- A real estate tech startup that's spun out of a large brokerage is offering a lead-scoring system that boosted the brokerage's success with online leads.

- The scoring system relies on a predictive algorithm that's the result of ongoing analysis of the behaviors and outcomes of nearly 100,000 online leads.

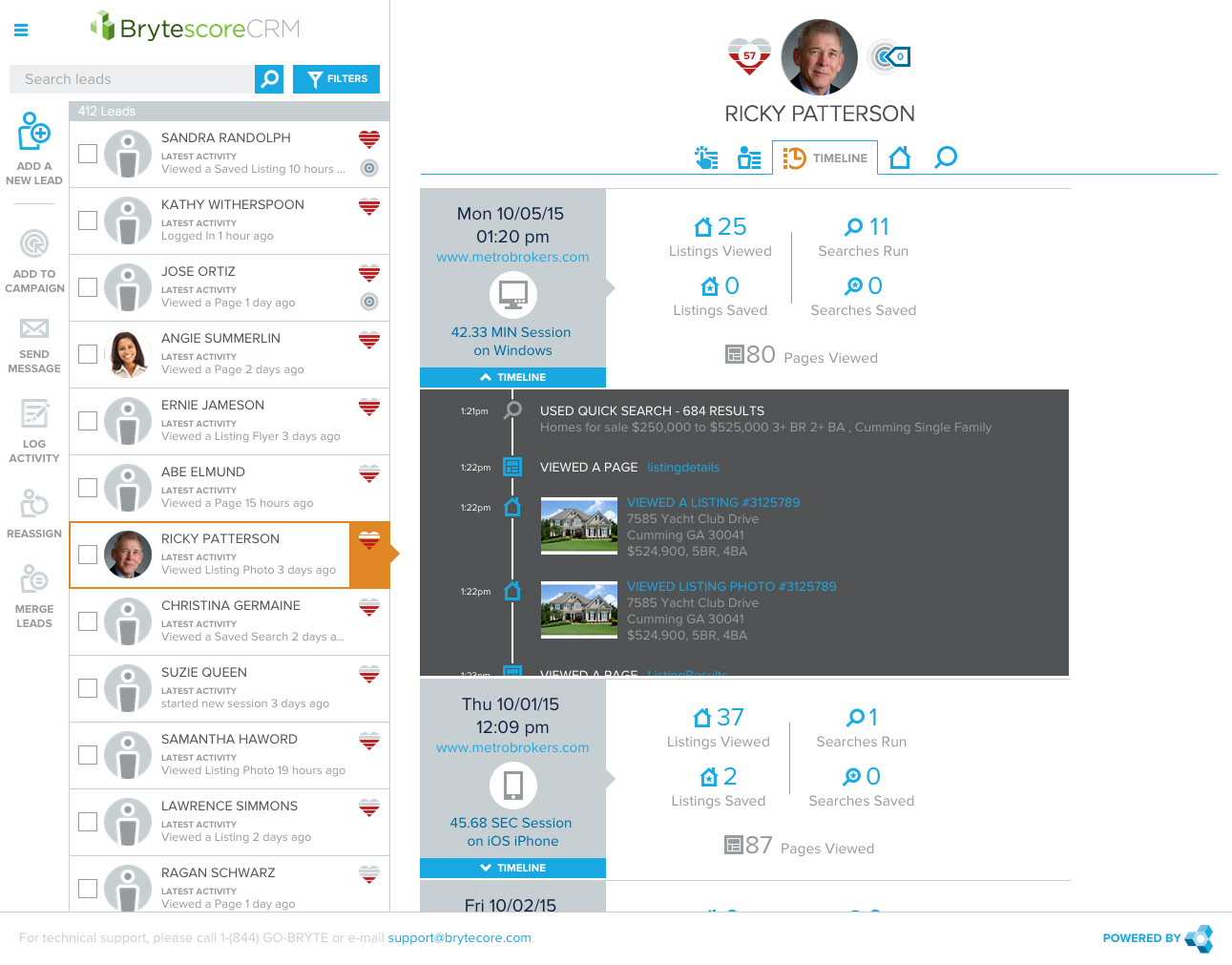

- Brokerages can use the lead ratings by integrating the scoring system into their websites or using the startup's own customer relationship management system.

If you’re browsing a store with no clear objective in mind, it can be annoying when a salesperson asks you questions.

“However, when you go in and you have a need … and you have to purchase a very specific product,” that salesperson can be a “godsend,” said Craig McClelland, chief operating officer at Atlanta, Georgia-based Better Homes and Gardens Real Estate Metro Brokers, an 1,800-agent brokerage.

The same holds true in real estate.

That’s why Brytecore, a real estate tech startup recently spun out of Metro Brokers, is serving up lead-scoring software, McClelland said: to help agents seem like godsends, not pests, when they reach out to prospective buyers and sellers.

Brytecore’s Brytescores

Using a predictive algorithm based on the activity and outcomes of nearly 100,000 online leads captured by Metro Brokers over the years, Brytecore assigns “Brytescores” to brokerages’ online leads to indicate how ripe they are for contact. The software is designed to slash the amount of time agents waste calling cold leads and boost the share of online leads that brokerages convert into clients.

