The number of homes repossessed by lenders finally dropped to precrisis levels last year, but a surge in properties entering the foreclosure process or headed for the auction block at the end of the year indicates lenders are preparing to do some “spring cleaning” by taking action against hundreds of thousands of delinquent borrowers during the next six months.

Lenders took back just 327,069 homes last year — the lowest annual total since 2006, according to RealtyTrac’s year-end foreclosure market report. At the height of the downturn, 1 million homes a year were going into lenders’ “real estate owned” (REO) inventories.

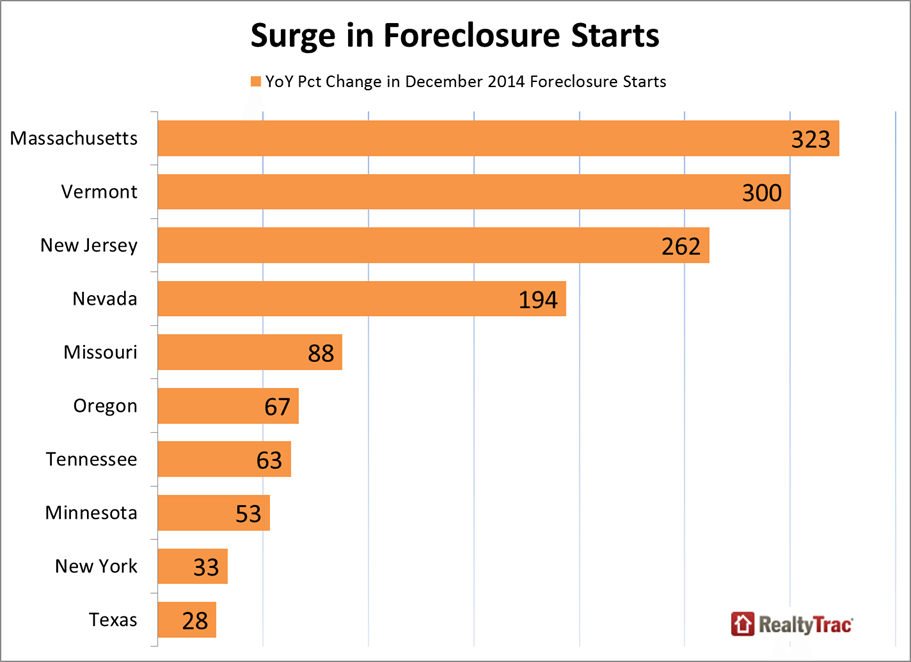

But in the final month of the year, foreclosure starts — legal notices to homeowners that begin the process of auctioning off or repossessing a home — were up 14 percent from the year before, to 59,358.

Scheduled foreclosure auctions — the beginning of the foreclosure process in some states — were also up 7 percent from a year ago during the final three months of 2014. During the fourth quarter, 148,023 homes were headed for the auction block, the first annual increase in four years.

The surge in foreclosure starts doesn’t mean that more homeowners are getting in trouble — the overall pool of distressed mortgages has not increased. It’s more an indication that lenders are tackling backlogs of distressed properties in judicial foreclosure states created by the “robo-signing” scandal.

“The geographic location of the surge in foreclosure starts is not surprising,” said Andres Carbacho-Burgos, an economist at Moody’s Analytics, which uses RealtyTrac foreclosure data to forecast trends. “The list of states with increased activity in the last months of 2014 includes those with judicial foreclosure backlogs such as Massachusetts, New Jersey, Pennsylvania and New York.”

Although Nevada is also on the list and is not a judicial foreclosure state, it has “a substantial pool of seriously delinquent mortgages relative to the years before the housing crisis,” he said.

Public records compiled by RealtyTrac showed that last year 1.12 million homes were hit with some kind of foreclosure filing, such as a default notice, scheduled auction or bank repossession, a decline of 18 percent from 2013 and 61 percent from the 2010 peak of 2.87 million.

It was taking an average of 604 days to move homes all the way through the foreclosure process during the fourth quarter, down from a record-high 615 days in the third quarter. That was the first quarterly decrease in foreclosure timelines since the first quarter of 2011, RealtyTrac said.