Credit markets are still struggling to understand the Fed and to lay odds on its intentions, and failing, still on hair trigger for more selling and rate increases.

The housing market is better — in some places a great deal better — and psychology even better than the markets themselves.

It is a great relief to a lot of the nation just to be able to sell a home, let alone at a higher price. However, no one knows or can know how housing will fare with mortgages pressing toward 5 percent.

The stock market is happily drunk (again), but — a positive indicator for the economy? Or just more computer gaming, the market’s principal source of trading?

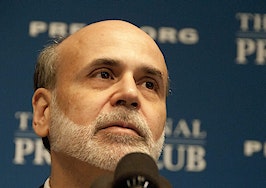

By comparison, this Fed business makes the stock market seem the soul of sobriety. The Fed’s newest flailing whipsawed markets all day Wednesday. First came the release of the Fed’s June 19 meeting minutes, which everyone scoured to try to understand the disastrous Bernanke press conference right after that day’s meeting.

Did he have a bad day? Did he overstate the Fed’s intentions quickly to taper QE (quantitative easing) to zero? Did he mean to hint at raising the Fed funds rate next year?

The bond market had improved slightly from last Friday’s sell-panic, but when it found in the minutes that half of those present at the meeting wanted to end QE by the end of 2013 … sell again. Sell if you could, if your losses were not too deep to recognize.

But briefly, clutching at hope for Bernanke’s speech two hours later, at the day’s market close. The speech was a snoozer (the last hundred years of banking zzzzzzz).

Just as trading stopped, the chairman again took questions. “Highly accommodative monetary policy for the foreseeable future is what’s needed in the U.S. It may well be sometime after we hit 6.5 percent unemployment before rates reach any significant level.”

Traders who had gone short bonds on the minutes got clocked by the Q-and-A charm, and short-covering gave us the best rates of the week, but entirely artificial.

The markers of something very odd underway: The 10-year T-note has not “retraced” from this epic spike. Any market gone vertical in either direction should have retraced the move by about one-third by now. The five-year T-note looks the same, even midrange traders self-protective. Only the two-year indicates some relaxation in immediate Fed fear.

The Fed’s minutes also contained this idiocy: “The staff viewed the uncertainty around the forecast for economic activity as normal relative to the experience of the last 20 years.” Normal uncertainty? Now?

The forecast to which they refer, at the June 19 meeting, called for U.S. GDP (gross domestic product) growth about 2.6 percent this year, rising to 3.4 percent in 2014. This week the International Monetary Fund revised down its U.S. forecast, GDP to 1.7 percent this year and 2.7 percent next.

The IMF: “Downside risks to global growth prospects still predominate.”

I have never seen a gap between the IMF and Fed like this. Some international agencies have axes to grind and take extreme positions (BIS, Bundesbank …), but not the IMF. Its managing director, Christine Lagarde, is a positive-spinner.

Market participants learn quickly to shed confusing crosscurrents, to get to the heart of the matter, or face unintended and immediate career change.

The heart of this matter: The Fed looks crazy. Not just a bad day, or a streak of ineptitude, but nuts.

Which gives markets a sell bias, and pushes even serious people off into conspiracy theories. Will the confirmation of a new chairman be blocked by wingnuts in Congress unless the Fed swears off QE? Have tightwads inside the Fed seized the asylum?

At this moment, clarity of any kind would help. The Fed may be stuck in a transition from one chairman to another, the retiring one having lost command.

In a situation like this, we look to the rest of government for reassurance. Cue crickets chirping. Anybody there? Where is the president? Keeping Romney out of office had some merit as a second-term goal, but was that it?

New Treasury Secretary Jack Lew’s sole contribution is his signature on new currency. He makes Timothy Geithner look hyperactive. And with a vacant executive branch, Congress is at its awful worst.

We have relied on the Fed alone far too long. Rise up, somebody.

Lou Barnes is a mortgage broker based in Boulder, Colo. He can be reached at lbarnes@pmglending.com.