Long Treasurys broke upward, out of the trading range of the last eight weeks. Not by much, but out, the 10-year T-note above 2.8 percent for the first time in more than two years — 2.86 percent at this moment. Mortgages are stickier, the rise negligible (investors have lost fear of another refi wave), but the march toward 5 percent is underway.

Two patterns are helpful, one 24 hours old, the other a 60-year vintage.

Before discussing those, dismiss a false lead: The 17-nation eurozone enjoyed positive gross domestic product (GDP) in the second quarter, ballyhooed in the U.S. press as an “end to recession.” A positive quarter is the technical definition of a recession’s end, but not even the Europeans believe this is anything more than a passing moment of stabilization.

Yesterday’s trading was instructive. News that should have helped long-term rates did not: Egypt’s descent into civil war; 200 points off the Dow; and zero-gain industrial production in July. News that overwhelmed all else and pushed up rates: New claims for unemployment insurance last week fell to a six-year low: 320,000.

Thursdays’ market calculus is now persistent: Jobs override all. If employment is strengthening, the Federal Reserve will taper quantitative easing to zero within six months. Thus stocks traded down on good economic news. I have never found a direct conveyor of QE cash to stocks, except running through the vacant minds of stock boosters. Whether real or imaginary, the mind prevails, but it does not say much for the investment-value underpinnings of stocks that good economic news is bad news.

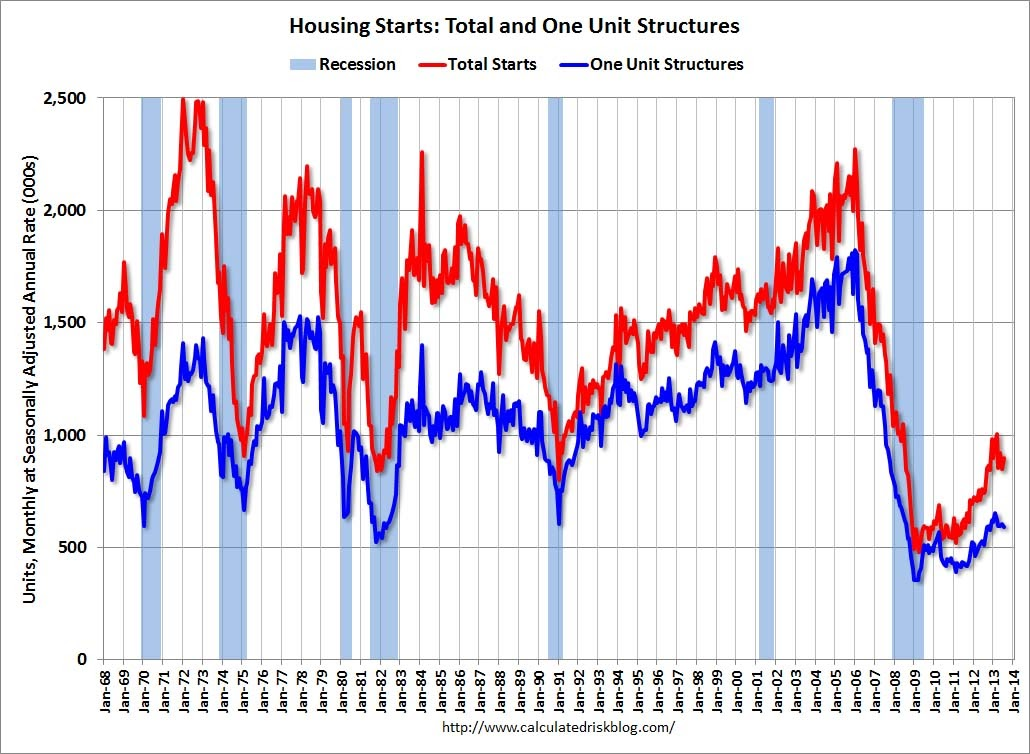

The trading-desk shorthand for unemployment insurance applications is “claims.” Every U.S. recession since the big war has ended in the same pattern: Credit-sensitive housing and autos rebound as soon as the Fed cuts rates. The job market is the last to recover, often lagging housing by two years.

Jobs are the most politically sensitive element, which typically forces the Fed to be too easy during recovery for too long — and which the Fed knows as surely as sunrise. Claims have been the best leading indicator for the Fed, but when claims plunge the Fed is already too late, forcing it into catch-up mode, which many fear today.

The Fed chopped rates in late 2008, but housing did not turn until 2012. Too much distress in the market, and tight credit offset cheap rates. Today, one year into housing recovery, jobs are showing signs of life, right on schedule.

