Houses.com, a relatively new online brokerage, referral site and portal from the owner of Condo.com, has signed a nationwide referral partnership with online brokerage Movoto, operator of a popular real estate search site.

San Mateo, California-based Movoto, which was acquired by Tokyo-based global human resources giant Recruit Holdings Co. Ltd. in October, will pay a referral fee to Houses.com on deals it closes from leads the firm sends its way.

In April, Movoto attracted 4.1 million unique visitors, making it the eighth-most visited real estate-related website or network, according to comScore rankings.

The deal between Houses.com and Movoto might represent a case of one “paper brokerage” sending leads to another.

In at least a few markets where it operates, Movoto appears to display Internet Data Exchange (IDX) listings — a feed of pooled multiple listing service data reserved for agent and brokerage websites — even though it does not represent buyers or sellers itself in those markets. Instead, Movoto charges a referral fee of from 35 to 45 percent of the agent’s commission for deals it sends to agents in its referral network.

Houses.com, which was launched by Condo.com’s Miami-based parent company, eReal Estate Holdings LLC, in 2012, appears to have a similar model.

Houses.com gets listings from MLSs as a broker in approximately 30 states, and from partnerships with companies like RealtyTrac in others, eReal Estate Holdings CEO Rich Swerdlow told Inman News. The site currently has approximately 5 million for-sale, for-rent and foreclosure listings, he said.

Swerdlow calls Houses.com a “hybrid model.” It sells advertising to agents like Zillow, Trulia and realtor.com. But, since it’s a licensed brokerage, he says the firm is also able to collect a referral fee on closed deals it sends to agents. Agents typically pay between 20 and 30 percent of their commissions on deals referred to them from Houses.com, Swerdlow said.

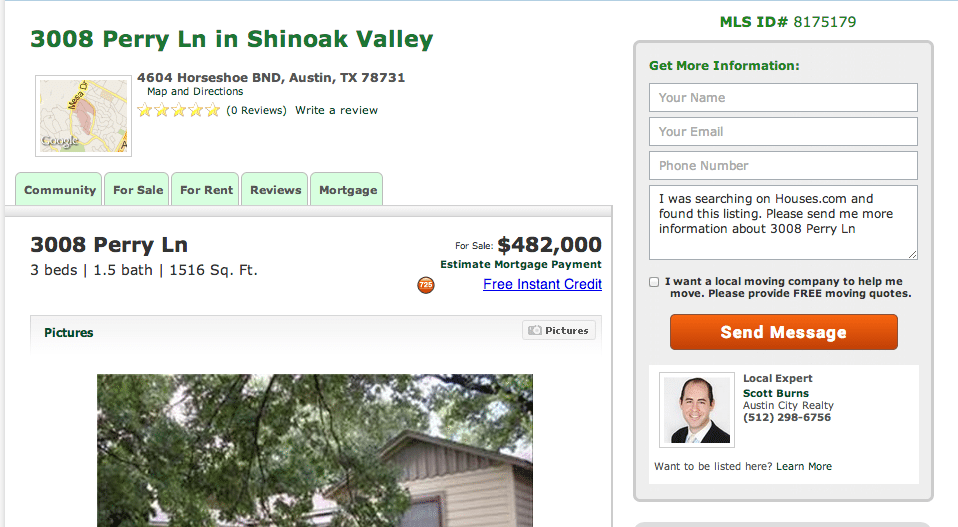

Screen shot of an agent ad on a property detail page for a listing in Austin, Texas, on Houses.com.

The requirement that a firm be a licensed brokerage to collect a referral fee stems, in part, from the U.S. Real Estate Settlement and Procedures Act (RESPA) that addresses prohibitions to kickbacks and unearned fees in Section 2607 of Title 12, said real estate attorney Brian Larson, managing member of the Minneapolis-St. Paul-based law firm Larson Skinner PLLC.

The RESPA prohibitions do not include “payments pursuant to cooperative brokerage and referral arrangements or agreements between real estate agents and brokers,” as a portion of the Act reads.

Larson says “real estate agents and brokers” can be construed as those who have real estate licenses.

In addition, all 50 U.S. states have real estate laws that require firms be licensed brokers in order to collect a commission-based fee on a real estate transaction such as a referral fee, said Marx Sterbcow, managing attorney of the New Orleans-based law firm Sterbcow Law Group, LLC, which specializes in RESPA law.

That law is what keeps nonbrokers like Zillow, Trulia and realtor.com from collecting fees tied directly to the transaction. Instead, they charge by impressions, a percentage of traffic in a ZIP code or, in realtor.com’s case, by the agent’s return on investment.

Houses.com, whose brokerage licenses are established under Condo.com, has about 25 agents nationwide and does the bulk of its business as referrals, Swerdlow said.

Unlike impression- or lead-based advertising models that Zillow, Trulia and realtor.com employ, agents pay Houses.com based on performance, deals they close, Swerdlow said.

Approximately 2,000 agents across the U.S. currently advertise on the site, Swerdlow said. They can choose to advertise on an exclusive or nonexclusive basis by ZIP code or housing community.

Swerdlow says Houses.com chose to partner with Movoto because of its proven ability to convert Houses.com leads to closed deals, which is how Houses.com gets paid. Movoto pays Houses.com a referral fee on each closed deal it facilitates on a Houses.com lead.

“We are thrilled about our partnership with Movoto as part of our commitment to becoming the definitive marketplace for single-family houses and provide consumers with the best services for finding homes and all of the products and services that accompany homebuying,”

Movoto’s new owner, Recruit Holdings Co., has said it plans to make the site the No. 1 real estate portal in the U.S., and expects it to challenge Zillow, Trulia and realtor.com. Web traffic-wise, Movoto is on its way.

Traffic to Movoto has shot up since its acquisition. It was the eighth-most visited real estate site in the U.S. in April, according to data from both comScore and Experian Marketing Services.

Houses.com, along with its sister portals Condo.com and Property.com, currently attracts 20 million visits per year, Swerdlow said. Movoto attracted 5.2 million visits to its site in April, according to Experian data.

Movoto compares its business model to Redfin’s. In early May, Redfin, which operates as a brokerage and referral site in close to 30 markets, backpedalled on its practice of temporarily operating as a paper brokerage in some expansion markets.