Online leads often deliver a poor return on investment for real estate agents, but they can also work wonders for agents who take a disciplined approach to harvesting and nurturing them, according to a recent Inman survey that explores the payoff of online leads.

Agents frequently find little value in leads that they purchase or acquire organically from sources including real estate websites, social networks and “big data” lead generators, and report that online leads generally account for just a small fraction of their business, the survey found (click to download PDF version of report).

But there are glaring exceptions to this rule. Some respondents revealed that they have built their businesses on the back of online leads.

No doubt that’s largely because these agents have learned how to engage online leads better than many of their peers.

But agents powering their businesses through online marketing channels may also be making better decisions about where they get their online leads from, as some types tend to bear much more fruit than others, according to our survey.

Major findings of this report include:

- Search engine and Facebook ads generally yield the paid leads that deliver the highest return on investment (among lead types included in the survey) for agent respondents, but agent respondents invest in leads from those sources half as often as they invest in paid leads from listing portals.

- Online leads accounted for 5 percent or less of most agent respondents’ deals in 2014.

- One out of 10 respondents attribute 46 percent or more of their deals in 2014 to online leads and say they convert online leads at a rate that is more than triple the rate claimed by a majority of agent respondents.

- Five out of 10 agent respondents have bought leads from third-party listing portals and about the same share currently do so.

- The vast majority of respondents think one word-of-mouth referral is more valuable than 10 online leads.

- Respondents see more promise in investing in unpaid online leads than investing in paid online leads.

Many agents believe they could benefit more from spending more time trying to tap marketing channels for unpaid online leads, such as by beefing up their agent profiles on listing portals or interacting with consumers on Facebook, instead of shelling out more cash for online leads.

But if agents choose to purchase online leads, Inman’s survey suggests agents should first turn their eyes towards Facebook, search engines and their brokers, as those sources deliver the best return on investment for respondents.

Next on their lists should be third-party listing portals, according to agent respondents.

Real estate search sites such as Zillow, Trulia and realtor.com were the most common sources of paid leads for survey respondents, eliciting both the most praise and the most criticism from respondents.

For every respondent that declared paid leads from listing portals worthless — or worth less than they used to be — another seemed to cast such leads as an important source of their business.

A staple of agents’ marketing strategy

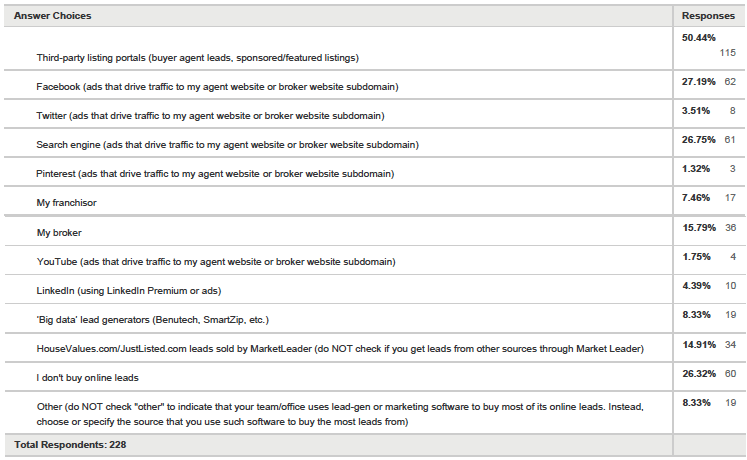

What’s inarguable is that purchasing online leads is now a staple of many real estate agents’ marketing strategies: More than 7 out of 10 agent respondents indicated they buy online leads.

But many aren’t sure whether they’re getting their money’s worth.

Close to half of agent respondents said they think they overinvest in paid online lead generation, and more than 7 out of 10 said they believe online leads are generally overrated.

“The online leads are buyers and sellers who try to get as much information at no cost as possible before they sign with the agent they know or who was referred to them,” was one respondent’s bleak assessment of online leads. “It is very rare when Internet leads become true clients.”

One word-of-worth referral is worth more than 10 online leads in the eyes of about 7 out of 10 agent respondents.

