Events are coming so fast in bunches, connected and separate, that it’s hard to sort noise and style from substance.

The Fed met this week, concluding with Chair Powell’s first press conference and new projections for the cost of money. In any other month or year or decade the Fed news would have dominated all else. This time, just an “uh-huh” from markets and back to the other jaw-dropping shows in progress.

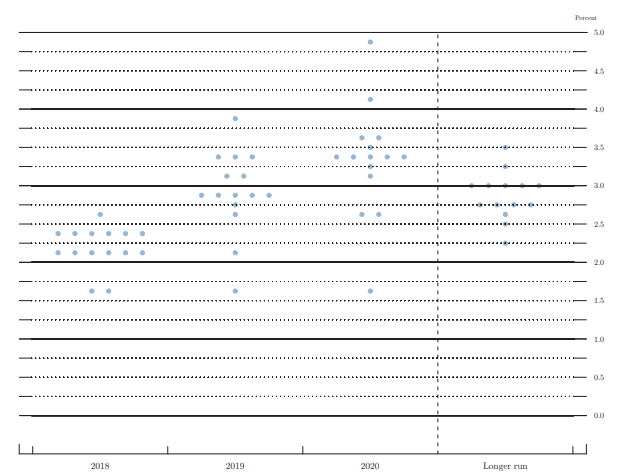

The Fed took the Fed funds rate up 0.25 percent to 1.75 percent and confirmed its intention to be 2.25 percent or higher at year’s end and 3.00 percent or more by the end of next year. The bond and mortgage markets had priced-in the hike, and part of the next one, and ignored the Fed’s further intentions. The 10-year T-note fell in yield at Wednesday meeting-end.

Chair Powell is not an economist and not afflicted by their prideful pretense to predict the future via model-building. In different words than Yellen, Powell told us that the Fed will rely on incoming data, especially wage growth, to calibrate future monetary policy. He knows what markets know: nobody knows how inflation works in this economy. The good news is Powell’s competence. The bad news is the risk of a reactive Fed, policy lurching from datum to datum.

The dominant shows in progress involve the stock market, the tariff announcement and the possibility of trade war, a tough week for technology, and White House staff changes implying substantial and hawkish change in security policy.

Stocks. The principal difficulty in that market is the leap in value from Dow 6,626 in March 2009 to 18,332 on election day 2016, and then in just 15 months to 26,616. The Dow could easily unwind to 18,000 and the move have nothing to do with Fed, economy, administration, or anything. That said, the 3 percent single-day dump on Thursday coincided with the imposition of tariffs on China.

Economy. There’s another player beside the Fed and tariffs threatening slowdown. In our present dysfunction the Treasury is a fountain of new Treasury bills sold to finance an explosion in the Federal budget deficit not seen since 1981. A $500 billion increase in deficit in a single year brings some stimulus (Powell said the disciplined obvious: nobody knows how much stimulus), but to tighten credit any central bank sells securities — and the Treasury’s sales of new IOUs are suddenly having the same effect. This way: during most of 2017 one-year Libor traded close to 1.75; since fall, Libor has spiked to 2.50%, crowded up there by the flood of T-bills, and bringing the first significant slowing pressure in this cycle. Mortgage borrowers with Libor ARMs last year adjusted up from 3.375 percent to 4.00 percent. Next month’s notices: 4.50 percent, and going higher.

Technology. This week technology brought timeless lessons in human nature. Poor Facebook and it’s tongue-tied founder, cost-free connectivity gone to the Dark Side.

Above all let us mourn the death of 49-year-old Elaine Herzberg, killed this week by a robo-car.

A Google excursion found the first person killed by any automobile: Henry Bliss in 1899 when disembarking a street car on the upper West Side of NYC was run over by an electric-powered taxicab (et tu, Uber?). The cab driver was charged with manslaughter, but found not to be negligent and acquitted.

Technophile exuberance at autonomous autos is in trouble, and with financial consequences. We slaughtered 40,000 of ourselves last year with our cars, but we did it, not some damned robot. The fix may involve v e r y, v e r y, s l o w autobots covered with warning lights and sirens. Isaac Asimov’s flat-genius multi-volume exploration of robotic AI is worth study by today’s youngsters and elders.

Technology is tough. Romans did not build millennial-durable aqueducts on the first try. Cathedral architects learned the need for buttresses the hard way. It’s a shame that we have no video of early experiments with gunpowder.

Beyond technology, Ms. Herzberg’s sacrifice is memorial to our inability to connect present action to future result.

The Trump administration is now in daily play in markets. Trade and security are big deals. And since this administration is unlike any other in U.S. modern history, so much more difficult to handicap its consequences.

It is possible that the new replacements in the White House will temper their views, now that those views will have consequences. It is also possible that Mr. Trump’s style is mostly negotiating ploy, grating but not dangerous.

The changes in White House senior staff to an aggressive group may enable more productive action at home and abroad. Or something else.

U.S. 10-year T-note in just the last week. The Fed raised its rate on Wednesday, tariffs announced on Thursday — the more powerful force clear:

The 10-year in the last year, astounding stability developing:

The Fed-sensitive 2-year T-note in the last week. The same pattern as in 10s, tariffs canceling the pricing-up for the next Fed hike. The Fed will not hike during a trade war:

The 2-year in the last year. Every recession is preceded by a path like this:

The new set of damned dots, each Fed governor and regional Fed president forecasting the Fed funds rate at the end of each future year. These dots are incompatible with today’s market rates and vice-versa:

Lou Barnes is a mortgage broker based in Boulder, Colorado. He can be reached at lbarnes@pmglending.com.