A partnership between real estate startup Planwise and Informa Research Services Inc. will give smaller players in real estate search a plug-and-play tool that allows them to compete with the mortgage options that tech titans like Zillow, Trulia and realtor.com provide consumers.

The tool, free to anyone that wants to plug in the 10 lines of code needed to embed it, will let agents, brokerages and multiple listing services offer consumers the ability to get prequalified or preapproved for a mortgage right from their websites.

Powered by Informa Research Services Inc.’s mortgage pricing engine, the tool gives consumers the ability shop for loans from the more than 6,000 lenders in Informa’s database, Planwise founder and CEO Vincent Turner said.

The new partnership between Planwise and Informa, which is set to go into effect sometime before the end of August, also builds a more highly engaged home shopper, he said.

Eventually, Turner envisions MLS, brokerage and agent websites will use Planwise’s software to marry home search with mortgage info, allowing consumers to search for only those homes whose price falls within the amount they’ve been prequalified or preapproved for.

If brokers, agents or MLSs have preferred lenders they’d like to direct consumers to, Planwise will accommodate those by either getting them into Informa’s lender network if they’re not already there or by developing a custom integration into the tool, Turner said.

The partnership advances Planwise’s June-announced pivot from a financial planning tool to a full-blown mortgage marketplace that integrates the mortgage process into the home search experience.

How it works

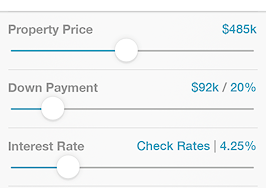

Planwise’s three-step home affordability tool will surface loan information for consumers after they enter the following info:

- Property info like purchase price, closing costs, down payment amount and interest rate for a home they’re looking to buy.

- Check whether they are a renter or homeowner looking to sell.

- Their financial info including available cash, current monthly income, current monthly rent (if applicable), other monthly expenses, monthly loan payment amount.

Then, consumers will be presented with the top 25 to 50 offers from Informa’s network of lenders based on rate and loan amount, Turner said.

Consumers can then choose one lender from that group to begin the preapproval process. Up until then, neither the consumer nor Planwise has shared sensitive financial info like their credit score or contact info with the lender.

For those consumers who have a Planwise account, Planwise will send that info to lenders to complete the preapproval process. Otherwise, they send it themselves.

Once, preapproved for a loan, consumers know exactly how much they have to spend on a home, making them a much more valuable home-shopping audience, Turner said.

Planwise has a revenue-sharing deal with Informa on mortgage deals it helps close on the platform, Turner said. Lenders also have the option to license the Planwise tool, giving them the ability to show only their loan products to consumers.

In March, Zillow launched a tool that allows consumers to get preapproved for a mortgage from one of its partner lenders in just a matter of minutes. Earlier this month, it baked the tool into its iOS mobile apps.

In June, realtor.com partnered with Bankrate to roll out a free iPhone and Android mobile app that allows consumers to shop for homes that fall within their target home price range and potential mortgage payment.

Trulia began helping consumers shop for a mortgage with the launch of its mortgage marketplace in September 2012, which also works on its mobile apps.

In November, MLS tech provider Solid Earth announced that it would begin integrating Planwise into the public-facing MLS websites powered by its Spring platform.

Last September, real estate tech firm Tribus began baking Planwise into the websites it builds for brokers and agents.

The National Association of Realtors’ investment wing, Second Century Ventures, invested an undisclosed amount in Planwise in January. Planwise was an inaugural member of NAR’s tech accelerator program REach in 2013.