Two years into offering a mobile application that generates property-specific loan preapprovals for lenders, real estate agents and homebuyers, Pre Approve Me App has become a leading provider of smartphone technology for lenders.

And the real estate startup recently landed its biggest lender client to date: The Federal Savings Bank in Chicago.

For nearly half a year, Pre Approve Me has been working with The Federal Savings Bank to provide its loan officers with a smartphone app that enables them to obtain loan preapprovals for their clients within minutes, as well as track all paperwork involved in the mortgage transaction process.

The app gives The Federal Savings Bank’s loan officers:

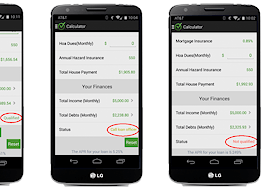

- A customized debt-to-income ratio calculator that inputs all relevant buyer info and assesses whether they qualify to buy a particular home.

- A customized preapproval letter that can be ordered directly from the app, eliminating the buyer’s need to contact their loan officer.

- A milestone tracker that updates buyers and real estate agents on the progress of the loan application.

- A snap scanner function that enables buyers to use their smartphone camera to take pictures of any outstanding paperwork and converts it to a PDF for the loan officer.

- A contact tab that puts buyers in touch with their real estate agent or loan officer.

Jason Bressler, chief information officer at The Federal Savings Bank, said the app makes the home purchasing and mortgage application process more clear and transparent, not only for buyers, but also for the bank’s Realtors, accountants, bankers and loan officers.

“Mobile isn’t the future of the mortgage and banking industry, it’s here, now — and if you’re not involved and haven’t been planning for ways to put yourself in front of your clients and referral sources mobily, you’re already getting left behind,” Bressler said.

George Lourigan, senior vice president of mortgage lending at the bank, called the app “the most exciting mortgage product released in years.”

“Realtors love the app because they can get a preapproval letter immediately, no matter the day or time of day. They also love being able to show their buyers what their payment would be for each house they see. Once they are under contract, they can track the loan through the process and even know if their buyers need help getting some documents to the mortgage banker,” Lourigan said.

The Pre Approve Me app.

Borrowers also appreciate the app’s instant preapproval feature and the ability to track their loan throughout the process, but they find the ability to send documents to their mortgage banker by taking photos and sending them to the loan officer particularly useful, Lourigan said.

“All of these features make my job as a mortgage banker so much easier,” he added.

Pre Approve Me’s so-called “white label” app is specifically branded for The Federal Savings Bank and made to look like it is the bank’s own solution.

“The Federal Savings Bank’s app looks like a 100 percent Federal Savings Bank app,” said Michael Neef, founder of Pre Approve Me app. “It provides the feeling that it’s their internal solution, instead of something they just bought from an outside party. This makes the app more personal, and from a user’s point of view, it gives the bank something unique to offer, an added value for their clients.

“With so many educational offerings out there, like Zillow, Bankrate or even Craigslist, it can be difficult for loan officers to stay at the top of the minds of their customers. We’re able to help mortgage companies create a very unique educational value proposition that helps them move buyers through the loan process more easily than ever.”

To date, the company has created 25 different branded versions of the app for companies ranging to small firms with 10 loan officers, to now The Federal Savings Bank’s 450 loan officers.

“Working closely with a progressive group like The Federal Savings Bank really helps us shape the direction of our product and solve fundamental problems that have existed for years within the loan process,” Neef said.

Michael Neef

The app offers significant benefits to loan officers, said Neef, a former branch manager at American Pacific Mortgage.

“With my background as a loan officer, I know how difficult it is for loan officers to have a work-life balance when you know your clients have so much depending on your ability to get them an offer,” he said. “I would carry my laptop everywhere, looking for Wi-Fi hot spots, and I would have to drop everything, including family, hobbies or work, to get my clients to submit an offer quickly. Some other loan officers are better at creating work-life balance, but their life still suffers from not being able to get offers in early. The app allows them to service their clients the way they deserve to be cared for.”

But the app also offers significant benefits for buyers, Neef said. Some of the pain points the app is designed to address are the buyer’s ability to get loan documentation to a loan officer, which Neef calls “the No. 1 delay in the loan process today,” as well as to view loan conditions in real time and to avoid last-minute surprises like requests for 1099 tax forms or bank statements. Satisfying all of these needs “really gives the buyer the edge in getting a loan closed faster,” Neef said.

Neef acknowledged that there are other apps on the market that offer some sort of preapproval service, but he noted that most of them are in the form of loan calculators or other solutions that are not customer-specific.

“We’re the only app on the market that offers this technology,” he said. “Most companies don’t have the technical experience to build a solution or understand what the customers want. Technology is finally to the place where we can use it to bridge the gap and turn an arduous process into one that is simple and stress-free.”

Pre Approve Me App is compatible with both iOS and Android smartphones. The app is free for agents and homebuyers, while loan officers pay a $50 monthly subscription fee after a 15-day free trial.