“One or two GOOD leads can pay for a year’s worth of leads,” said one respondent. “That said, you do get a lot of useless leads. Have to kiss a lot of toads to get to the prince.”

While most agent respondents indicated that they buy online leads, only half invest more than $200 in them a month.

Online buyer and seller leads cost roughly the same, the survey found. About half of respondents put the average cost of each type at $5 or less.

Small fraction of deals grow out of online leads

Online leads generally convert into deals at a very low rate, and play only a marginal role in the businesses of most respondents.

Most agent respondents reported that 4 percent or less of their online leads convert into closed deals, with the largest share (40 percent) putting that rate at less than 2 percent.

Online leads made a measly contribution to the business of most respondents in 2014, accounting for 5 percent or less of a majority of agent survey participants’ closed deals. Four out of 10 agent respondents said online leads accounted for 2.5 percent or less of their closed deals last year.

But to conclude that online leads can’t boost an agent’s bottom line would be a mistake.

The all-stars

A small but distinct group of agents, teams and broker-owners appears to have mastered the art of tapping online leads for business, and largely built their businesses around it.

“In three years, I have grossed over $1 million from online leads,” said one agent respondent.

Around 1 in 10 agent respondents said they shell out more than $1,000 a month on online leads.

About the same share of respondents report that online leads (paid and unpaid) accounted for 46 percent or more of their closed deals in 2014, and claim to convert 13.1 percent or more of their online leads into sales — more than triple the conversion rate cited by most respondents (0 to 4 percent).

This cohort’s success with online leads bolsters the view that the return on investment of online leads hinges largely on how an agent engages online leads.

“It takes much more proactive effort on an agent’s behalf to be successful with Internet leads than most other lead sources,” said one team leader respondent. “A specific follow-up game plan is essential to be successful.”

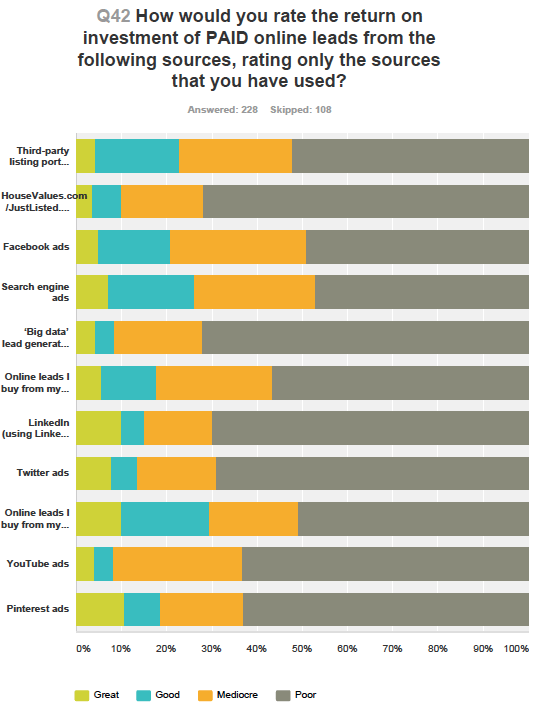

Return on investment of paid online leads

The techniques that these agents use to cultivate online leads likely power their success.

But agents who’ve cracked the code of online leads also may be making better decisions about the sources they choose to harvest them from.

“… There are a lot of companies trying to sell programs to agents for online leads that are just a money grab,” said one respondent. “You have to decipher which programs work and which don’t.”

Indeed, the results of Inman’s survey suggest that different online lead types offer varying levels of return on investment.

Leads generated by search engine and Facebook ads generally provide the best return on investment among paid online leads included in Inman’s survey, according to agent respondents. These were the only types of online leads to earn more ratings of “great,” “good” and “mediocre” collectively than ratings of “poor.”

Online leads sold by brokers placed third, with 48 percent of agent respondents who rated the lead type saying it’s ROI is “mediocre,” “good” or “great” (and the rest rating it “poor”).

Facebook ads received a notable number of plaudits from respondents for their targeting capabilities.

