The millennial generation is slow to get started in the housing market, and many of them put to blame their high amounts of student debt. Mapping Student Debt reports more than 42 million Americans owe a total of $1.1 trillion in school debt.

Using data from the Department of Education and tax information from the Internal Revenue Service, Mapping Student Debt breaks down where borrowers are the most bogged down. The maps below measure ZIP code-level data, average household student loan balances and delinquency in relation to ZIP code median income.

Using data from the Department of Education and tax information from the Internal Revenue Service, Mapping Student Debt breaks down where borrowers are the most bogged down. The maps below measure ZIP code-level data, average household student loan balances and delinquency in relation to ZIP code median income.

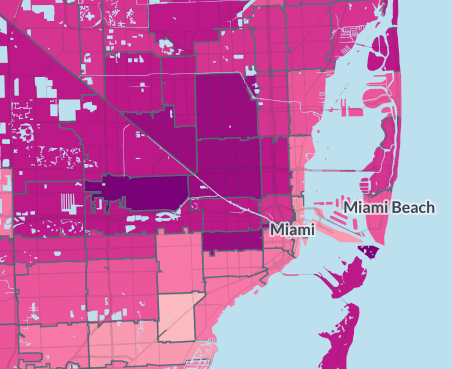

According to the map below, the lighter the color the lower the delinquency rate of loans. Dark purple represents an area with extremely high delinquency.

Despite incomes or loan balance, many ZIP codes in the Miami area have residents who are delinquent in their student loans. Areas with the lowest amount of delinquency include the 33146 and 33158 ZIP codes, which are both south of Miami.

Even some high-earning areas, like ZIP code 33149, which makes a median income of $121,624, has a high delinquency rate and an extremely high average loan balance.

Let’s take a closer look at the city:

The 33131 and 33132 ZIP codes in the center of the city have moderately low delinquency rates despite having astronomical average loan balances

Maps by Mapping Student Debt through an interactive project with the Washington Center for Equitable Growth.