Did you know that 6 percent of the global ultrahigh net worth (UHNW) population is composed of expatriates? The ultrawealthy are on the move, and Sotheby’s International Realty dutifully set out to trace their footsteps, find out more about their preferred locations and explain their movements. After putting the pieces together, we found out that Malta might stand to gain.

During the last EMEA event held in Rome, in a presentation, it was revealed that the UHNW population is on the move. This movement is due to various reasons, prominent amongst which are: the internationalization of business holdings, educational institutions stimulating foreign demand, ease of travel and the rise of global citizenship investor programs.

All this is seeing the UHNW crowd moving to locations where such opportunities exist. Interestingly, 12 of the top 40 ranked cities for the UHNW are European. The cities are London, Paris and Zurich, which are in the top 10, followed by Geneva, Frankfurt, Madrid, Vienna and Milan.

Moreover, a report published by SIR in collaboration with Wealth X said that nearly $3 trillion (USD) of the world’s private wealth is owner-occupied residential properties — a value greater than the GDP of all India. Of UHNW individuals worldwide, 211,275 are recorded as those with $30 million (USD) and above in net assets, and 79 percent of them own two or more residences.

How does this wider scenario come across as good news for the small island of Malta? The island is already seen as a location of choice, as well as a lifestyle and tax haven for foreign investors. Because the UHNW are moving to Europe and Malta has begun its own citizenship investor program, it is now ideally placed and likely to attract the UHNW profile.

The primary and most straightforward advantage of acquiring Maltese citizenship through the citizenship investor program, particularly for non-Europeans, is that as a full member of the European Union, a Maltese passport is a gateway to all other European member states. With a 15 percent flat tax rate, no inheritance tax, no wealth taxes and no property tax, Malta’s proposition is noteworthy to say the least.

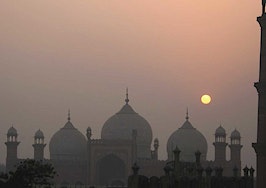

In addition, the island is deemed highly attractive in its own right for its pleasant climate where the sun shines year-round, a high level of personal safety, sandy beaches and colorful nightlife. It is also exceptionally rich in history and culture. Malta’s strategic location in the heart of the Mediterranean has always been and continues to be significantly important today.

In order to become a citizen of Malta, the requirement is for any good-standing person, 18 years old or more, to purchase a property in Malta valued at €350,000 (about $390,000 USD) or more, or a minimum lease of €16,000 (about $18,000), an investment in stocks or bonds of at least €150,000 (about $165,000) and a minimum contribution of €650,000 (about $716,000) in order to cover the application fees. The process of setting up residence in Malta and being granted citizenship takes around 12 months, after which the investor can start reaping all the benefits of citizenship.

According to the Wealth X report, some of the main hubs for luxury real estate, such as New York and Honk Kong, will remain; however, niche locations and rural areas around the world are also gaining popularity.

Manuela Zammit is a brand representative at Malta Sotheby’s International Realty, forming part of CSB Group where she works in the marketing department. Follow her on LinkedIn.