However, the job market today has headwinds even stronger than housing. For one, housing will continue to be thin until Congress and the White House take their feet off the mortgage hose. Even more important, since the early 1990s the U.S. has faced unprecedented competition from labor overseas. Median household income had been stuck near $55,000 per year from the mid-1990s until 2009 when it fell to almost $50,000, where it still is, and its purchasing power is undercut by health care racketeering.

Claims are down in part because there isn’t anybody left to fire. The drop in claims this time may not have cyclical counterparts: more jobs and higher incomes. The whole point of the Fed’s removing the punch bowl is to prevent overheating and inflation, but we can’t have either one without rising incomes. And they ain’t. And no economy anywhere ever overheated without a surge in credit. Not here, not hardly.

Another historical pattern: When the Fed appears to be turning, long-term rates always rise. And people like me always warn that the rise may abort the recovery, and it never has. This time is different in two ways (maybe). First, the panicked runup in long rates since May is not justified by Fed statements or implications, or by economic data — especially inflation. Too far too fast. Second, can it be that a still-impaired and misregulated financial system has been more dependent on QE than we or the Fed have known? Despite falling mortgage production and Treasury issuance, the Fed has been the only buyer, and rates must go much higher to find another.

Then there is the world. As U.S. markets and the Fed conspire to jack long rates, they are rising everywhere. The U.S. economy is better, but everywhere else is slowing or in trouble one way or another. Fainting elsewhere is our best chance for lower rates.

10-year T-note, Thursday’s close. 2.86 percent on Friday.

“Claims”

Bad news and goods news: Housing has a long way to go.

Still in recession range. An upward breakout would add to pressure on rates.

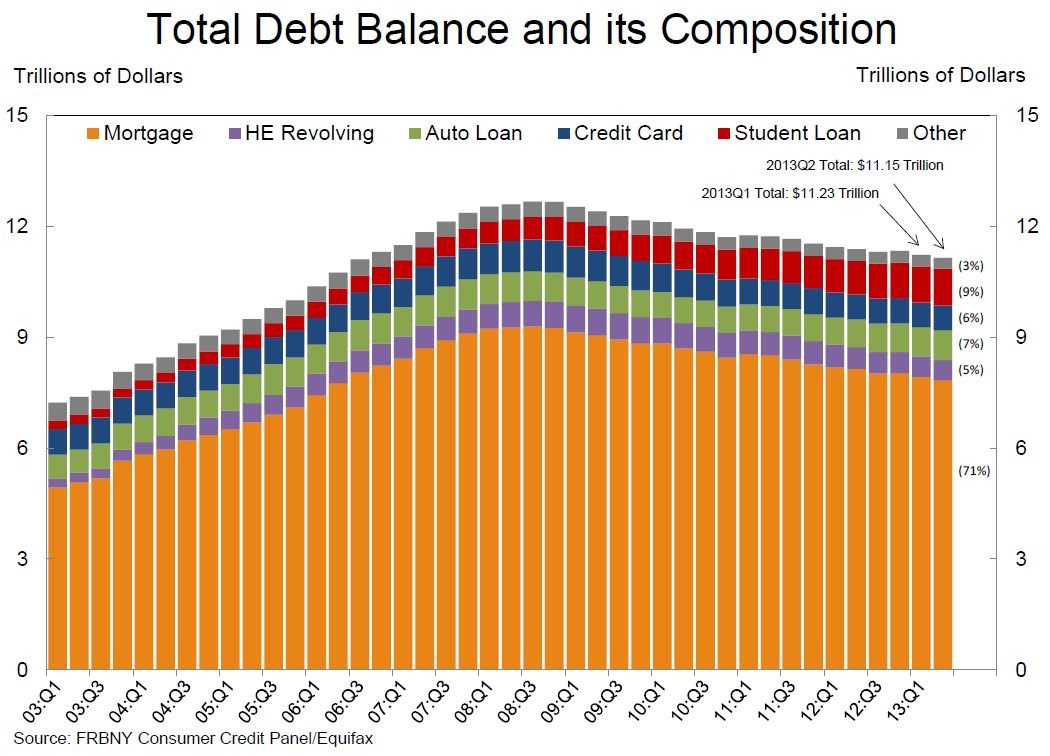

From the quarterly New York Fed report, good reading. The only growth in credit is autos (easy to repossess), hence hot sales, and the grotesque doubling of student loan debt in five years.

Delinquencies are better, but a long, long way from resembling normal.

Lou Barnes is a mortgage broker based in Boulder, Colo. He can be reached at lbarnes@pmglending.com.