Perhaps the lead-scoring system’s biggest selling point is that it was incubated and leveraged for several years by a large brokerage to jack up its return on investment in digital marketing and advertising.

While Brytecore spun out of Metro Brokers in August, Metro Brokers has a 30 percent stake in the Brytecore, funds the startup and uses the various platforms that Brytecore is now selling to other brokerages.

“This is not just a poke-your-agent-with-a-hot-stick-to-make-them-call system,” said McClelland, who personally owns equity in Brytecore.

Metro Brokers has used Brytescores to more than triple its online lead conversion rate, McClelland says.

Integration

Brokerages can use Brytescores by either integrating the Brytescore API (application programming interface) into their websites and customer relationship management (CRM) systems (Brytecore will help with this) or by adopting Brytecore’s CRM and plugging it into their websites (Brytecore will also help with this).

Agents using a CRM synchronized with Brytescores see hearts next to every lead — the fuller the heart, the hotter the lead — along with lead profiles. These profiles include leads’ search preferences, search history and a heat map representing where leads have focused their search.

Like lead profiles generated by some CRMs, Brytescore-augmented profiles arm agents with talking points and context for phone calls and emails.

If Brytescore profiles show that leads have been searching for listings with a median price of $300,000 in the northeast part of a town and within certain school districts, the agent can kick off a conversation by referencing listings that fit that mold.

Trigger-happy lead scoring

But CRM systems that show Web analytics on leads are a dime a dozen these days — Kunversion, BoomTown and Blueroof360 all offer similar analytics, to name just a handful of Brytecore competitors.

The biggest differentiator of Brytescores, Brytecore claims, is the accuracy of its lead-scoring algorithm.

Most CRM-based lead-scoring systems are based on assumptions and a limited number of variables, said Brytecore CEO Eddie Krebs. Perhaps a CRM labels a lead “hot” because the lead searches 10 listings in a day or prints out directions to a listing.

Krebs says scoring systems like those are too simplistic and often prompt agents to repeatedly call “hot” leads who are actually ice-cold, resulting in burnout, he said.

That’s partly because typical lead-scoring systems might not take into account important variables, like a lead’s demographic characteristics — and also because they are based on somewhat arbitrary triggers.

But another reason many lead-scoring systems fall short, Krebs said, is that they don’t factor in the typical contact-to-close or contact-to-appointment timelines of various types of leads.

Patience, paaaaaatiiieeeencceee

Surveying 1,000 online leads every month for the last two years, Metro Brokers has found that at least 32 percent of online leads end up transacting within 24 months of registering on its website or contacting the firm through listing portals.

The monthly studies have also highlighted the reality that online leads take a really, really long time to blossom into clients.

The typical online lead who transacts within a 24-month window of registering with or contacting a Metro Brokers doesn’t buy or sell until 450 days after that initial connection, the brokerage’s monthly studies have found.

The upshot?

Brokerages and agents can achieve much better online lead conversion rates than they typically settle for (6 out of 10 agents convert less than 4 percent of online leads, according to an Inman study) — but only if they nurture online leads over the long haul.

“We found 32 percent opportunity of conversion, so settling for 1 percent, we couldn’t keep doing that,” McClelland said.

Secret sauce

Brytescore technology has helped the firm bat that rate up to somewhere between 3 and 5 percent.

Brytecore is able to offer that boost to lead conversion rates — in part because its founders were able to develop Brytecore’s lead-scoring technology with the full support and resources of Metro Brokers, where they once ran the firm’s tech department.

There, they baked a wide array of variables, including demographic characteristics from Facebook profiles and website-behavior triggers, into a predictive algorithm.

Then they used “machine learning” — which refers to a self-updating statistical model that analyzes data, recognizes patterns and makes predictions — to continually tweak the predictive algorithm based on the behaviors and outcomes of 100,000 online leads captured by Metro Brokers over the years.

The result is an algorithm that can discover — and these are just theoretical examples — that millennial buyers who search 15 listings are much less ready to transact (and therefore less ripe for contact) than baby boomers who search 15 listings, or that millennials using MacBooks are 22 percent more likely to transact than millennials using Android devices.

The lead-scoring software embedded in many CRMs might not use algorithms, let alone machine learning to tweak those algorithms.

And even if they do use these tools, machine learning only bears fruit if many, many behaviors and outcomes are available for analysis. Most CRMs haven’t studied the behaviors and outcomes of nearly 100,000 online leads over timelines spanning several years, Krebs said.

But at least one marketing and lead-management platform is toiling away on lead-scoring algorithms that use machine learning, lead outcome data and a wide range of variables.

BoomTown has invested heavily in such an effort, said Stacey Finnegan, a product market manager at BoomTown. Its lead rankings are currently more dependent on predictive algorithms than lead-activity triggers, he claims.

Quick response remains paramount

While Brytescores may provide unusually accurate lead ratings, they are useless unless brokerages and agents properly act on them.

That’s why brokerages would be well advised to pair Brytescores with reminder systems– which are often built into CRMs — that prompt agents to contact leads when their scores reach a certain level.

Brytescores are intended primarily to help agents nurture all the online leads that do not engage at first contact.

Brytescores or no Brytescores, agents and brokerages should also remember that calling or emailing online leads within the first five minutes of obtaining their contact information remains paramount.