“Even though the response rate is low, it is higher than Zillow, Trulia or realtor.com, and the cost is much lower,” said one broker-owner respondent. “It also allows us to market our listings to specific demographics without having a buyer agent’s face on our listings.”

The survey’s findings suggest that respondents may be underinvesting in paid leads from Facebook, search engines and brokers.

Respondents were about twice as likely to say that they get paid leads from portals as they were to say that they get paid leads from Facebook or Google, and cited brokers as a source of paid leads about a third as often as they cited portals.

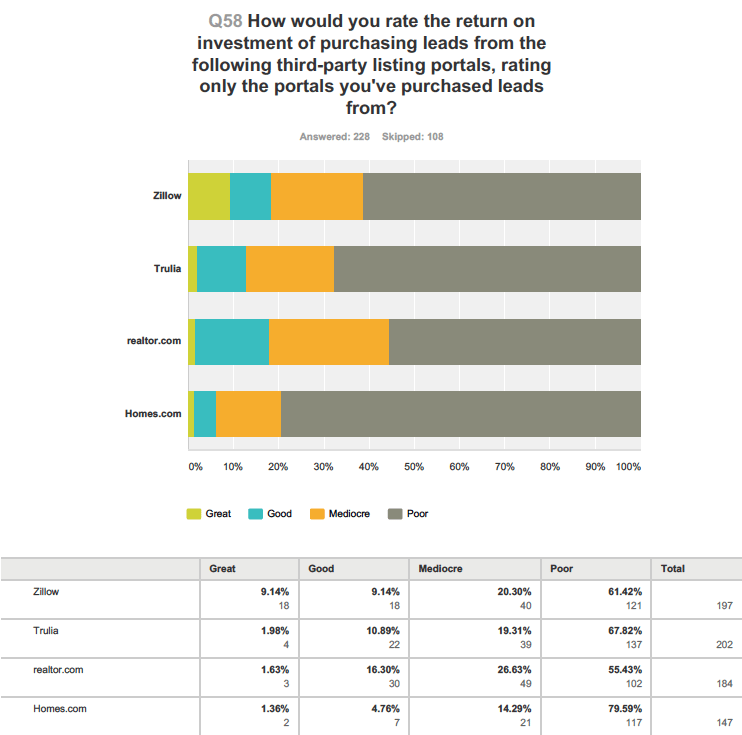

Listing portals

Listing portal ads offer the fourth-highest return on investment of the online lead sources included in the survey, according to agent respondents.

Forty-seven percent rated the ROI of paid leads from portals either “mediocre,” “good” or “great,” with the rest scoring it “poor.”

Close to 5 out of 10 agent respondents indicated they had bought leads from third-party listing portals, and the same share report currently doing so.

Listing portals were also the most polarizing type of paid leads among respondents.

Some agents boasted of their ability to convert leads from listing portals into business.

“While many bitch about them and condemn them, I learn how to make it [work] for me and laugh my way to the bank,” said one agent respondent.

“I’ve mastered using both Zillow and Trulia and in my first year closed 35 sales using only those portals,” added another.

On the other hand, plenty of respondents also reported disappointing results with paid leads from listing portals.

“Spent over $25,000 in an 18-month period and received very few leads and of those we did receive, not one closed,” said one team leader respondent about buying leads from Zillow. “Not one.”

A number of respondents also claimed that the return on investment of leads sold by portals has seemed to drop off.

“Zillow was great, but over the last 18 to 24 months [it] became a waste, canceled six months ago,” said one respondent. Another reported being “too dependent on portals where quality and quantity has decreased while costs continue to increase.”

Some respondents griped about listing portals tacking ads for competing real estate agents onto their listings even after they had paid for such ads not to appear. Portals also took grief for sending the same leads to multiple agents.

Online leads from listing portals pay off only if the agent buying leads from a portal has beefed up their profile on the portal, others said.

“Unless you have a ton of feedback and good history of sales, you won’t show well to consumers and won’t be chosen out of a list of potential agents to assist [buyers],” said one respondent.

