interest rate hike is still expected from the Federal Reserve following the late 2015 bump that was the first increase seen in the past decade. On top of that, employement and the labor market are having a good year as well.

Rental demand and investor opportunity

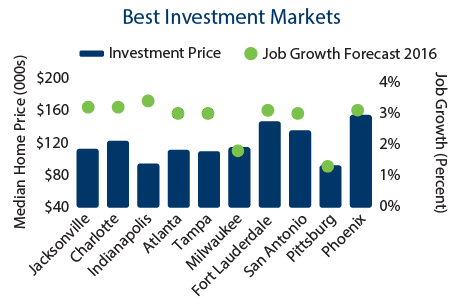

By calculating job growth figures and supply and demand in cities throughout the nation, HomeUnion ranked the top cities on combination of investment opportunity and return in 2016. Jacksonville took the top spot, followed by Charlotte and Indianapolis.

Southern and Midwestern cities were represented on the list for biggest opportunity, with Milwaukee also getting a top spot. Fort Lauderdale, San Antonio and Phoenix also ranked high for investment markets.

Southern and Midwestern cities were represented on the list for biggest opportunity, with Milwaukee also getting a top spot. Fort Lauderdale, San Antonio and Phoenix also ranked high for investment markets.

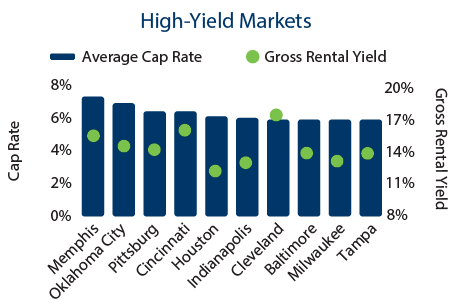

Few cities made both lists for opportunity and high demand of rental units. Fort Lauderdale was the only market to snag a spot on both.

The Bay Area made a big apperance on the list of high-demand markets, with San Franciso, San Jose, and Oakland all pricing high and having strong demand for rentals.

Milwaukee, Tampa and Indianapolis were all ranked as high-yield real estate markets. While San Antonio didn’t make the list of where investors are prone for high returns, its nearby neighbor, Houston, did make the cut.

And for markets with a high upside potential, Fort Lauderdale ranked in the no. 1 spot. Baltimore, Chicago, Miami and the Inland Empire are also markets where the possible earning potential is strong.

And for markets with a high upside potential, Fort Lauderdale ranked in the no. 1 spot. Baltimore, Chicago, Miami and the Inland Empire are also markets where the possible earning potential is strong.

Nationwide in 2015, 300,000 of the 460,000 new households created were rental properties, taking vacancy to an increadibly low rate below 5 percent, which is widely considered full occupancy.

Rent conditions in San Francsico

People just can’t get enough of San Francisco living. Housing supply can’t keep up with the strong demand that continues to flood the San Francisco market, HomeUnion says.

Investment properties are attractive, but yields aren’t nearly as high as many other areas, according to the report. But for those investors with cash in hand, transactions can be a bit easier to snag. However, even traditional buyers are stepping up to the plate in San Francisco with cash ready to close the deal.

Jobs continue to flood San Francisco, and employers are expected to keep up the pace for the rest of the year. By the end of 2016, 48,000 new jobs are to be created, which is a 4.4 percent increase over last year.

Vacancy is very low at 3 percent, and rent is expected to rise 5.4 percent on average. Single-family rents are expected to hit $4,693 per month this year, which is significantly lower than the massive jump of 8.8 percent last year.