When their return on investment was rated individually by agents, all four listing portals included in the survey — Zillow, Trulia, realtor.com and Homes.com — received more ratings of “poor” than all their ratings of “mediocre,” “good” and “great” put together.

Realtor.com scored the best among agent respondents in terms of ROI, with 45 percent rating the ROI of the portal’s paid leads higher than “poor,” followed by Zillow (38 percent), Trulia (30 percent) and Homes.com (20 percent).

Among respondents who identified as broker-owners, team leaders, sales managers or in-house marketers working for them, Zillow was rated the best in terms of ROI, with realtor.com placing second.

Zillow notably bagged a considerably larger share of “great” ratings among all groups of respondents, including agent respondents.

Worst-rated paid lead sources

But while paid leads from listing portals tended to receive lackluster ratings overall, they still generally deliver a considerably better return on investment than some other online lead sources, the survey suggests.

Paid leads from “big data” lead generators, HouseValues.com, JustListed.com, and LinkedIn ranked as the worst-rated types of online leads by return on investment among agent respondents.

More than 7 out of 10 agent respondents said leads from each of those sources provide a “poor” return on investment.

A number of respondents complained of being locked into one-year contracts with Market Leader, operator of HouseValues.com and JustListed.com, and SmartZip, a “big data” lead generator.

Return on investment of unpaid online leads

Unpaid online leads appear to generally offer more promise in the eyes of agent respondents.

Agent respondents were more than twice as likely to say that they underinvest in unpaid online lead generation as they were to say that they underinvest in paid online lead generation.

And they tended to rate the return on investment of unpaid online leads — with “investment” referring to time and resources invested in generating such leads — higher than they rated online paid leads.

Real estate agents looking to dredge up more leads organically might want to focus the most energy on interacting on Facebook, attracting organic traffic through search engines and reeling in visitors through agent profiles, property details pages and discussion forums on listing portals, as unpaid leads that grow out of these activities generally deliver the highest return on investment, according to agent respondents.

About 6 out of 10 respondents said the return on investment of unpaid leads from the multiple listing service and search engines is either “mediocre,” “good” or “great.” The other two unpaid online lead types that bagged more ratings of “mediocre,” “good” or “great” than ratings of “poor” come from Facebook (58 percent) and listing portals (56 percent), according to agent respondents.

Less than 4 out of 10 agent respondents said that unpaid leads from LinkedIn, Twitter, Pinterest and Craigslist delivered better than a “poor” return on investment.

Facebook is the most common source of unpaid leads among agent respondents.

Providing another indication that agents can benefit from interacting on discussion forums hosted by listing portals or polishing their profiles on such websites, unpaid leads from listing portals ranked as the second most often cited source of unpaid leads captured by agent websites, with search engines following close behind.

Respondents cited Facebook most often as their biggest source of unpaid leads, followed by search engines and listing portals.

Agent websites

Though 7 out of 10 agent respondents indicated that they pay for online leads, only 4 out of 10 pay money to drive traffic to their websites that they then convert into leads.

One quarter of respondents didn’t know what percentage of unique visitors to their websites convert into leads.

But of those who could offer such a conversion rate, 7 out of 10 put it at 3 percent or less.

The most common sources of paid traffic for agent websites are search engine and Facebook ads, with Facebook delivering the best return on investment, according to the survey.

Best ad types

Inman also polled respondents about different advertising products offered by listing portals, Facebook and Twitter.

The survey suggests that the return on investment of featured or sponsored listings does not differ substantially from the ROI of buyer agent ads.

Facebook has three main ad products: Facebook desktop news feed ads, Facebook right-hand column ads and Facebook mobile ads.

Only 44 percent of respondents said they had bought any of these products.

But of those who indicated that they had purchased Facebook advertising and noticed a difference between its ad products, the largest share of respondents rated Facebook desktop news feed ads as the best product.

Asked which Twitter ad product provides the most ROI — “promoted tweets,” “promoted accounts” “or promoted trends” — 9 out of 10 indicated they have never bought ads on Twitter.

Of those who said that they had purchased Twitter advertising and noticed a difference between Twitter’s ad products, most said promoted tweets offered the best ROI.

All survey results: